The COVID-19 pandemic threatened gender equality globally, leaving women more vulnerable to the health and economic crisis. However, new research published by the Global Impact Investing Network (GIIN) found that impact investments in financial inclusion reacted to COVID-19 by including more women as end-client stakeholders. Perhaps unsurprisingly – given the precarious economic conditions of the pandemic – the GIIN’s research also found a decreased number of active clients served by financial inclusion portfolio companies. Additionally, the number of decent jobs supported at or above a living wage at these companies decreased during COVID-19, with disproportionate decreases among female employees. Nonetheless, greater participation by women as financial inclusion clients is powerful. This one small but meaningful bright spot amid a devastating crisis offers hope that the power of impact investing can enhance gender equality even during the most challenging times.

The GIIN defines impact investments as “investments that seek measurable social and/or environmental impact along with financial returns.” They are critical to the financial inclusion landscape. With the impact investing industry surpassing one trillion U.S. dollars for the first time in 2021, investors increasingly see the potential for capital to achieve more than making additional profit. Especially during times of crisis, impact investors hold tremendous power to use their capital and investment strategies to deepen their positive social and environmental impact.

To better understand how the COVID-19 pandemic affected financial inclusion impact investments and the role that impact investors play during crises, the GIIN conducted the first known quantitative regression analysis on the relationship between the pandemic and impact performance. Here are two of the key findings we discovered:

1. Financial inclusion impact investments served a greater proportion of women during and because of the COVID-19 pandemic.

Women often face disproportionate burdens during times of crisis, and the pandemic proved no different, with women’s access to financial services decreasing across the traditional financial market. In fact, the Financial Access Survey from the International Monetary Fund indicated that the percentage of female loan recipients decreased in a majority of markets during COVID-19. After years of progress documented by this survey — comprised primarily of emerging markets — the proportion of women clients served regressed during the pandemic. Unfortunately, reports of women’s financial hardship continue to fill the headlines in publications by McKinsey, World Economic Forum, and the ILO, among others.

However, interestingly, impact investments in financial inclusion tell a different story. The investments included in our recent research demonstrated improvements in gender equality, bucking the global trend. In this case, we measured improvements in gender equality by assessing the proportion of women who were clients of financial inclusion companies. Impact investments enabled expanded access to responsible financial services for women clients during the pandemic, both in number and as a percentage of total clients served by financial inclusion companies. This shift occurred not despite the pandemic — but because of it.

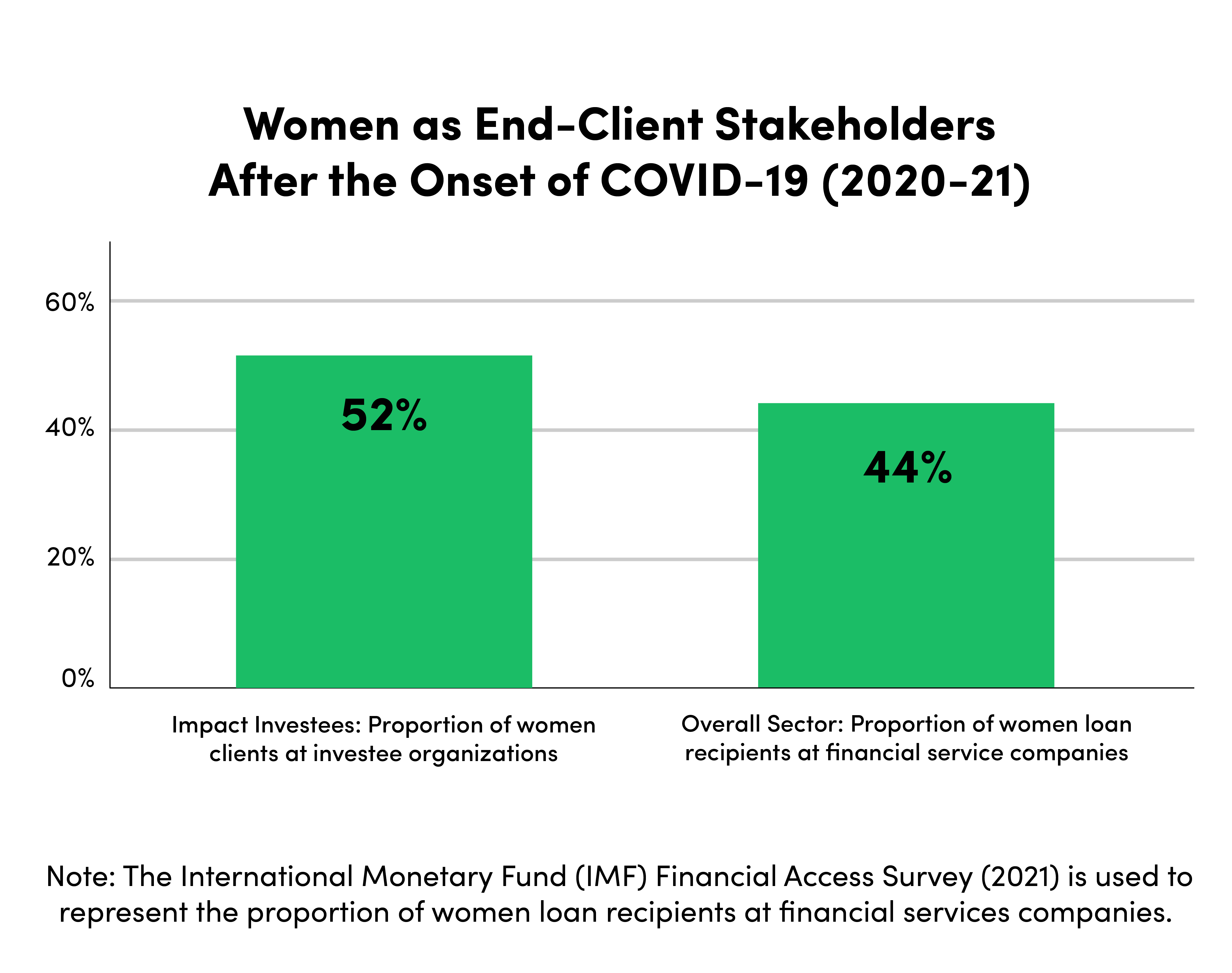

Our regression analysis finds that the COVID-19 pandemic led to a 5 percent increase in the proportion of women served. Compared to the broader financial services market, where women represent only 44 percent of clients, women comprised 52 percent of the clients at financial inclusion companies capitalized by impact investments during the pandemic.

The encouraging progress of financial inclusion impact investments in increasing women’s access to finance coincides with the impact investing industry’s focus on mitigating the social impacts of COVID-19. However, we recognize that increased access to finance often doesn’t benefit all women equitably. While standardized gender-based impact data reflecting racial equity and socioeconomic status was not available for this research, this type of nuanced data would offer critical insights into how the pandemic affected women differentially based on their identity. We encourage impact investors to continue to expand their demographic data collection, which will deepen the resulting insights and inform inclusive impact strategies accordingly.

We have always known that impact investors can play a critical role in combatting global inequities, especially when there is a heightened need for basic services. So it was encouraging to see that during the pandemic, some impact investors targeted gender equality explicitly, perhaps recognizing the inherent toll COVID-19 would take on women globally. The following examples – a small handful of many – demonstrate how some investors catalyzed change during COVID-19:

- By April 2020, when COVID-19 was already widespread worldwide, many impact investors began to offer additional support for their portfolio companies to address the challenges brought on by the pandemic.

- Throughout 2020, a U.S.-based foundation, Open Society Foundations, invested more in its offerings to domestic workers, the majority of whom are women, directly in response to the pandemic.

- In December 2020, a cohort of impact investors worked with the Impact Investment Exchange (IIX) to launch the third bond in the award-winning Women’s Livelihood Bond (TM) series, specifically aimed at supporting underserved women to respond, recover from, and build resilience in the aftermath of the pandemic.

- In 2021, British International Investment (BII), the development finance institution in the U.K., committed to more gender-smart investing to respond to the impacts of COVID-19.

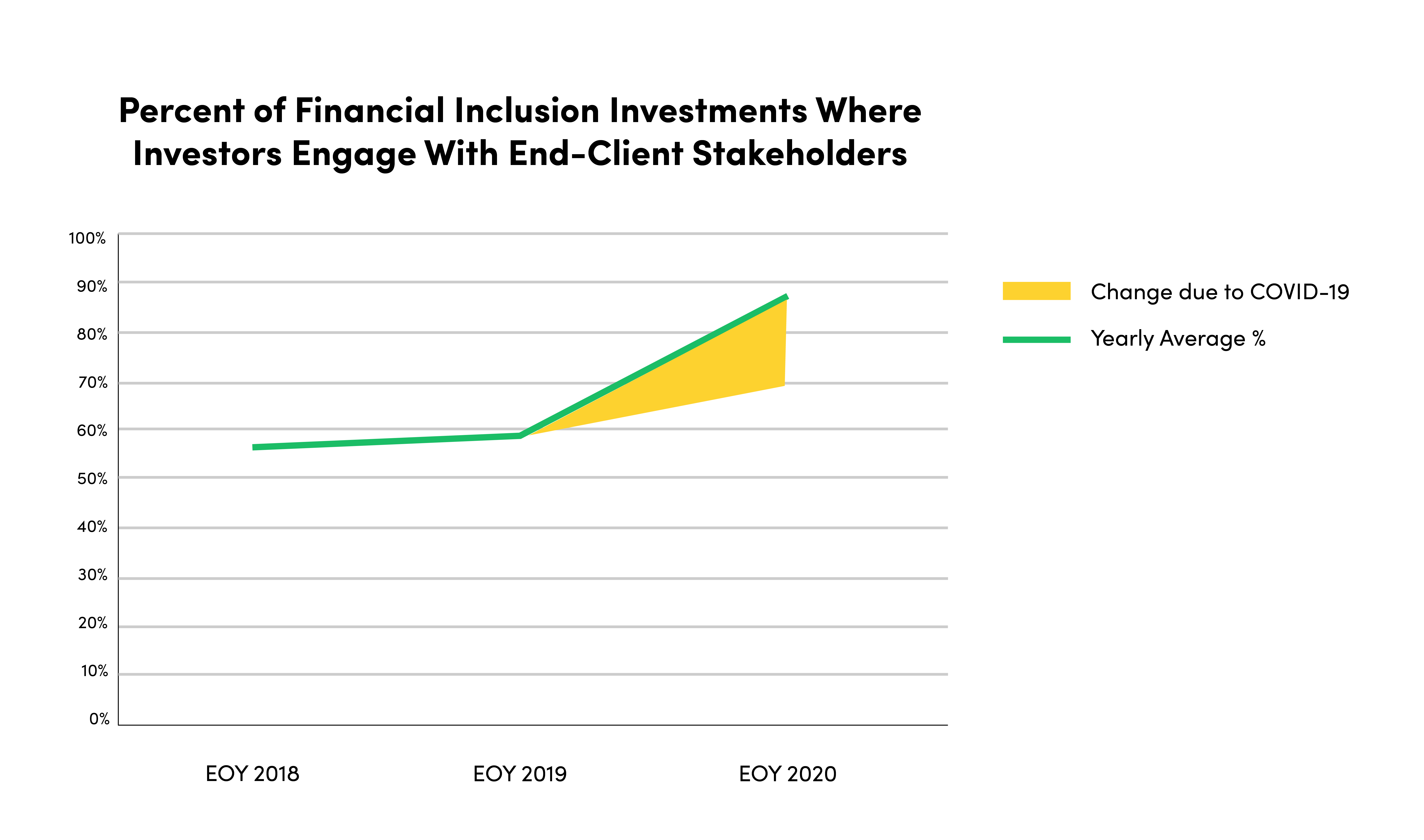

After the onset of COVID-19 in 2020, impact investors also increasingly pursued strategies to enhance their impact outcomes. Evidence indicates that the pandemic led to a significant increase in investors’ engagement with the end–client stakeholders of their portfolio companies. These activities included monitoring stakeholder satisfaction, collecting impact data directly, or identifying stakeholder needs. The percentage of investors engaging with end–client stakeholders leaped from 58 percent to 87 percent, with analysis attributing the vast majority of change to the new reality brought on by COVID-19. These new and strengthened mechanisms may have helped to buck the market trend and increase gender equality, presenting an opportunity for investors to sustain the practices they adopted due to the pandemic. Thus, investors can aim to continue them even as the emergent phase of the COVID-19 crisis subsides.

2. During the pandemic, women bore the brunt of job loss at financial inclusion companies.

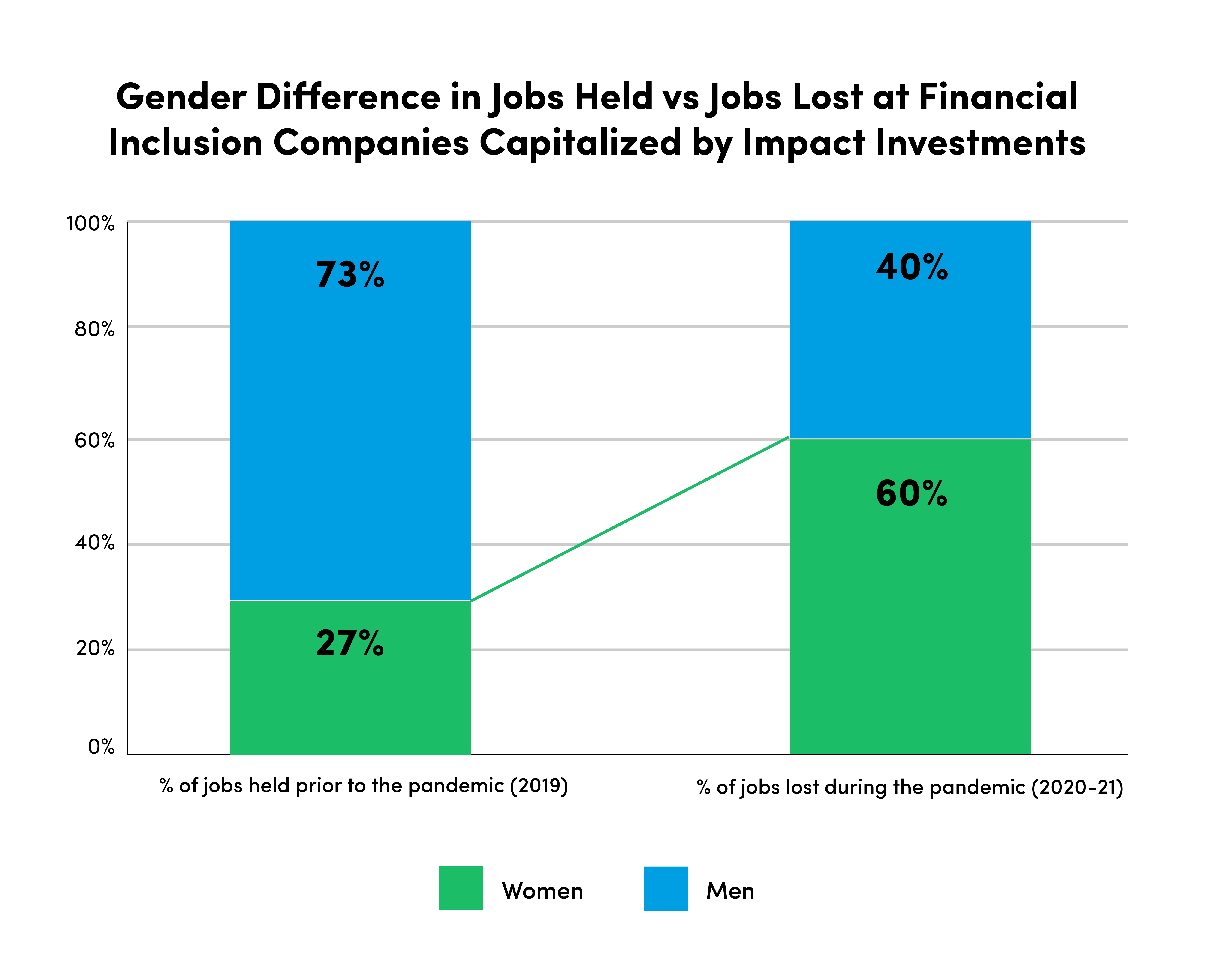

Despite progress on gender equality for the end–clients of financial inclusion companies, COVID-19-related job loss disproportionately affected women working at financial inclusion companies in impact investors’ portfolios. In 2019, women accounted for only 27 percent of jobs held at these companies, yet they represented 60 percent of jobs lost due to the COVID-19 pandemic in 2020 and 2021. Unfortunately, this mirrors broader global trends indicating that women lost significantly more jobs than men due to COVID-19.

Losing employment, especially during a crisis, can deeply affect women and their households. Not only does job loss increase the risk of women and the families they support falling into hunger and poverty, but it also leads to long-term negative developmental effects on children in the household. Conversely, holding a job during a crisis can give women the tools to help themselves and others by providing income to pay for food, education, and healthcare costs. With a greater focus on gender equality, financial inclusion companies can provide steady employment – and therefore support — for women, especially during crises.

There are indications that impact investments contributed to greater gender equality among their clients served but not for employees at financial inclusion companies. This paradox offers both hope and caution. On the one hand, greater female representation in a company’s client base demonstrates that companies can achieve impact even when global crises heighten the needs of the most vulnerable. On the other hand, more significant gender disparity in employee retention reflects the importance of looking at internal policies along with external ones.

The takeaway: impact investors have an opportunity to use their privilege and power to support gender equality in times of crisis and beyond.

Impact investments hold transformative power, even – and perhaps especially — in times of crises.

Investors carry tremendous power by the mere virtue of the capital allocation and management decisions they can make. In addition to providing capital, impact investors are responsible for influencing impact results and can do so through deeper engagement mechanisms and by incorporating impact into investment terms. Some examples might include the following:

- Investors might choose to monitor stakeholder satisfaction, identify needs through collaborative consultation with stakeholders, or directly collect impact data to identify investment opportunities in financial inclusion companies that address their clients’ needs.

- Through deep and thoughtful engagement with portfolio companies, investors can sit on the board of directors, offer non-financial support or technical assistance, engage in corporate governance matters, and support through shareholder advocacy.

- In setting investment terms, investors might codify impact goals into legal documents, link management compensation to impact terms, or provide flexible repayment structures.

Impact investments hold transformative power, even – and perhaps especially — in times of crises. It is an encouraging sign that the research shows improvements in gender equality across financial inclusion investments throughout the COVID-19 global pandemic. No matter the state of global affairs, investors can continue to engage deeply with investees and end-client stakeholders by building upon the mutually beneficial methods strengthened during COVID-19. In addition, impact investors can leverage the opportunity to engage in activities to build resilience within their portfolios. With the learnings coming out of the pandemic, each impact investor can act with greater confidence, knowing that their impact strategy can be durable and resilient – all while building towards a more equitable society.

The full research brief is publicly available here.

Questions? Comments? Want to get involved in the GIIN’s impact performance benchmarks? Feel free to reach out to research@thegiin.org.