Topics

- Alternative Data

- Blockchain

- Challenges and Crises

- Credit

- Digital Financial Services

- Digital Payments

- Enabling Environment

- Fintech

- Human Centered Design

- Insurance

- Remittances

Program

The Inclusive Fintech 50 application data from the third year signals continued progress on innovations to onboard low-income customers, despite the challenges posed by the pandemic:

- Inclusive fintechs are using creative approaches to serve new customers. From retail partnerships that help drive customer acquisition, to insurance platforms offering micro-coverage, to native language chatbots, to enhanced biometric identity verification solutions, early-stage inclusive fintechs are pursuing outside-the-box solutions to reach un/underbanked people around the world.

Nevertheless, there are two areas of concern:

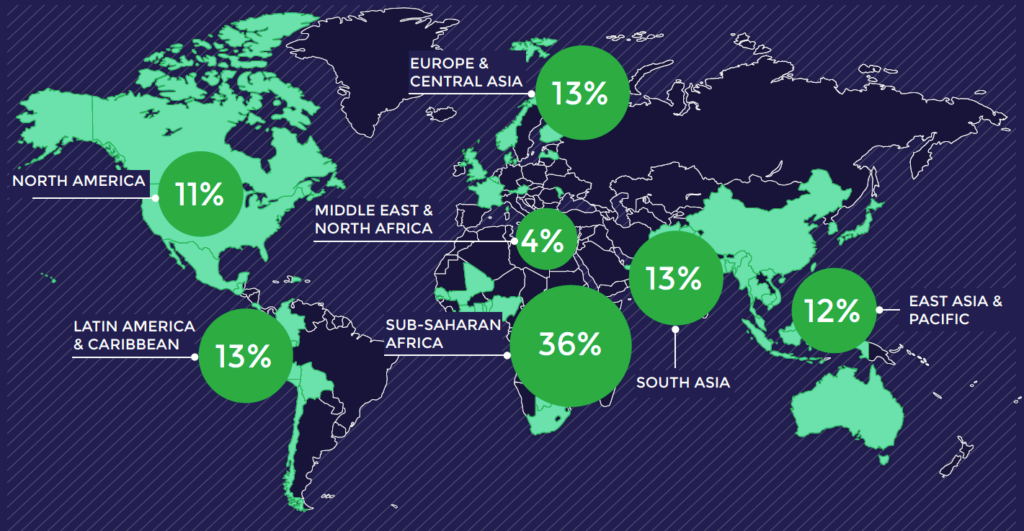

- Funding concentration persists. While fintech investments across emerging markets have been increasing, early-stage inclusive fintechs continue to face disparities based on geography, funding status, and gender.

- Potential customer risks persist around data usage. Although data is central to the business models of inclusive fintechs, some applicants require customer consent related to data, and some still do not.