As part of our partnership with the Mastercard Center for Inclusive Growth, CFI is embarking on an ambitious research program to collect data on micro, small, and medium enterprise (MSME) performance and resilience during the COVID-19 pandemic. CFI’s research will provide financial inclusion stakeholders the insights they need to develop policy, products, and services to support MSMEs across the globe.

Countrywide lockdowns in response to COVID-19 are slowing economies globally, and the impact is likely to be devastating for MSMEs in emerging markets. However, without data, it will be impossible to understand the extent to which COVID-19 has impacted the livelihoods of MSME operators in emerging markets and how they are coping in response. In turn, this will make it more difficult for governments, the donor community, and private institutions to craft effective responses to the crisis. CFI’s research aims to fill the data gap to ensure these stakeholders have visibility on MSMEs in order to address their needs.

The centerpiece of this program will be a longitudinal phone survey of clients at Accion partner institutions in Latin America, sub-Saharan Africa, and Asia, conducted every other month over the course of twelve months.

Broadly, the survey aims to answer the following research questions:

- How has business performance and practice changed since COVID-19 began?

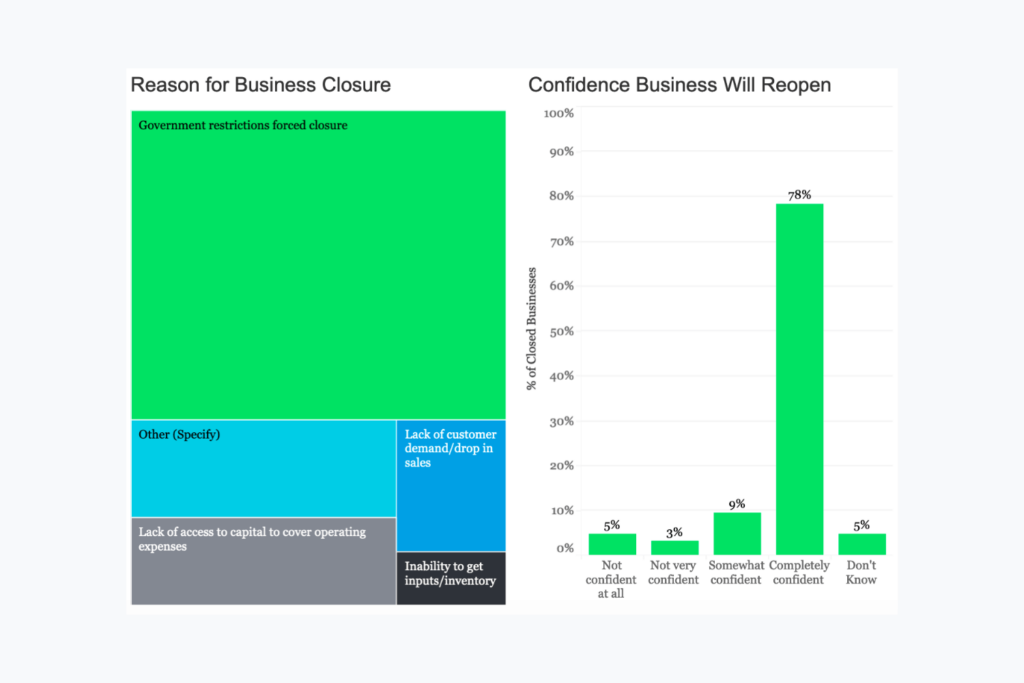

- Which MSMEs are shuttering operations and why?

- What strategies are operational businesses using to cope with COVID-19?

- What financial services are MSMEs using? Can financial assistance be quickly delivered through these channels?

- How are changes in MSME owners’ livelihoods impacting household well-being?

CFI’s survey will collect details of business operations, business practices, and household well-being. The longitudinal methodology will allow CFI to see how these indicators change over time with the aim of providing critical data on the pace of MSME deterioration and recovery in each market.

CFI expects to provide insights into the types of behaviors and products that correlate with better resilience during this shock. Those insights can be used to develop, test, and scale interventions that promote success factors—business practices or use of financial services—amongst struggling MSMEs.

Data collection is set to begin in early May in Lagos, Nigeria with preliminary results published in June.

This new effort is a component of our partnership with the Mastercard Center for Inclusive Growth to increase the financial health and resilience of individuals and businesses, with a refocused effort to support our understanding of and responses to COVID-19 on MSMEs and vulnerable populations.