COVID-19 is a test of endurance for financial service providers (FSPs) and the communities we serve. In addition to protecting the health of our clients and staff, priorities are to help people meet their basic needs while easing the strain on their finances, and continuing to support essential services. Once the immediate danger has passed, success will depend on how quickly we can regain our momentum on other client-oriented initiatives that will drive efficiency and growth. Insights from customer research can guide our response to the present crisis while supporting a faster transition from survival to recovery.

Debt relief and loan restructuring are two of the most important mechanisms for delivering immediate relief to FSP borrowers whose livelihoods are on hold due to stringent lockdowns. These restructuring efforts require the support of regulators, donors and investors, and they should be approached from an informed perspective on who our borrowers are as well as their financial motivations and behaviors.

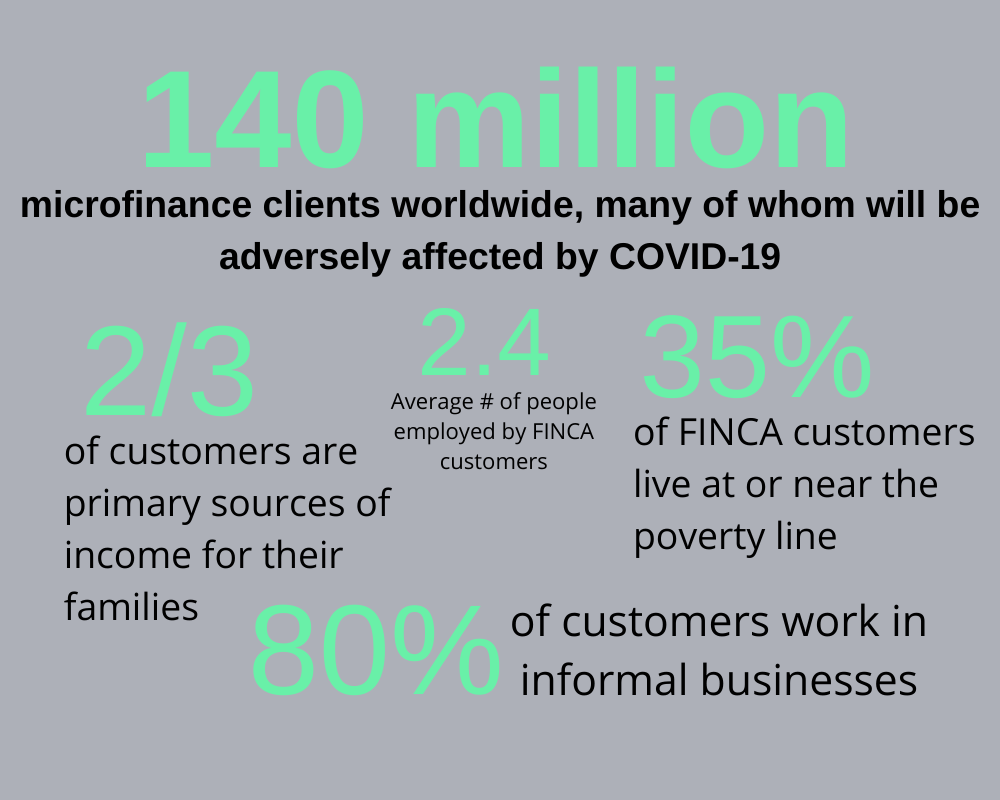

Data shows that our borrowers are carrying an enormous burden of responsibility for their families and their communities. In a 2019 survey, we found that two-thirds of FINCA’s microfinance customers are the primary sources of income for their families. Further, they are job creators, employing 2.4 people per enterprise. With so many people depending on them, our customers are highly motivated to reestablish their livelihoods and remain in good standing with their lenders. These facts are also a reminder that our actions on COVID-19 will affect many people – far beyond the 140 million microfinance customers directly served worldwide.

With so many people depending on them, our customers are highly motivated to reestablish their livelihoods.

Other data illustrates our customers’ special vulnerability to the financial and health impacts of COVID-19. Eighty percent of FINCA’s borrowers work in informal businesses, living on daily earnings in trade and services, with no protections to their income or safety. Thirty-five percent are already living below or near their country’s poverty line. A similar number live in homes without running water, headed by someone with less than a secondary education.

Finally, we know that our customers are financially disciplined, striving to save money regularly even though the amounts are small and hard to grow. Behavioral research adds detail to this picture. In a recent human-centered design activity for FINCA Uganda, in partnership with the World Savings and Retail Banking Institute (WSBI), small-scale entrepreneurs expressed strong motivations to save that were easily overtaken by family pressures. Lacking access to formal services, they resort to measures like hiding their savings in a welded metal box. These mechanisms may work for modest goals, but they are insufficient for an extended hardship.

Hiding savings in a metal box is insufficient for an extended hardship.

With so much at stake, we need fresh information about who is being most affected by COVID-19 lockdowns and how FSP clients are coping. Led by the Social Performance Task Force (SPTF), FINCA and other organizations are working collaboratively to develop survey tools that will give us insight into household conditions and survival strategies.

Events are unfolding rapidly, including important sector-wide efforts, so we must act quickly to elevate the customer perspective. FINCA’s research team in Uganda is already conducting a phone survey to assess client distress and coping mechanisms. Other FINCA subsidiaries in Eurasia and Latin America are adapting it to their local markets. For its part, SPTF intends to release its survey tools very soon – perhaps by the time this article is published.

Pilot data from Uganda reinforces our sense of urgency. Customers told us they had neither time nor resources to stock up on food in advance of the national lockdown, so they are already cutting back to one meal a day and doing their best to stretch out a week’s worth of provisions. Due to a staggering collapse in income (which has been documented elsewhere), they are curtailing “non-essentials” such as sugar and soap.

Ugandans are cutting back on meals and purchases of “non-essentials” such as sugar and soap.

Emotional well-being is also a concern. Confinement at home is creating stress, especially among men, who are more likely to be idle, which raises the specter of household tension and even domestic violence. One bright spot is that, for now, people are able to rely on family, friends and home gardens to fill in the gaps in daily consumption. But we don’t know how long these resources will last.

As insights emerge more clearly from the data, they should inform both humanitarian and development efforts. Data on clients and their local economies, and comparisons across markets, can help minimize damage to the livelihoods of FSP customers as governments structure the next phases of lockdowns.

Closer to home, the aim is to strengthen FSPs’ ability to support their customers, whether through outreach and communications, humanitarian partnerships, service delivery or other forms of engagement. By consolidating and sharing findings, we hope to mobilize a more informed response across the sector, including the investors and donors who will be called upon to finance the recovery.

We hope to mobilize a more informed response across the sector.

Organizations wishing to conduct rapid surveys to assess distress and coping mechanisms due to COVID-19 and other interested parties may contact the author at Scott.Graham@FINCA.org or Anton Simanowitz at Anton@socialperformance.net for more information.