Series

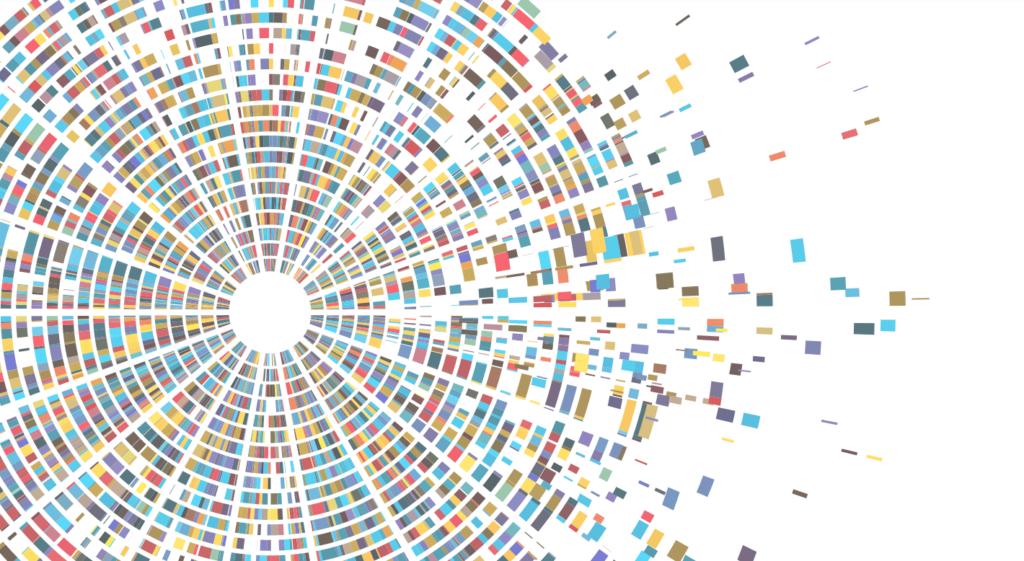

The Global Microscope has assessed the enabling environment for financial inclusion across 55 countries since 2007. This report summarizes the key findings of an assessment of the Global Microscope index’s existing data from 2007 to 2020. This was aimed at understanding the relationship between key financial inclusion enablers (ie, policies, regulation, and infrastructure) and financial inclusion outcomes.

This report discusses the policies that have driven change, the priorities to keep in mind for the future, the tools that will help achieve these goals, and the unique ways these priorities and tools apply across different parts of the financial system. Below are key findings from the 2021 report:

- A higher overall Global Microscope score showed a positive relationship with the number of accounts with formal financial institutions and mobile money providers among the population.

- The infrastructure domain had the strongest relation to account ownership, documenting the positive effects on inclusion from policies facilitating the expansion of payment systems, strong digital identification regimes, widespread connectivity, and robust credit information systems. The other four domains are government and policy support, stability and integrity, products and outlets, and consumer protection.

- Consumer protection was also positively linked to the prevalence of bank accounts, underscoring the importance of measures to ensure that financial consumers are treated fairly across the range of distribution channels and products.

- The magnitude and quality of regulatory implementation significantly impacts financial inclusion. Larger regulatory improvements were associated with increasingly larger gains in account ownership.

The Global Microscope work is supported by CFI, the Bill & Melinda Gates Foundation, and IDB LAB.

Dive deeper