The economic crisis brought about by the COVID-19 pandemic is disproportionally impacting small businesses and low-income households. While there is emerging evidence about how individuals and MSMEs have been impacted by COVID-19, the impact on the providers that serve these customer segments is less clear, particularly when tech-enabled providers play an important role in mitigating the economic impacts of the pandemic for households and businesses by deploying services quickly and efficiently. Additionally, fintechs are well-suited to bounce back and reorient themselves in times of crisis given their agile nature. However, in order to determine how best to support fintechs, more information is needed to understand how these providers have adapted to a challenging economic landscape.

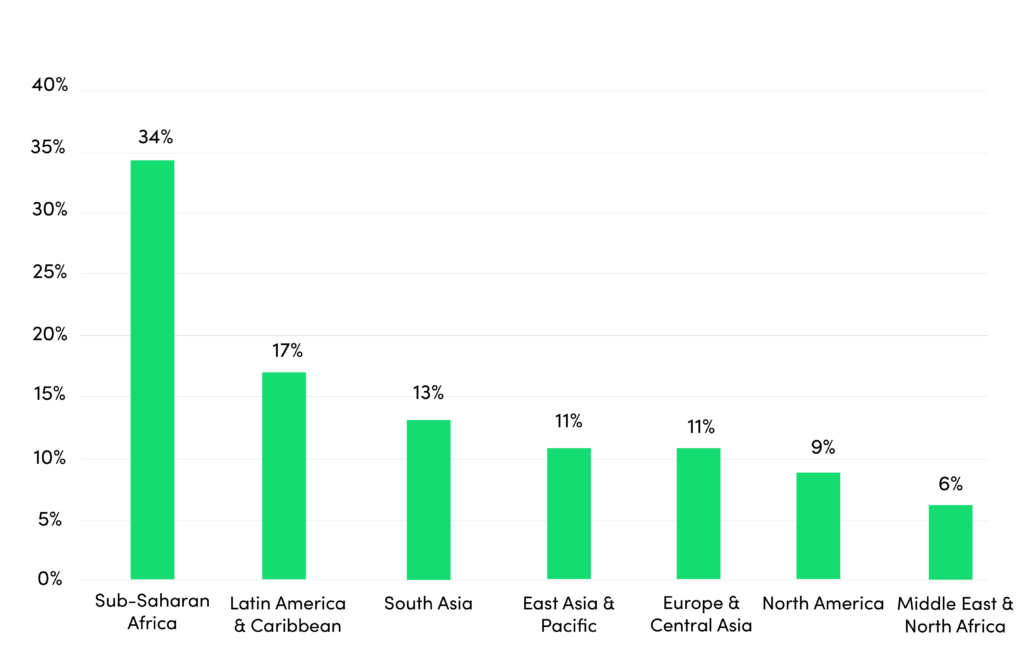

To understand more about the impact on and the role of these providers, CFI, in partnership with the Swiss Capacity Building Facility, conducted research to understand fintechs’ early adaptation and coping models under COVID-19. This brief draws findings from the Inclusive Fintech 50 applicant data coupled with key informant interviews with investors and fintechs conducted in March 2020. During June and July 2020, 403 early-stage fintechs (Figures 1 and 2) applied through a publicly available online form that gathered data related to target market, financials, product details, as well as seven COVID-19-specific questions exploring changes in fintechs’ business and operating models between December 2019 and May 2020. The findings also include COVID-19 survey findings from six 2019 Inclusive Fintech 50 winners.

Inclusive Fintech 50 Sample Distribution

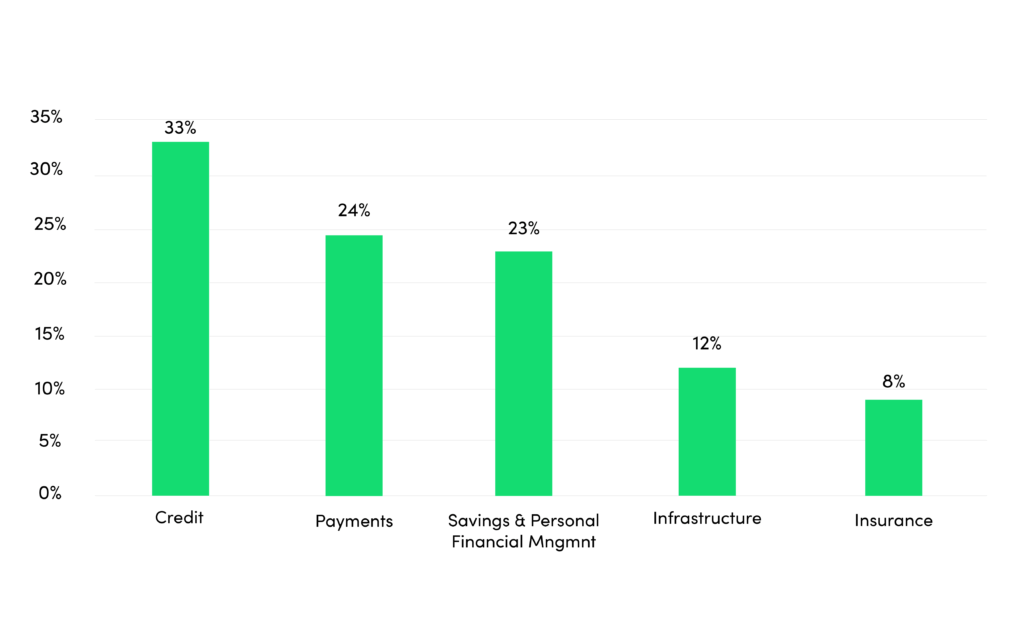

Figure 1. Inclusive Fintech 50 Distribution by Product Category

Note: Infrastructure includes a fintech whose main business is to provide processes and tools that enable multiple types of financial services such as credit, payments, insurance, and personal wealth management.

Figure 2. Inclusive Fintech 50 Distribution by Fintech’s Operating Country

The findings show these early-stage fintechs innovated rapidly to meet the changing needs of their customer base, while simultaneously reconfiguring operating models, internal policies, and growth strategies. Importantly, the findings present clear opportunities for investors to play a central role in expanding financial services to the underserved through these critical providers.

Findings from our research reflect five key takeaways:

- Fintechs are operationally resilient. Fintechs are maintaining a cash buffer and employing diverse strategies to keep their staff on board.

- New partnerships. The pandemic is enabling early-stage fintechs to increase their business opportunities by creating new partnerships with banks, government, and non-governmental organizations (NGOs) that need to digitize their services.

- New approaches to customer acquisition. Early-stage fintechs are employing digital delivery channels like platforms to increase uptake.

- New products and product changes. Early-stage fintechs are pivoting products to meet client needs. Payments and — surprisingly — savings and financial management fintechs grew their services between December 2019 and May 2020.

- New funding sources: Almost all of the fintechs have had to change their fundraising strategies in light of COVID-19, mainly diversifying their funding base.

While fintechs have shown resilience by innovating and evolving their offerings in the wake of the COVID-19 crisis, their biggest need remains access to capital in order to continue innovating.

I. Operationally Resilient Fintechs:

Conserving cash and protecting core operations

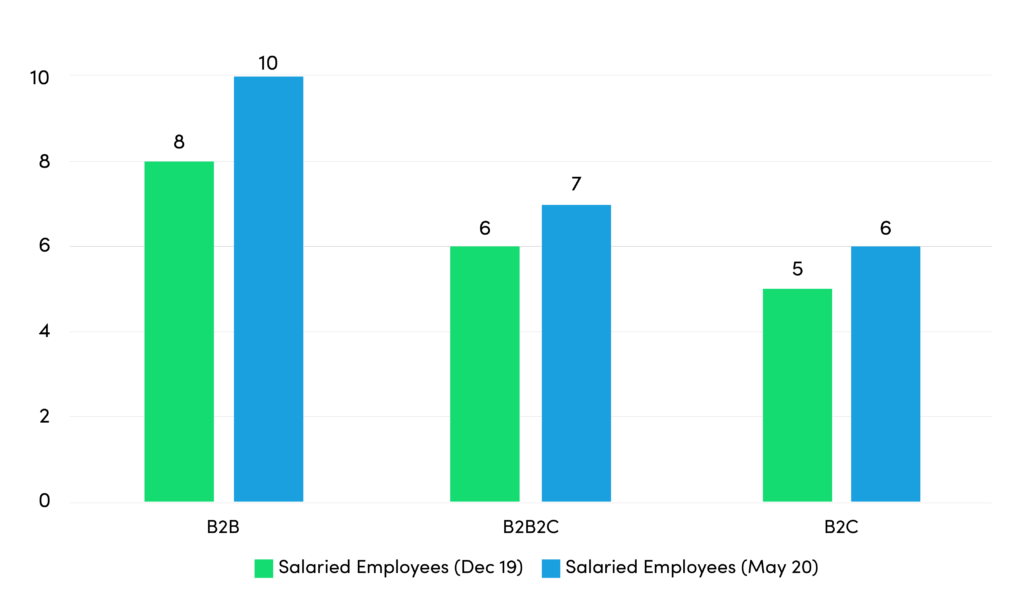

Fintech CEOs have had to make very difficult decisions to ensure they survive the pandemic. Our findings suggest that fintechs are employing diverse strategies to keep their staff on-board, such as salary cuts, work-from-home measures, and shifting to part-time to preserve cash: the median number of employees in May 2020 was seven, compared to six in December 2019. The relatively small increase in the median number of staff may be explained by the growth in payment, savings, and financial management and insurance services during this time period, discussed in detail in point four. The small median number of salaried employees in general (Figure 3) seems to have made it easier for early-stage fintechs to manage costs, likely avoid layoffs and, in some cases, marginally increase the number of their staff.

Figure 3. Change in Salaried Employees, by business model

Note: B2B—business to business model; B2B2C—business-to-business-to-consumer model; B2C—business-to-consumer model

For fintechs with more than 50 employees (a total of 39 with the majority Series A/B), only 30 percent decreased the number of their employees. They comprise mainly digital lenders which may reflect the decrease in their services during the pandemic (discussed in detail in point 4). These findings are also reflected in MSC’s qualitative research whereby fintechs are implementing “softer” measures like salary cuts before thinking about more stringent measures such as layoffs and furloughs.

Maintaining a cash buffer

To continue operations and survive the crisis, it’s prudent to keep more cash on hand. Given that startups rely on cyclical, often short-term funding for each phase of their product development, preserving cash may be more challenging. Interestingly, our data shows only a slight decrease in fintechs’ median cash runway before and during the pandemic: seven months of cash runway in May 2020 compared with nine months cash runway in December 2019. Undoubtedly seven months is considered a short runway, especially given the limited debt liquidity in the market at the moment. Nevertheless, the cash buffer that fintechs have still been able to maintain between December 2019 and May 2020 supports our qualitative findings that fintechs have been preparing for three-, six-, and nine-month slowdown scenarios and options to decrease spending, which demonstrates operational resiliency. Some resilience may come from the growth in payment and savings/financial management services as well (discussed further in point four).

Interviews with investors indicate that early-stage fintechs are seeking bridge rounds to maintain and grow this cash buffer and are being advised to budget six months, for example, for an equity raise during these challenging times.

A little less than a third of fintechs (29 percent) have a year or more of cash reserve (the majority in growth stage), and a similar percentage have six months or less (Figure 4).

Figure 4. Fintech Cash Runway (May 2020)

II. New Partnerships:

Increasing business opportunities in partnership with institutions that need to accelerate their digitization processes/services

Creating new strategic alliances

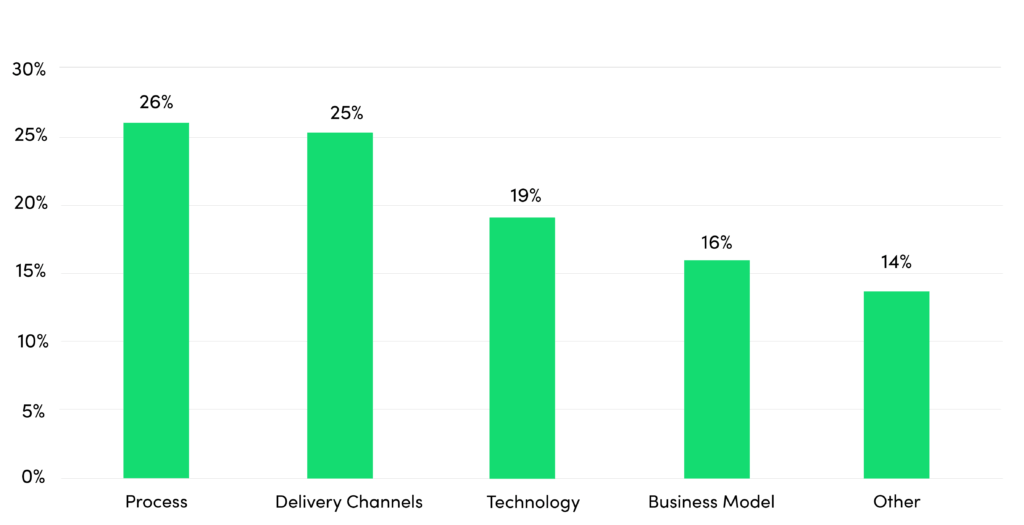

Findings from the Inclusive Fintech 50 dataset reveals that COVID-19 gave many fintechs the impetus to further leverage their unique skills and assets to digitize features and services they had not yet digitized. As demonstrated in Figure 5, the majority of fintechs focused on adapting their delivery channels (i.e. increasing partnerships/customers) and processes (i.e. digitizing features).

Figure 5. Changes Fintechs made due to COVID-19

The majority in the ”Other” category refers to “no change/no impact,” followed by fintech “working remotely.”

It also presented an opportunity for B2B and B2B2C fintechs to build partnerships with businesses that may be non-traditional to them, such as banks, logistics services, and e-commerce platforms. This relates to the growing trend of embedded finance, where the provision of financial services is integrated within the offering of any business service. This new perception of the delivery of financial services is bringing new prospects for fintechs.

Our qualitative findings suggest that the majority of these new partnerships are with institutions that need to digitize quickly due to COVID-19 lockdowns. A B2B fintech based in India that provides lending to MSMEs in our sample started working with banks, as they could not fully operate during the COVID-19 lockdown. The fintech introduced digital compliance measures to make it easier for banks to continue their service, and as of early June 2020, this fintech had created 12 new partnerships. The fintech also noted that they have received more demand from MSMEs and as a result, the fintech has tailored portions of their onboarding processes for MSMEs.

Some fintechs in our sample are partnering with companies considered essential to continue their operations, like e-commerce platform Jumia or logistics service providers to deliver essential goods during the lockdown.

“Prior to COVID-19, our clients, the (boda) drivers operat[ed] as individual business[es]. However, the government has restricted drivers from operating [and] this has led to lack of jobs, business for the drivers and the ripple effect is inability to pay towards the full acquisition of their assets. [We have] started partnerships with [e-commerce platform] and other delivery houses who still require the services of the drivers as they are allowed to operate.” (B2B Credit Fintech, Sub-Saharan Africa)

Others are taking a leaner approach to partnerships by targeting community organizers, business owners, and neighborhood clubs that could implement the fintech’s platform for free.

III. New Approaches to Customer Acquisition:

Focusing on online strategies and offline functionality

Increasing use of Facebook and WhatsApp for customer acquisition

The early-stage fintechs in the Inclusive Fintech 50 sample are increasing their use of digital acquisition channels, such as Facebook, to market their products. Qualitative findings point to an increased use of targeted social media campaigns, webinars, and other online marketing strategies such as email campaigns or WhatsApp chat room for clients — indicating that these channels are cheaper than TV and print media and likely more effective.

Our findings also indicate that for customers who may not have access to these platforms, some fintechs are using SMS messages and radio to communicate information about a product, registration, and even training materials. In fact, a payments fintech operating in Sub-Saharan Africa reverted to a phone and SMS campaign, due to COVID-19, which resulted in a customer conversion rate of 15 percent compared to 17 percent of door-to-door campaigns they conducted prior to the COVID-19 crisis. They have found that their SMS/phone campaigns have a higher return on investment due to the reduced investment in the resources required for door-to-door campaigns.

Increased use of training and offline functionality as a way to onboard consumers and agents

Online training is a common solution for fintechs to guide first-time users. Similarly, fintechs are adopting remote and online processes and tools to onboard and train their agent network (i.e. using video call services like Skype). This shift away from in-person customer onboarding may disadvantage some consumers; some fintechs (7 percent of the IF50 sample) are taking into consideration rural clients (7 percent). Aiming to improve their outreach to these populations, fintechs have added offline functionalities to their products, like apps that work offline in order to for users to consume content, apps that can use mobile network signals to synchronize users’ or a savings group’s data, and cards that can be read by POS machines.

IV. New Products and Product Changes:

Adapting products and service to meet clients’ changing needs

Growth in payment and savings and personal financial management services

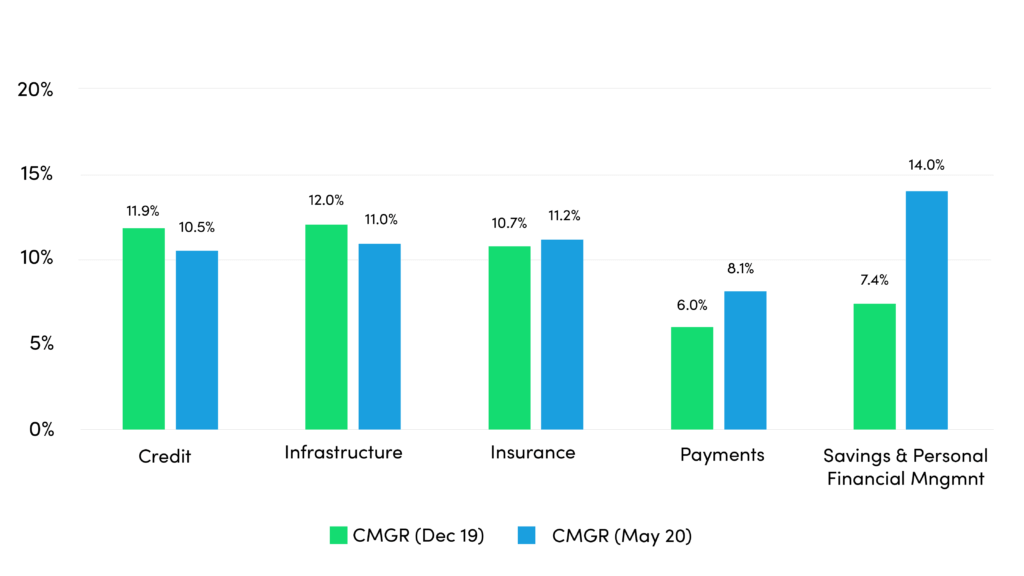

Our data (Figure 6) shows that payments (comprising 24 percent of Inclusive Fintech 50 data) and savings and financial management services (comprising 23 percent of Inclusive Fintech 50 data) grew during the early days of the pandemic (approximately 2 percentage points and 7 percentage points, respectively). The growth in payment services is unsurprising. While the World Bank predicts a 20 percent fall in remittances during COVID-19, remittance providers themselves are noting very large increases in June 2020 due to scaling digital channels.

According to UNCDF’s survey of remittance service providers, Moneygram’s account deposit and mobile wallet transactions increased 148 percent year-over-year in the second quarter of 2020 globally. Before COVID-19, Vodafone MPAiSA Fiji did 6,500 transactions — almost USD$1 million — per month, which has now increased to 22,000 transactions per month and USD$3.1 million in volume.

In Pakistan, mobile money provider Easypaisa reported a 35 percent increase in new customers during the lockdown, with inactive customers also returning to the service.

Moreover, fintechs are adding services to their anchor products to meet the financial needs of their clients at this time, such as mobile wallets, credit, and microinsurance products (i.e. health insurance due to COVID-19-related illness and income protection insurance). A B2B credit fintech in sub-Saharan Africa, for example, added cargo to their ride-hailing services to grow their business post-lockdown measures. Another B2B Fintech in South Asia that offers digital tools to financial service providers (FSPs) revised their credit scoring algorithm to acquire more customers and introduced new processes and tools so their clients could continue conducting basic activities like disbursements, loan approval, and customer onboarding mechanisms without time-consuming registration processes.

Given the pandemic’s toll on household incomes, we did not expect to see a rise in savings products. However, 53 fintechs, representing 57 percent of the savings and financial management product category in the Inclusive Fintech 50 dataset, focus on financial management/education services and investment. Some of the savings and financial management fintechs are either now offering incentives as a result of COVID-19 to save in flexible ways, or bundling services on top of their core products to increase their scale, such as insurance and payment.

“We introduced a new product which was an emergency fund ROSCA, which are five months long allowing people to gain access to quicker cash for shorter time. We also introduced working capital committees and connected people who wanted to help with those who were in need of help to build resilience and accountability rather than just give out donation. We saved multiple women-run businesses and gave them ability to remain afloat.” (B2C Savings Fintech, South Asia)

Growth in insurance products

The Inclusive Fintech 50 data also reflects a very slight growth in the uptake of insurance products between December 2019 and May 2020 (Figure 6), which is likely an outcome of the health crisis created by COVID-19. In fact, the founder of Toffee Insurance, based in India and a 2019 Inclusive Fintech 50 winner, discussed with Accion Venture Lab (AVL) how people across income levels are “proactively looking for products.” He argues that COVID-19 is changing consumer perceptions of insurance and that fintechs can meet this demand.

Figure 6. Fintech Compound Monthly Growth Rate, December 2019 and May 2020

Offering clients flexible repayment options

As shown in Figure 6, credit services slightly decreased between December 2019 and May 2020. This is no surprise given that COVID-19 lockdowns are negatively impacting small businesses, and moratoria have been offered on repayments. Similar to MFIs giving leniency to its clients, credit fintechs too are implementing similar measures, such as flexible repayment options, grace periods, or increasing the number of payment installments. This is associated with a reduction in lending and tightening of the underwriting process, reflecting fintechs’ risk mitigation strategies.

V. New Funding Sources:

Fintechs are changing their fundraising strategies

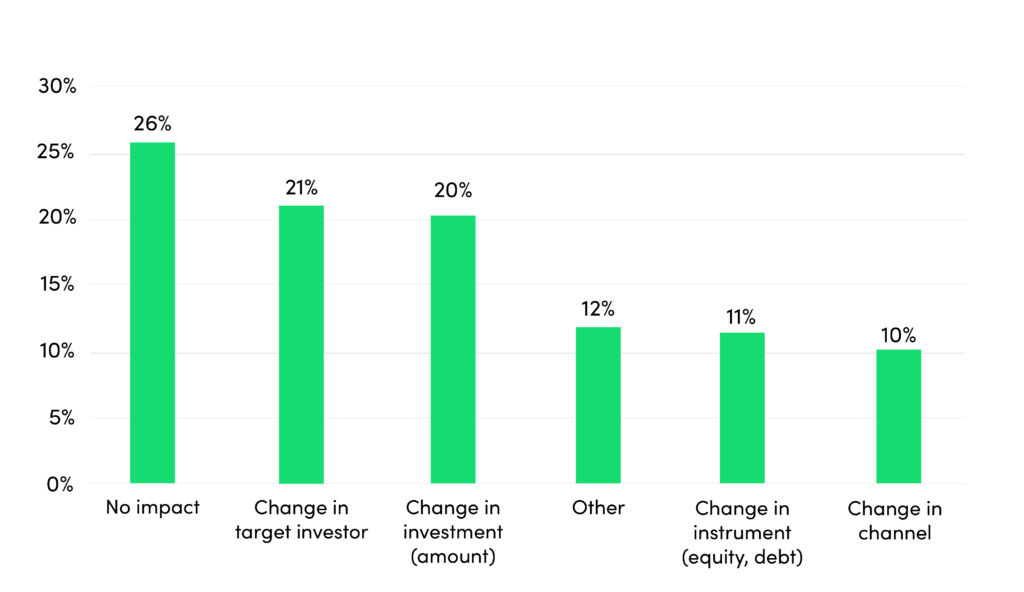

In a recent blog, we wrote that while fintechs are looking for the cash they need to prove their business model and scale, in the absence of face-to-face meetings and travel restrictions, fundraising and investment will look very different for fintechs and investors. While the investors we spoke with are ready to invest in emerging fintechs as the pandemic subsides, our data tells us that fintechs are turning to different types of investors and instruments to grow their business. Interestingly however, more than a quarter of our respondents noted their fundraising strategy as of May 2020 had not changed (Figure 7).

Figure 7. Fintech Fundraising Strategies due to COVID-19

The majority of inclusive fintechs (self-funded/seed) that have changed funding strategies are no longer primarily seeking equity investments and instead have broadened their search to include shorter-term investment instruments such as debt and grants. They are approaching impact investors and development financial institutions, given the increase in interest — due to the pandemic — in inclusive finance and fintechs’ product offerings. There were some self-funded fintechs that noted they were ready to move to equity financing as debt financing interest rates were high. This finding supports our interviews with impact investors that fintechs have a pressing need for short-term cash.

“[We] originally planned to raise a Series A round, but given the COVID investment climate and drastic reductions in valuations we pivoted to raising a seed extension. [We] see an opportunity while economic access and inclusion has been brought to the forefront by this pandemic. We are now in closing conversations on our Seed Extension for an incremental $2 million.” (B2B Credit Fintech, Seed/Angel Stage, United States)

For later-stage fintechs (Series A and B), the Inclusive Fintech 50 data points to a mix of financing instruments — debt financing, equity and equity-like instruments such as convertible notes. Their willingness to continue equity financing reflects that they are willing to accept reduced valuations, which may attract new investors.

Nigel Morris of QED Investors argues that “investing in consumer-centric, value-creating, [and] digitally-oriented” fintech models have remained largely unchanged, and he believes that “a great company going into COVID is invariably a great company coming out.” Fintechs in our sample remain hopeful because of the value-added, customer-centric services they are offering to those who need it the most in this time of crisis and hope that their agility signals their resilience and commitment.

What’s Next for Fintechs?

The findings have demonstrated how the COVID-19 crisis has created opportunities for fintechs to expand and tailor financial services and contribute to the financial resilience of small businesses and low-income households. They have proven operational resiliency and agility, created new partnerships, designed strategies to acquire new customers, and pivoted products to meet customer needs. Indeed, a recent survey of fintech customers conducted by BFA’s Catalyst Fund found that there is clear demand for credit and other financial products, and large gaps in insurance coverage of all kinds (i.e., health, life, disability). They also found that almost 50 percent of fintech customers report they have utilized the startup’s services since the onset of the pandemic, and 60 percent report that the service was very useful.

Still, fintechs’ biggest need is access to an investor network and capital in order to continue innovating. It is incumbent on investors to rise to this occasion and fuel fintechs with the tools they need to respond to the needs of the hour. We provide recommendations to assist investors in their strategies and fintechs wanting to learn from their peers.

Recommendations

Investors:

- Streamline investments efforts by collaborating with other investors to deploy capital to high-impact investment opportunities more quickly, and better monitor rapidly emerging trends. Initiatives like the Nest, the Response, Recovery, and Resilience Investment Coalition, and Village Capital are connecting impact investors with impact-oriented start-ups.

- Assist fintechs with management advice and technical assistance. Technical assistance models, such as those offered by SCBF, enable financial institutions to innovate and scale in order to increase uptake.

- Deploy bridge loans to provide early-stage fintechs cash buffers to protect their operations and continue innovating.

Fintechs:

- Employ customer-centric research to design products/services that respond to the needs and preferences of your target market.

- Design a segmented partnership strategy that leverages the opportunities COVID-19 is presenting: accelerating digitization of traditional institutions and digital platforms that are embedding financial services in their product suite.

- Win hard-earned customer trust by employing robust and transparent consumer protection.

We hope that these findings and the insights from the 2020 Inclusive Fintech 50 white paper will provide investors with evidence to assist them in their discovery process.