One billion mobile money accounts.

This is the headline figure that emerged from this year’s State of the Industry Report on Mobile Money by GSMA. The growth in mobile money accounts is indeed remarkable. But beyond this number, the report tells the story of an evolving industry, marked by significant advances in volume of activity, types of transactions, people using the services, and emerging business models.

Based on the current trajectory, mobile money accounts are on pace to generate $1 trillion in annual transactions by 2023. Will COVID-19 derail this progress? Or will the pandemic demonstrate the power of mobile money, and further fortify the critical role mobile money plays in low- and middle-income countries (LMICs)?

The Digital Ecosystem Comes to Life

Ever since mobile money emerged in the mid-2000s, businesses, researchers, and those working to advance inclusive finance have talked about how to get more money to stay in the system (see examples here and here). If funds stay in the mobile money ecosystem, the complexity and inherit cost of cashing in and out in remote areas is diminished and users can benefit from other products and services beyond money transfer. In the early days, most people put money in for the sole purpose of someone else taking it out. That story seems to finally be changing (at least in some markets) as we now see a higher value circulating than exiting the global mobile money ecosystem ($22 billion vs $18 billion). Further, we also now see more digital transactions than cash-based transactions, indicating that people are leaving money in their digital wallets and using those funds to make digital transactions.

The report points to a few reasons for this shift. First, digital payments are quickly becoming a routine part of people’s lives. Taxis, schools, shopkeepers, and even governments increasingly accept mobile money payments, so the need to take cash out of the system to conduct daily transactions is lessening. Second, the industry is finding ways to make it easier for people to make those routine transactions, such as QR codes and overdraft coverage. For example, the report cites that merchants using QR codes transact three times more in value than those without. And third, mobile money providers are offering value-added tools to help micro and small enterprises not only better manage digital payments but also other business functions, such as inventory management and accounting.

The evolution toward a digital ecosystem is uneven worldwide.

That said, this evolution toward a digital ecosystem is not necessarily seen evenly throughout the world. Latin America and the Caribbean saw a decline in active accounts and transaction volume in 2019. And while South Asia has a high overall number of registered accounts, the percent of active accounts in the region is the lowest in the world. In India and Bangladesh, a survey of adults with a SIM card but no mobile money account found that their primary reasons for not using mobile money include a preference for cash and a high number of alternate ways to transfer money.

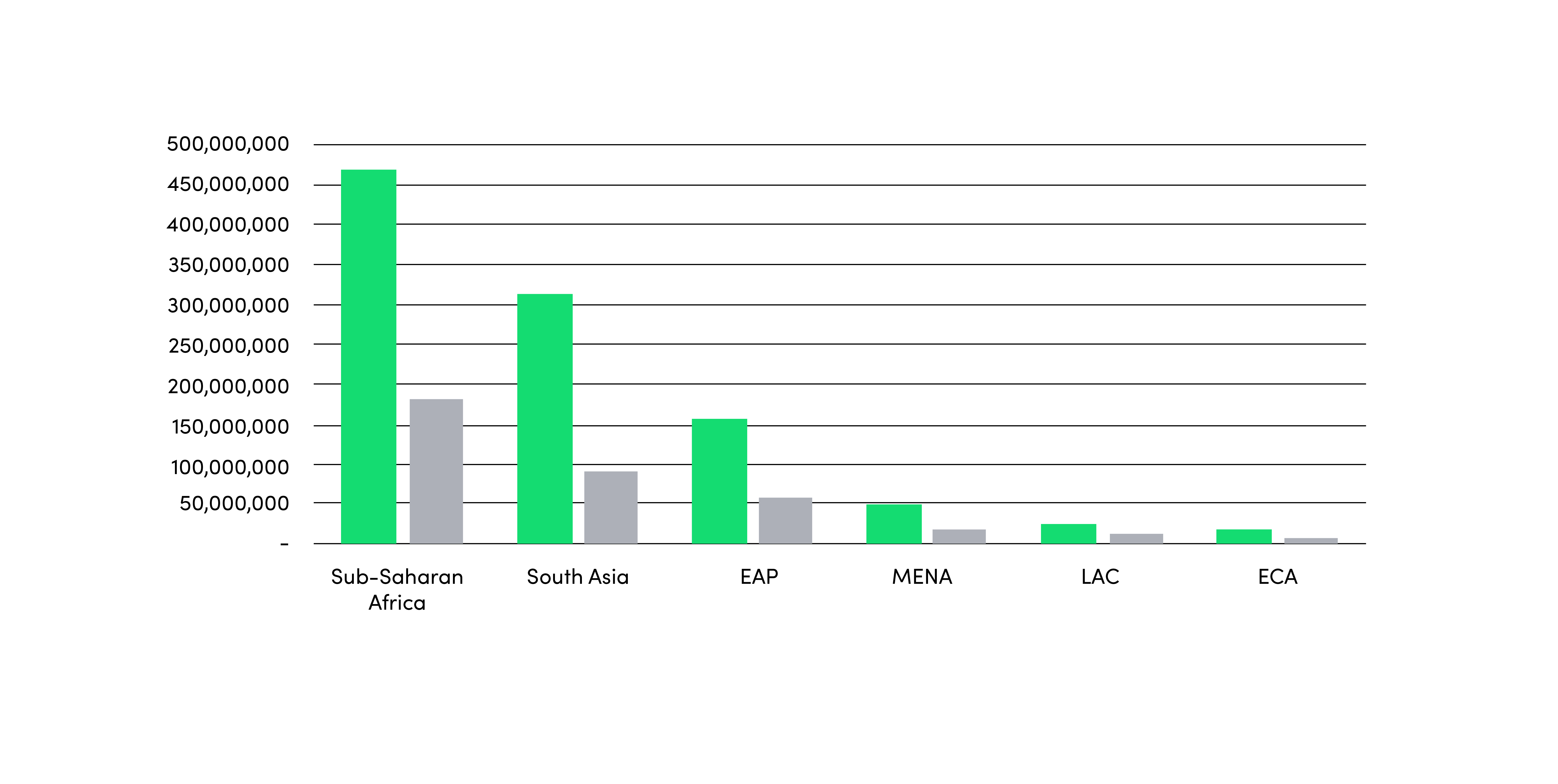

Sub-Saharan Africa, by contrast, has the highest percentage of active accounts at 50 percent (see graph below). In Mozambique, the same survey found that literacy and skills were the biggest obstacle to mobile money usage rather than a preference for cash. It’s clear that the evolution of mobile money is context specific and the trajectory will not look the same everywhere. But in many parts of the world, more is needed to develop the ecosystem in a way that provides value to the user, either by providing a service that beats the alternative options (e.g. faster, more convenient, less expensive) or offers new services not available via other channels (e.g. digital credit, value-added services for MSMEs, insurance, etc.).

Moving Beyond Payments

One of the most important ways providers can encourage more funds to stay in the system is to provide access to a range of financial services. While recent years have seen the growth of digital credit products offered directly by mobile money providers, the 2019 State of the Industry report notes that providers are increasingly partnering with financial institutions which can offer a wider range of services. For those services integrated with financial institutions, they are connected to an average of 13 banks.

This marks an important evolution of the market for several reasons. For individuals, it means those with a bank account can use mobile money services to seamlessly conduct transactions. For those without a bank account, it may open the door to an account and eventually to a range of products, from savings to credit and insurance. Partnerships with regulated financial institutions provide additional safeguards for customers, and result in better underwriting and risk mitigation for both customers and banks. A MicroSave report found that “non-performing loans in Kenya decreased by 20 percentage points for mobile money providers that had partnerships with banks.” Yet the research also showed that non-performing loans were still about three times higher for digital loans (16 percent) than traditional products (5 percent). Partnering with banks should help manage the potential for over-indebtedness, a well-noted risk of the nano-credit products offered by many mobile money providers.

Mobile money providers partnering with financial institutions has been a boon for both providers and customers.

For mobile money providers, partnerships with banks and other companies appear to have been key to 60 percent of providers reporting a positive EBITDA in 2019. This growth in profitability comes at the same time that providers report a reduction in reliance on customer fees, from 80 percent in 2018 to 67 percent in 2019. In addition, 21 percent report that business fees are now driving a majority of their revenue. Providers are shifting to the “payments as a platform” model, whereby their networks are leveraged by a wide range of service providers and businesses. This diversification – as well as innovative products and services – will continue to be key to the viability of mobile money business models and has the potential to deliver enormous value to customers.

We’re Not There Yet

While I feel encouraged about the positive evolution of the sector, there are several areas that need continued attention. First, male users still dominate. To truly realize the opportunities posed by mobile money for low-income populations, we must do more to design and deliver services that resonate with and empower women. Closing the gender gap in financial services is a key component of CFI’s new strategy, so expect to hear more from us on this topic in the coming months.

Second, there is immense untapped potential in delivering a range of financial products over mobile money platforms, particularly in markets where P2P continues to dominate. Fintech players offering a range of products and services — from innovative health and agricultural insurance products to sanitation loans — are showing up in headlines around the world. Many of these startups are likely to suffer due to COVID-19, making the support of donors and investors even more critical. Be sure to follow the results of the 2020 Inclusive Fintech 50 awards for a preview of the next wave of innovators, and insights into how previous winners are faring in light of COVID-19.

Gender equality, support for innovation and data issues are areas that need continued attention in mobile money.

Third, data localization, transparency, and privacy are topics of growing importance that will affect how much control customers have over their financial well-being. CFI will also be diving more deeply into these issues going forward to help ensure that as we take steps toward data regulation, customer needs and protections remain at the forefront.

While COVID-19 is having devastating impacts on economies and livelihoods around the world, the strong growth of mobile money in recent years may provide the foundation for a new round of innovation and advancement in access to and usage of digital financial services. Financial service providers, regulators, policymakers, and funders must collectively work to address pervasive challenges in financial inclusion to help realize its potential to transform lives, now more than ever.