Imagine you’re a small business owner in March 2020. You support your household with a food stall at the local market and have just hired your first two employees to meet increased demand. You’re able to put some of your income into savings, building a comfortable financial cushion for your business and your family. As the COVID-19 pandemic begins to reach your community, the market shuts down to prevent transmission of the virus and your previously healthy business income disappears nearly overnight.

Without the income the market normally provides, you cannot afford to continue paying your employees, so you let them go with a promise to bring them back after these temporary measures have passed. As it becomes clear that the pandemic will continue far longer than anticipated, you dip into your savings to pay necessary household expenses. The market eventually reopens, but with strict capacity restrictions and fewer customers than ever, and you cannot yet afford to hire either of your employees back. Months later, your savings have been exhausted, your income is a fraction of what it once was, and you find yourself skipping meals so that your children can eat. You turn to loans to keep your household and business afloat, but often skip loan payments in favor of paying household bills. Your once-thriving business is now barely able to keep you and your family housed and fed, and there’s no end or help in sight.

MSMEs have been dramatically affected by the COVID-19 pandemic and continue to face challenges.

For many small business owners in emerging markets, this scenario is anything but hypothetical. MSMEs — particularly micro and small businesses — have been severely impacted by the COVID-19 pandemic, resulting in financial instability, business closures, and lack of employment for many low-income people. The financial outcomes of a shock, such as a pandemic, for micro and small enterprises can have consequential effects, as losses can directly impact MSME owners’ household finances, community employment levels, and the ability to recover from future financial shocks or crises. MSMEs have been dramatically affected by the COVID-19 pandemic and continue to face challenges.

In May 2020, The Center for Financial Inclusion (CFI), as part of our partnership with Mastercard’s Center for Inclusive Growth, launched a six-wave, longitudinal survey examining the impact of COVID-19 on MSMEs in four countries: Colombia, India, Indonesia, and Nigeria. CFI’s survey is distinct as it focuses on the smallest businesses — with 95 percent of survey participants operating as sole proprietorships or microenterprises with fewer than 10 employees — and provides insights on changes over the course of a year, rather than a single snapshot in time. The survey leveraged CFI’s framework on the financial health of MSMEs, allowing a holistic look at the financial health and resilience of MSMEs throughout the COVID-19 crisis.

While it is difficult to compare data from surveyed countries due to the varying impact of the pandemic in each country, the resulting government response, and differences among the samples in each country, the aim of this brief is to present emerging trends from the data available thus far to understand how MSMEs are faring in light of the COVID-19 pandemic.

The trends illuminated by CFI’s data from this survey show that:

- MSMEs have been drastically affected by the pandemic, which has significantly impacted the financial health and resilience of MSMEs and their owners; and

- MSMEs surveyed largely have not adopted digitalization, despite the potential benefits that can come from embracing technology, both for business and for resilience against the financial effects of the pandemic.

To continue to weather this crisis and prepare for future shocks, MSMEs will require ongoing support, including the tools and education needed for digital transformation.

MSMEs Have Been Severely Impacted by the COVID-19 Pandemic

Data from the first five waves of CFI’s survey shows that financial health and resilience remain a challenge for MSMEs as the COVID-19 crisis continues. More than one year after the pandemic began, a significant share of businesses across all four markets continue to report reduction in profit levels. MSME owners are laying off employees or cutting employee hours to reduce expenses when financial pressure increases, which creates a ripple effect on the livelihoods of many. Other findings from the surveys show that people are reducing their number of meals, skipping loan payments, and turning to credit to survive.

People are reducing their number of meals, skipping loan payments, and turning to credit to survive.

Early in the pandemic, lockdowns and restrictions on physical movement led to significant income declines and business closures; although 74 percent of survey participants had steady or increasing profit levels pre-pandemic, that number dropped to just 16 percent by wave 1. Declining profits were largely attributed to government lockdowns and restrictions on movement in the first half of 2020, which led to 15 percent of MSMEs in our wave 1 sample to shut down. While data from subsequent waves shows that many businesses began to recover by the second wave, continued restrictions and uncertainty due to the ongoing pandemic proved those recoveries to be temporary and unstable, with surviving businesses reporting declining profits in later waves.

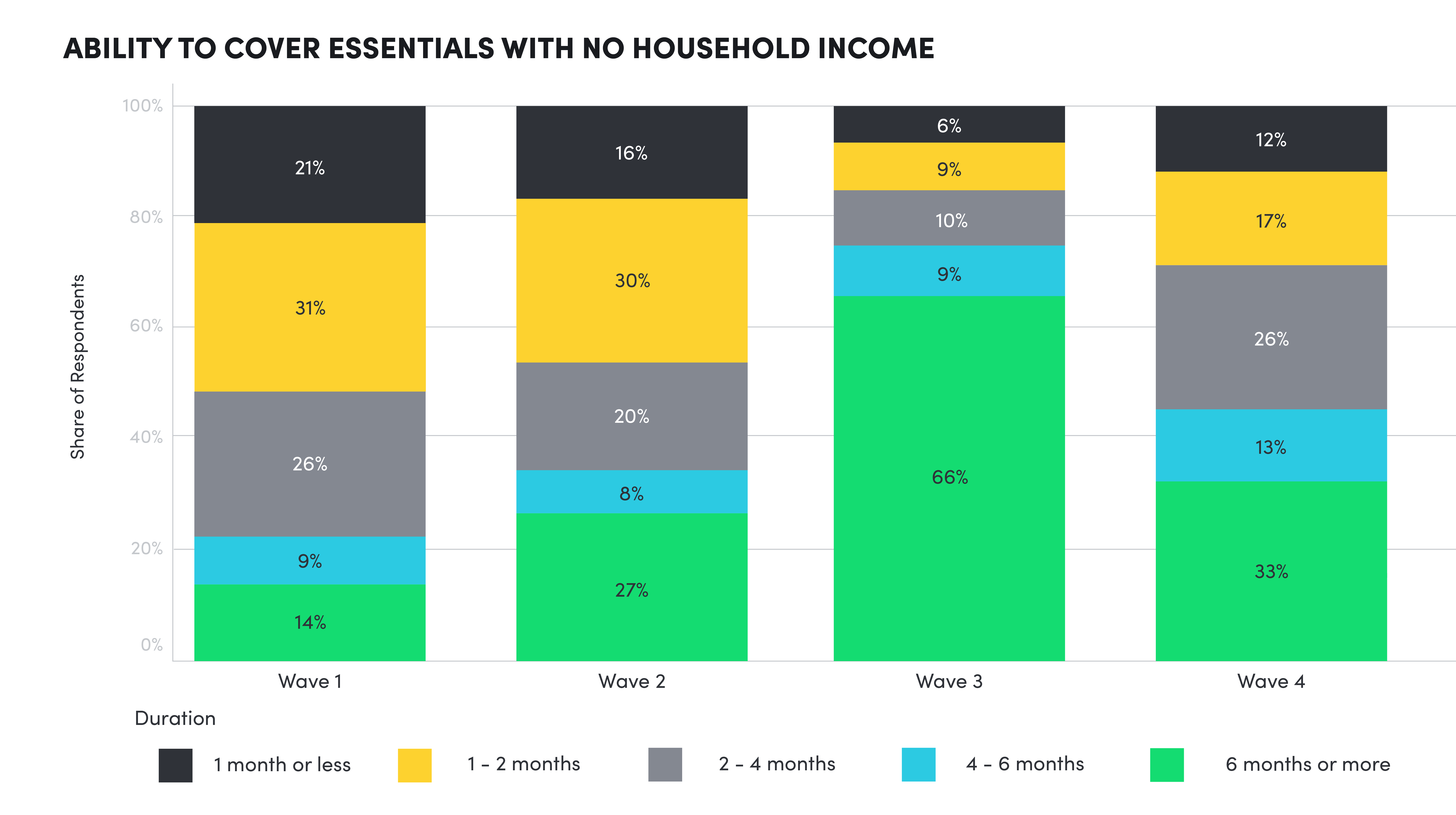

In India, 89 percent of MSME owners reported a decrease in profits in wave 1 and, although many saw an increase in profits in waves 2 and 3, profits significantly dropped again in wave 4 during June 2021 when India reported a heavy rise in COVID-19 cases. These profit trends are similarly reflected in the MSME’s ability to cover essentials over the longer-term, showing that as profits decrease due to COVID-19, financial security drops significantly.

Figure 1. In India, as profits decrease, the ability for households to cover essentials also decreases.

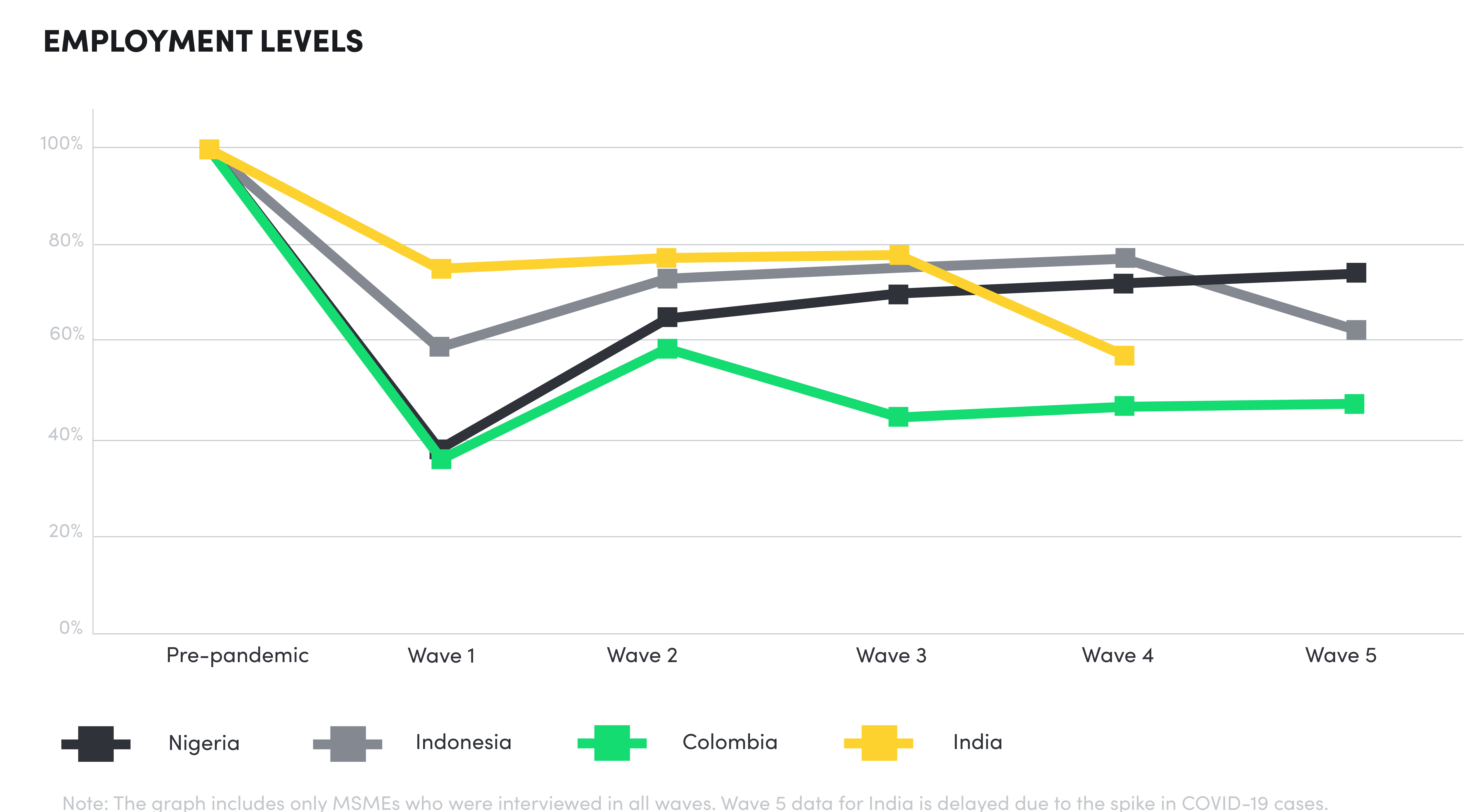

MSMEs are also struggling to return to pre-pandemic levels of employment. These businesses, which are a key employer of low-income and vulnerable workers, have reduced their workforce during the pandemic to cut costs. Now more than a year into the onset of COVID-19, the MSMEs surveyed in all four markets studied still have not returned to pre-pandemic employment levels. Based on the latest wave of data, the MSMEs surveyed in Colombia are operating with 48 percent of their pre-pandemic workforce, India with 58 percent, Indonesia with 63 percent, and Nigeria with 74 percent, indicating that employment continues to be fragile and MSMEs use workforce reduction as an early cost-cutting measure in times of financial instability.

Figure 2. MSMEs in our sample have not returned to pre-pandemic levels.

In response to the COVID-19 pandemic and its associated financial declines, MSMEs are also depleting their savings and turning to credit to survive. Early in the pandemic, 38 percent of business owners surveyed were unable to cover essential household expenses, leading to consequences such as food insecurity, with little improvement reported more than a year later. In Nigeria, for example, 22 percent of respondents in the latest wave reported that at least one member of the household has gone to bed hungry during the survey period and 36 percent reported that they had eaten fewer meals.

Figure 3. MSMEs are struggling to cover expenses with revenue, and the spike in COVID-19 cases in India between waves 3 and 4 resulted in a drastic decline in their ability to cover expenses with revenue.

More than 40 percent of respondents in Colombia, India, and Indonesia reported having two or more active loans in the latest wave of data, indicating that MSMEs are leaning heavily on debt to survive. Respondents also reported skipping loan payments as a coping strategy, signaling that many MSMEs that turn to debt to gain liquidity are having difficulty managing that debt. Savings and credit usage among survey participants also varied along gender lines: for example, in wave 5 in Nigeria, women had depleted a larger share of their savings compared to men (78 percent for women vs. 60 percent for men), yet women were less likely than men to rely on credit. Although the data doesn’t clearly illustrate the reason for these gender discrepancies, potential explanations may include systemic barriers to accessing credit for women, as well as higher levels of savings, delaying the need for credit to maintain liquidity.

MSMEs are Largely Not Embracing Digitalization

To cope with the pandemic, many businesses across the world have turned to digital platforms as a means of continuing business while physically distancing. However, even in markets with more built-out digital ecosystems like India and Indonesia, digital uptake is slow among our sample, perhaps pointing to the likelihood that the smallest firms are not able to take steps to digitize without some form of assistance.

Across India, Indonesia, and Nigeria, digital adoption was slow, and in some cases even declined. Usage in these three countries was inconsistent among respondents who reported having used a digital platform at least once; for example, in India, only 25 percent of those selling on a digital platform reported doing so during two or more survey periods. This suggests that MSMEs might test a digital platform to sell their product, but do not continue doing so, perhaps due to lack of digital literacy or challenges with onboarding.

Figure 4. Very few MSMEs report selling on digital platforms, and that number actually declined in all countries but Colombia where the sample skews toward more digitally savvy entrepreneurs.

Colombia was the only market showing a significant overall share and increase in the number of MSMEs selling on digital platforms. This is attributed to the comparatively robust digital product offerings of our Colombian partner financial institution, a fintech with a higher baseline of digital adoption among its clients. India’s results show the fragility of the country’s situation due to the pandemic, as wave 3 surveys were run February to March 2021, and wave 4 was from June to July 2021, two periods when the country experienced some of its largest impacts from COVID-19.

While digitalization can help MSMEs to build resilience and scale their businesses through the access and use of digital financial and communication tools, the MSMEs surveyed are largely not adopting digitalization and as a result, not seeing potential benefits associated with doing so.

Given the small sample size of those selling on digital platforms, it’s difficult to draw conclusions on the financial benefits of digital platform usage; however, we do see that MSMEs utilizing digital platforms in Nigeria were 1.2 times more likely to be able to cover business expenses with business revenue than MSMEs that did not sell on digital platforms, showing that digitalization may, in fact, be beneficial to business performance. Digitalization can help MSMEs to connect with customers, often in a wider geography than previously accessible. The use of digital can also benefit micro and small businesses in managing transactions, efficiently moving and delivering products, and accessing financial services.

Ensuring financial resilience for MSMEs post-COVID-19 and beyond

MSMEs are engines of growth and employment. They make up about 90 percent of formal and informal firms globally, and on average, account for about 70 percent of employment and about 50 percent of GDP. Their performance is crucial to the financial health of MSME owners, employees, and communities, particularly for low-income populations. The financial shock of the COVID-19 pandemic and its impact on MSMEs led to increased unemployment, food insecurity, and higher levels of debt among our sample, creating significant financial instability within low-income families and communities.

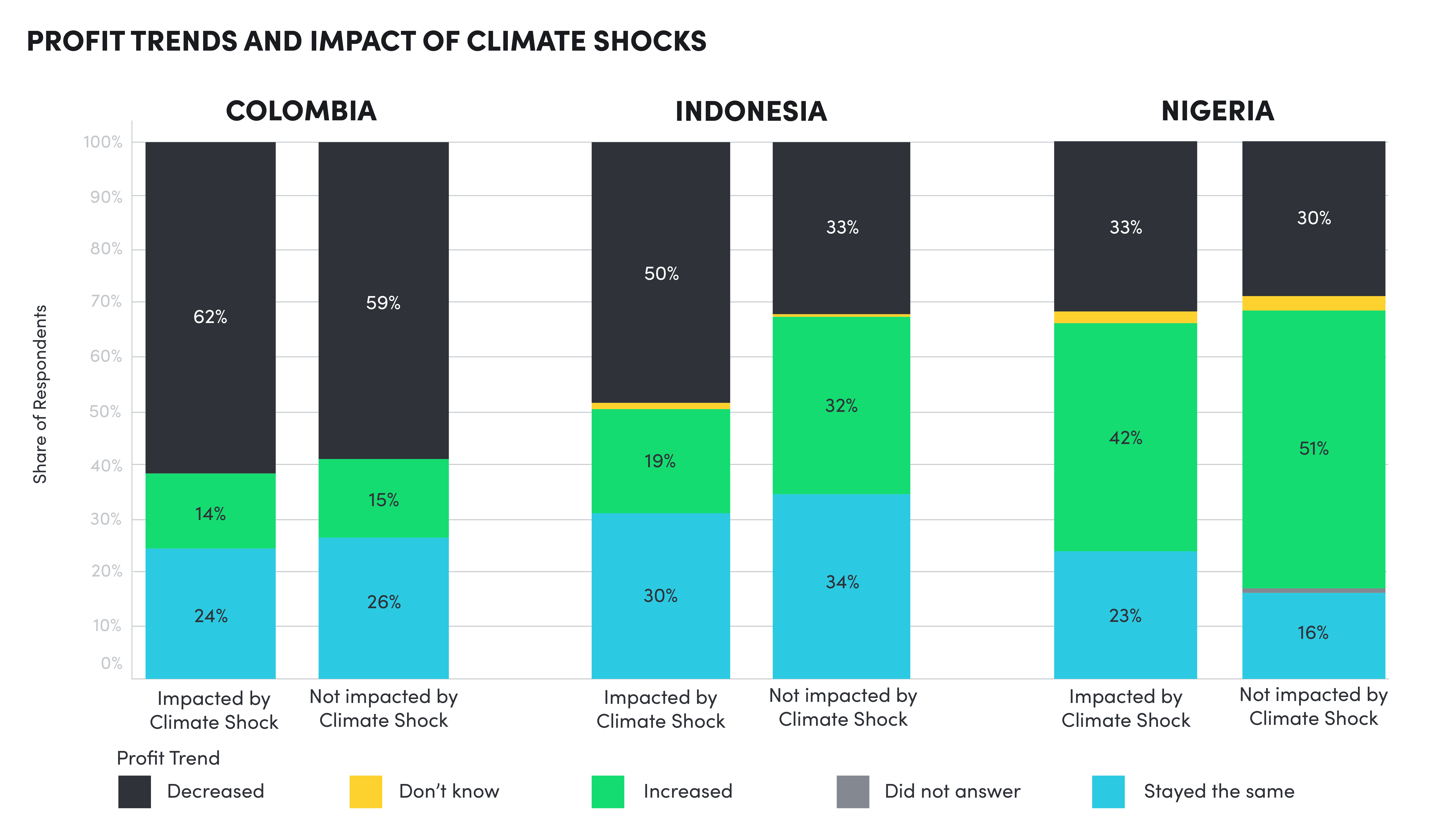

CFI’s data shows that MSMEs that have experienced previous shocks or crises, such as climate shocks, are having a more challenging time recovering from the financial effects of the pandemic. For instance, in Colombia, Indonesia, and Nigeria, MSMEs that were impacted by a climate shock (e.g., flooding, droughts, heatwaves, etc.) were more likely to report declining profit trends in the wake of COVID-19.

Figure 5. MSMEs impacted by climate shocks were more likely to report declining profits.

The cumulative impact of multiple shocks is exacerbated by the unexpected duration of the pandemic, leaving MSMEs more vulnerable than ever before. MSMEs require several types of support to help navigate the challenges of today and build resilience for the future. Data from CFI’s surveys suggest the following areas of focus:

1. MSMEs need ongoing support from government assistance programs.

Governments rapidly responded with a range of support measures targeting MSMEs in 2020, such as job retention schemes, debt moratoria, and loan guarantees, as well as support to help advance digitalization and skills development. Many governments also introduced emergency cash transfer payments to low-income households to help them make ends meet during the crisis. However, the majority of the MSMEs in our sample report not receiving a cash transfer; for example, in Nigeria, Colombia, and India, less than 10% of MSME owners received a government cash transfer in the latest wave of data collection.

In Nigeria, Colombia, and India, less than 10% of MSME owners received a government cash transfer according to the latest wave of data.

In Indonesia, where the government expanded the social assistance system in response to the pandemic, the share of respondents that received government assistance fell back to pre-pandemic levels in the latest survey conducted in July 2021. The IMF reports that most fiscal support measures ceased in low-income countries at the end of 2020. CFI’s data shows that the impact of the economic crisis is far from over for MSMEs and low-income households and ongoing support will be critical to their survival in the near-term and setting them back on the path to financial health in the medium- to long-term.

2. MSMEs need access to a wide range of financial services, especially insurance and innovative social protection measures, to increase resilience to shocks.

With the ongoing uncertainty of the pandemic, MSMEs are in an increasingly vulnerable position as savings continue to be deleted and multiple borrowing is on the rise. Less than 5 percent of MSMEs in the latest wave of data report having purchased insurance in response to the crisis. In addition to the important role of savings and credit, we must invest in expanding access to insurance to provide a safety net when a crisis hits. More Because insurance is a complex product that is difficult to test in small quantities, it remains out of reach for many low-income people globally. As such, more research is needed to explore the role of public-private partnerships that allow for risk sharing, along with innovations in risk assessments, delivery models, and product design. Financial institutions, policymakers, and investors must work together to ensure MSMEs have access to a range of financial services to help them thrive in the good times, and manage through the bad.

3. MSMEs need support with digital capacity building and overcoming high digitalization costs.

While some studies are finding that small businesses have accelerated their digitalization efforts in response to COVID-19, CFI’s sample which covers very small firms, many of which are customers of microfinance institutions, does not find the same levels of adoption. This points to an emerging risk that very small firms are at risk of being left further behind. The benefits of digitalization have been well articulated: it can help firms engage with customers, support access to financial services, and manage supply chains and transactions. But on their own, few micro and small firms are able to make this transition to digital adoption without access to robust services and tools as well as support with digital capacity building and overcoming the barrier of the high cost of digitalization. For technology to make a lasting, consistent impact, MSME owners and the financial service providers that serve them need support to demonstrate the ways in which digital products can assist businesses and their customers, and also how to leverage tech touch business models to make technology approachable and accessible to people with differing levels of digital literacy and capability.

The COVID-19 crisis has brought into sharp relief the precariousness of the smallest businesses in emerging economies. Investing in MSMEs and supporting their digitalization efforts will help these businesses navigate the challenges of the COVID-19 pandemic and help them prepare for future shocks and crises. Because MSMEs are critical for the employment of low-income people as well as the financial stability of families and communities, supporting MSMEs’ recovery from this crisis will help ensure future financial health and resilience, as well as employment opportunities for vulnerable populations. Any plan for recovery must account for and prioritize MSMEs and aim to improve their financial position in a post-pandemic world, preparing them for future financial shocks and providing a more secure path to recovery and growth.

The Center for Financial Inclusion’s (CFI) research on the financial health of MSMEs, conducted as part of our partnership with Mastercard’s Center for Inclusive Growth, aims to fill the data gap and ensure key stakeholders in financial services and policy have visibility into the wellbeing of MSMEs and their needs. In May 2020, CFI launched a six-wave, longitudinal survey examining the impact of COVID-19 on MSMEs in four countries: Colombia, India, Indonesia, and Nigeria. In each country, CFI is surveying MSME clients at one financial institution every other month for one year. CFI interviewed nearly 3,000 MSME owners across the four countries in the first wave, and 1,600 MSME owners in each subsequent wave. The collection of wave 4 data in India was delayed due to the surge in COVID cases in late spring of 2021.

COVID-19 and MSMEs: Data and Analysis to Understand Impact

What’s the scale of the pandemic’s impact and how are MSMEs coping?

Dive deeper into CFI’s data dashboards and analysis on Nigeria, Indonesia, Columbia, and India.