Informed and empowered men and women make fewer risky financial decisions than those with less knowledge. And for a low-income woman, having the right knowledge – like knowing when to borrow against her savings or separating business expenses from household ones – can make a long-term difference.

Digital financial tools are growing in importance as technology becomes more ubiquitous, accessible, and connected. Yet, the advent of digital financial services has surfaced unique challenges for low-income women customers. Across low- and middle-income countries, women are 8 percent less likely than men to own a mobile phone, and 20 percent less likely to use the internet on a mobile device. This leaves women fewer avenues to learn digital financial skills.

Digital financial services are not a silver bullet for financial inclusion, but they are the direction in which the industry is going. Financial capability must evolve to include digital financial capability (DFC), so low-income women are not left further behind. Digital financial capability is a critical component of the digital transformation journey, as it ensures that women customers can use digital financial services with ease and confidence.

Financial capability must evolve to include digital financial capability, so low-income women are not left further behind.

The shift from analog to digital tends to be seen as an easy transformation, swapping out one for the other. This assumption ignores the multiple barriers that may impede the uptake of digital financial services and risks further excluding women, oral communities, and others from the formal financial system. It also leads to a grave underestimation of the role of digital capability and digital financial capability, among other factors, in shaping financial capability.

We believe that digital financial capability can bridge that gap and provide practical tools to help low-income women effectively use digital financial services.

New Maxims to Guide Effective Digital Financial Capability Programs

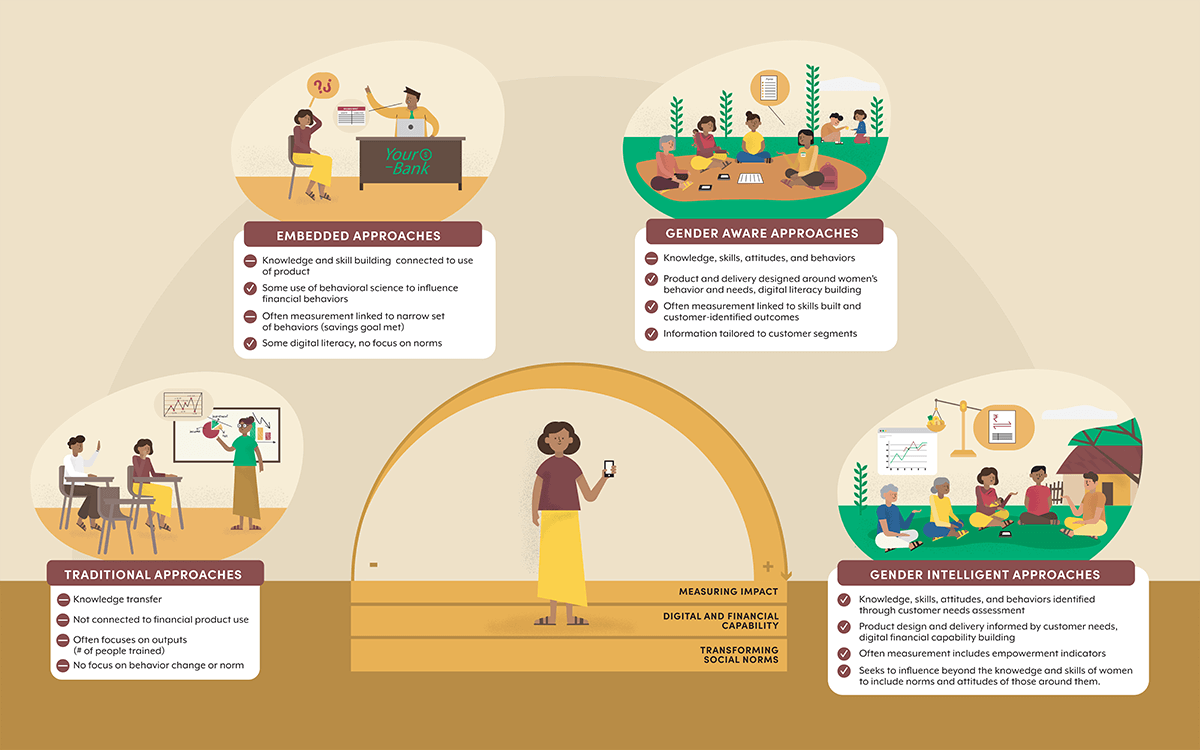

In the same way as the conversation on financial literacy shifted to the more action-oriented concept of financial capability, we believe that the digital financial capability conversation needs to transition to practical tools to help customers gain the knowledge, attitudes, and skills to effectively use digital financial services. Upcoming research by CFI has identified that traditional financial literacy approaches were ineffective, while social norms particularly impacted women, who were starting from lower educational levels.

The research has found that peer and role model learning was critical in building digital capability because women did not see themselves as digital financial service clients, and needed to build a degree of confidence and trust with the channel before fully engaging. Meanwhile, building flexibility in the form of test and learn approaches helped providers adapt to a woman’s contexts, like time constraints and continuous learning opportunities through low-tech touchpoints (video, SMS, chatbot for example). Finally, sex-disaggregated data is critical to measuring different impacts between men and women.

A Framework for Developing Effective Digital Financial Capability Programs

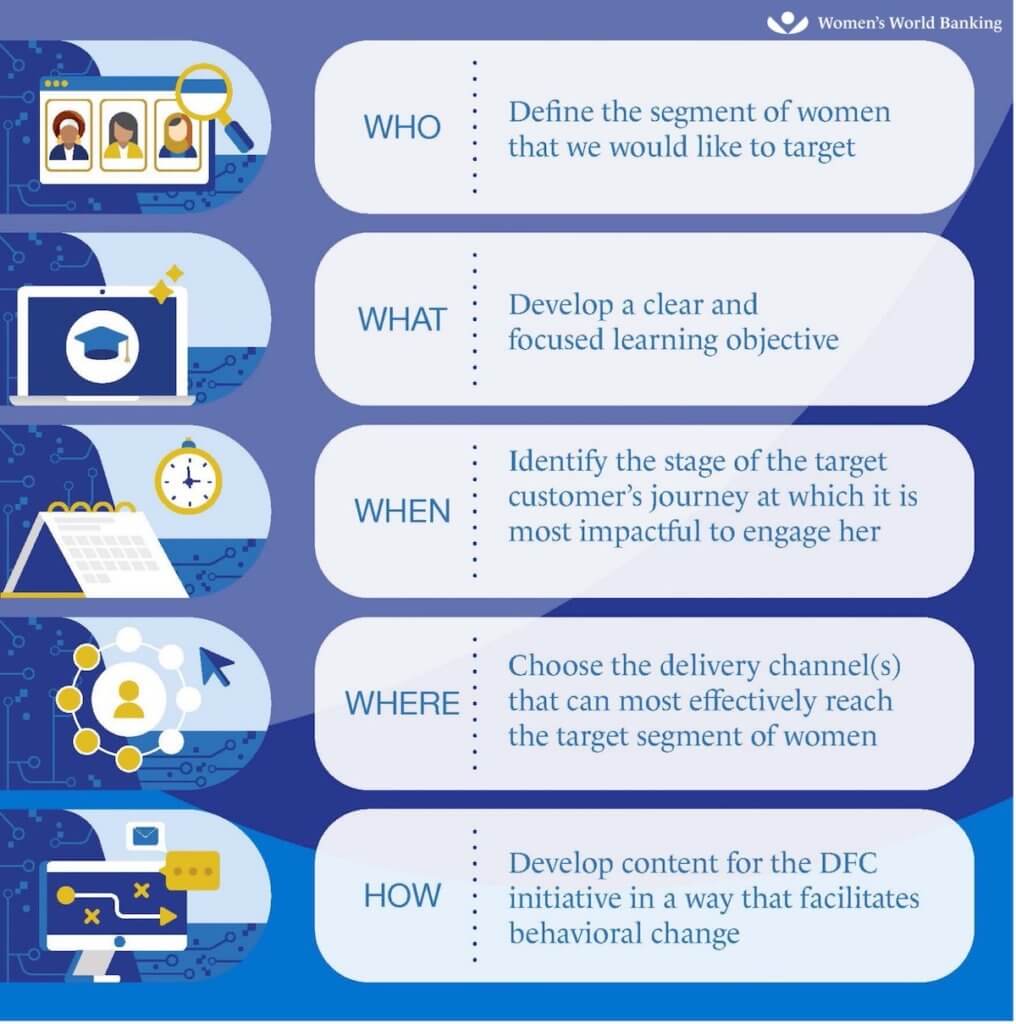

Women’s World Banking has developed a framework of five distinct principles for developing effective digital financial capability initiatives. The women-centered framework helps key financial inclusion stakeholders and practitioners identify who the women customers we are designing for are, what behaviors we are driving toward, when and where the digital financial capability initiative can reach women, and how our initiatives should be delivered to optimize their effectiveness. These principles are closely interrelated; while each needs to be considered and addressed individually, they inform one another and should be considered holistically.

Women’s World Banking’s framework also uses a set of supporting design elements to guide DFC content development and implementation. These seven core design elements, such as edutainment and learning-by-doing, are practical tips for packaging DFC content so that women customer segments can better understand and internalize it, convert it to new skills, and use digital financial products and services with more independence and confidence.

Action Steps Toward Embracing Digital Financial Capability Efforts

For women to be able to effectively enhance their digital financial capabilities, all stakeholders in the financial inclusion ecosystem have to play a role. We have compiled a list of recommendations for what key stakeholders could do to support the transition to empowering women to use financial and digital financial services through digital financial capability:

Time to leave traditional approaches behind

The evidence on what doesn’t work to build lasting financial capability is clear. It’s time to listen to the data.

Improve the evidence on what works

This will require investment in measuring both metrics that providers track (i.e., monitoring), and embedded impact evaluations that can rigorously evaluate impact.

Document and track the benefits to providers

To gain widespread adoption of digital financial capability approaches that produce lasting impact for women, we must build the case for providers, as well as donors and investors who support the inclusive finance ecosystem.

Work with policymakers to shift financial education investments into what works and what’s needed to bring women into the digital age

As we build the evidence on the benefits and lasting impact of gender intelligent approaches, governments and those that support them need to shift policies and activities toward more effective approaches to building digital financial capability.

Have we piqued your interest? Be sure to join us & Women’s World Banking on April 28th at 8 am EDT for a webinar on this topic featuring co-authors Julia Arnold, Marina Dimova, and a host of other leading experts in the field to learn more and find out how you can join the journey of learning and advocacy towards digital financial capability. Be sure to follow Women’s World Banking and CFI (LinkedIn, Twitter, newsletter sign-up) to stay up-to-date.