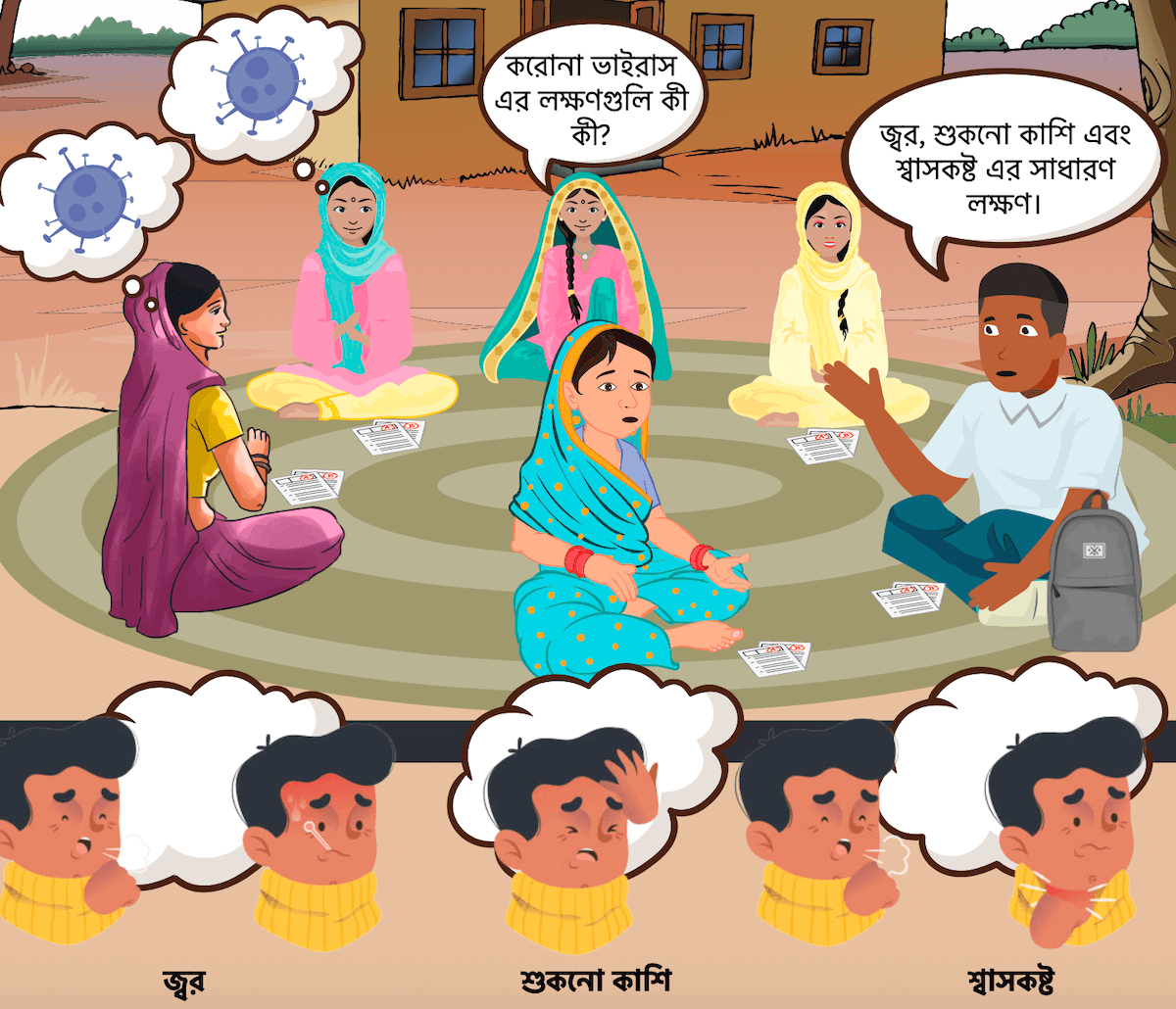

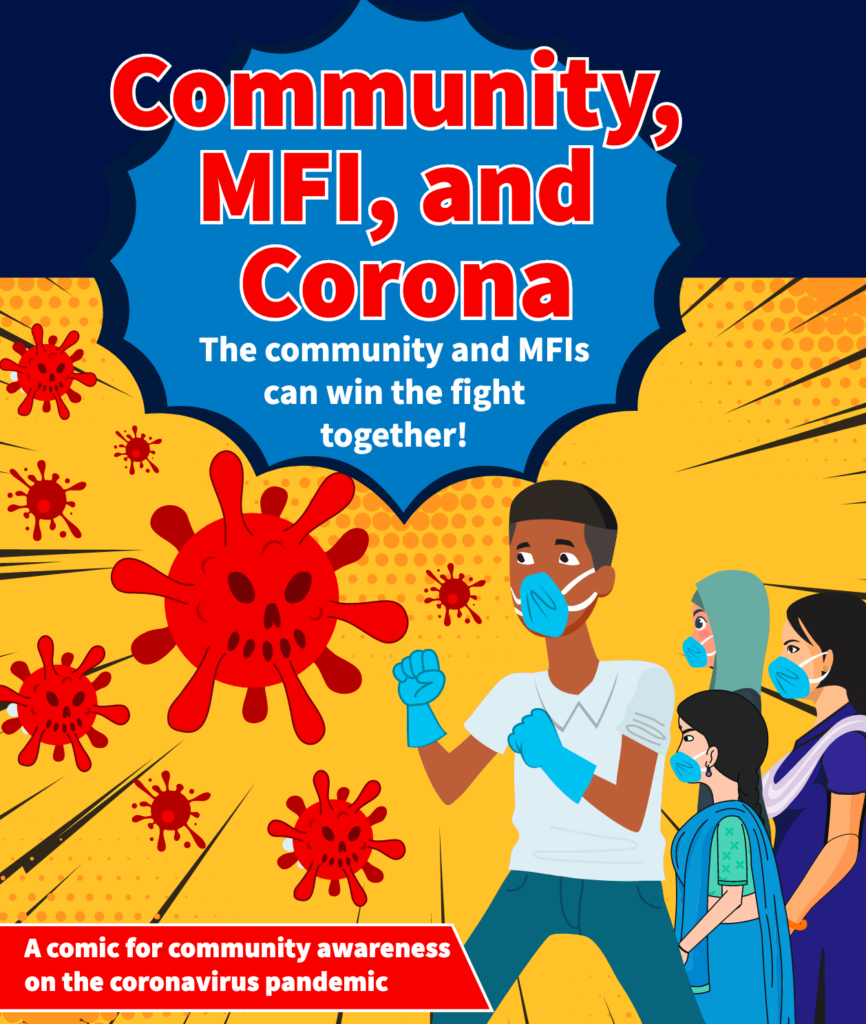

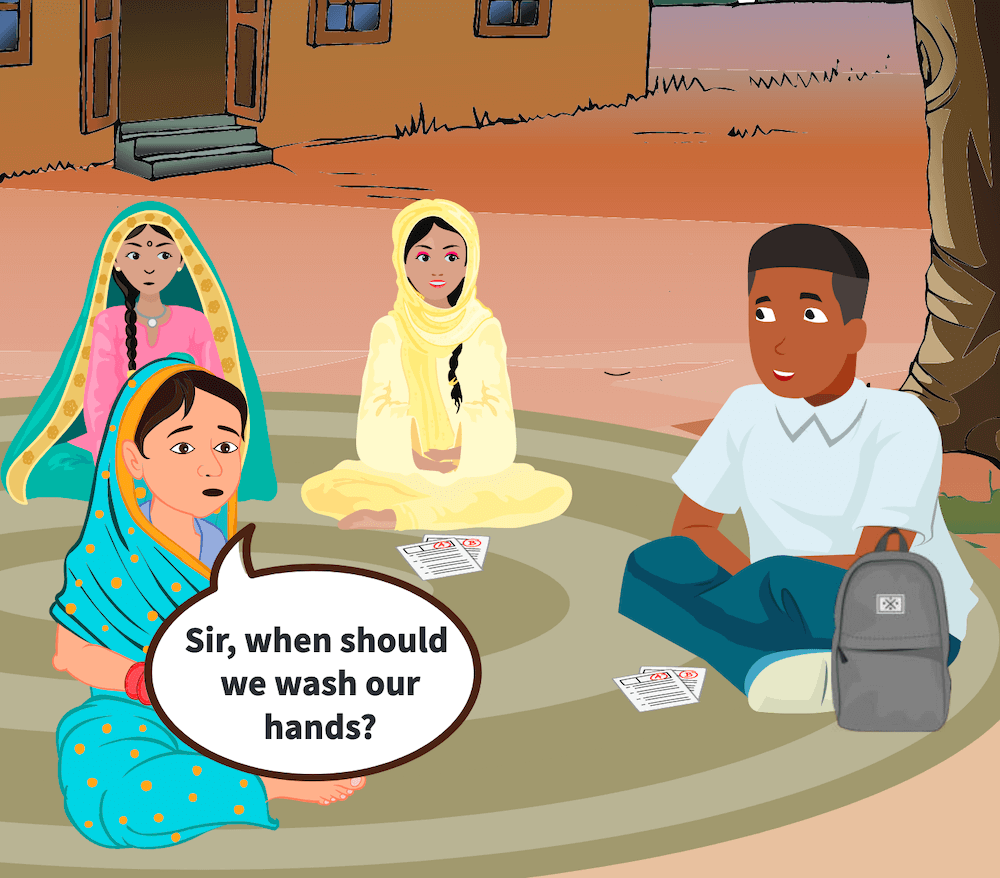

Expressive faces. Colorful illustrations. Simple and engaging dialogue.

A comic can be a powerful tool for raising awareness and changing attitudes because the medium can reach and captivate a broad audience. With the pandemic posing a dire threat to MFIs and the clients they serve, MSC (MicroSave Consulting) created a series of comics for clients and employees on how coronavirus spreads and how to take proper precautions. CFI reached out to Graham Wright, Group Managing Director of MSC, to discuss how the team got inspired to create the comics, where the comics are being used, and more.

In general, what has been the impact of the pandemic on the MFIs that MSC partners with?

Unsurprisingly, the impact on MFIs has been crippling. Most have had to close their offices throughout the lockdown, so branches are shuttered and staff are unable to move out to serve their clients. We have been encouraging MFIs to stay in touch with clients as they will be going through very difficult times. And in anticipation of reopening, we are working with many to conduct phone-based surveys of their small business clients with larger loans. These should provide insights into how clients are coping, and how to help them rebound when the lockdowns are lifted. The first insights from the research can be found here and results of these surveys will be available on our COVID-19 resource page.

Was there something specific that inspired MicroSave to do these comics?

We realized that most government awareness programs were generic and often not reaching MFI clients. So we saw the need for specific collaterals targeted to spread awareness among microfinance clients.  Was there something specific that inspired MicroSave to do these comics?

Was there something specific that inspired MicroSave to do these comics?

While interacting with MFIs we saw that there was also a need to train MFI frontline staff members on how to conduct their daily operations during COVID-19. They needed to be prepared for cash handling, workplace safety, client interaction and client and employee safety.

Putting these guidelines in conversational and engaging comics will, we believe, help MFIs efficiently train their employees and maintain the relationship of trusted partners with their clients.

What did the process of making the comics entail?

We discussed the need for education/training materials with several MFIs, and thus defined what they should cover. Clearly there are many important issues that both MFI clients and staff need to know – both about the pandemic (there is a lot of misinformation in the villages), and about how to manage operations that are, under normal circumstances, conducted in proximity.

We then sought support from MetLife Foundation – who responded to our request with impressive speed and generosity, allowing us to repurpose an existing contract to undertake these activities.

Based on these discussions, we built two comics: the MFI client awareness comic on coronavirus and MFI employee training comic on coronavirus.

The content was developed in line with WHO recommendations, although as we rolled out the comics we discovered that different countries have different takes on these. In particular, India, and many other countries, recommend two-meter social distancing over WHO’s one meter. In response, we have created two versions of each of the comics and users can download whichever is applicable to their country.

The African versions in both English and French should be available soon. Keep an eye on the website and our @MicroSave Twitter handle.

How do you envision that MFIs use these materials?

MFIs are already using the comics in a variety of countries. The Bengali version is already available on our website, and MFIs have translated these into Hindi and Bangla, too. We will encourage MFIs to send their translated versions to us and put them on the website as they become available.

MFI staff discuss how to re-engineer group meetings and visits to branches in line with WHO recommendations and the comics’ content.

Once translated, MFIs send the files to their staff and set up discussions to familiarize staff members with the content. They then typically discuss how best to implement both awareness of COVID-19 and hygiene measures among clients, and how to re-engineer group meetings and visits to bank branches in line with the WHO recommendations and the comics’ content.

For the client comics, are MFIs the main distribution channel or do you envision other organizations working with the BOP to use these materials?

The comics were specifically designed for MFIs, so we would expect them to be the main distribution channel. But we are also in discussion with a range of digital education platform providers who want to bring the content of the comics on to their platforms and thus allow both clients and staff to access them online. I think this is a tremendously important step forward that could significantly extend the reach and value of the comics, but we need additional support to do this.

Where has this been shared and what have been the responses so far?

The comics have been shared across a wide variety of networks, the international networks such as Opportunity International and Accion; through the Social Performance Task Force (and directly) to many of the microfinance investment vehicles; through local MFI apex organizations, like MFIN in India and CDF in Bangladesh; and directly to MFIs in MSC’s network.

The response has been very positive. Many have asked for the source files (which are in Adobe Illustrator and InDesign 2020) in order to translate and distribute them. We are delighted to share the source files; our only request is that the branding is maintained and translated versions are returned to us so that we can keep building the multi-language library on our website.

We estimate that they are being used by MFIs reaching 7.5 to 10 million clients already, but hope that this will increase significantly.

In light of the response to these materials, are you exploring using this format for other topics? If so, which topics?

We are already working on a similar set of comics for bank and telco cash in cash out agents, and hope to do the same for gig workers, too.