Region

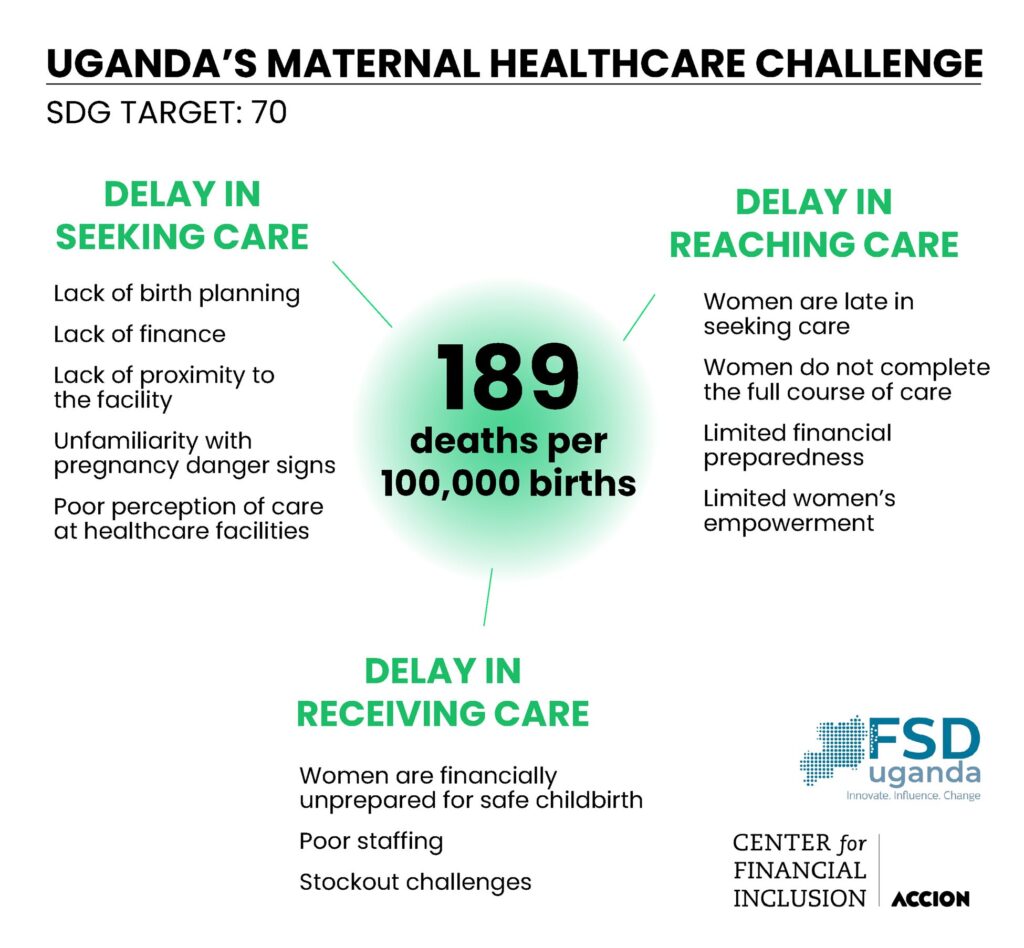

Despite progress over the past dozen years, the maternal mortality rate in Uganda remains alarmingly high. Compared to the Sustainable Development Goal (SDG) of less than 70 deaths per 100,000 live births, Uganda’s rate stands at 189 deaths per 100,000 live births.1 In fact, more women in Uganda die from pregnancy-related causes or complications within 42 days of delivery than from accidents or violence.2

More women in Uganda die from pregnancy-related causes or complications within 42 days of delivery than from accidents or violence.

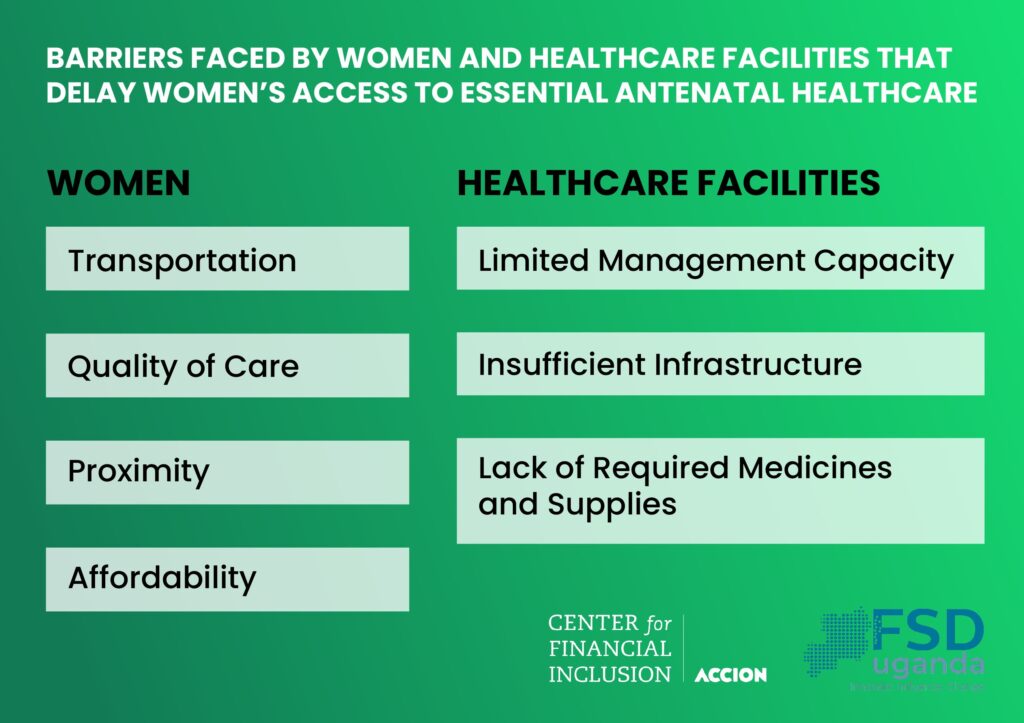

Research by FSD Uganda and other experts have found that the high maternal mortality rates in Uganda are primarily related to pregnant women’s lack of or delayed access to maternal3 healthcare (Morgan 2017 et al.). The barriers to accessing care — particularly severe for rural women — includes transportation, quality of care, proximity, and affordability (FSD Uganda). Additionally, both public and private healthcare facilities suffer from limited management capacity, insufficient infrastructure, and inadequate medicines and supplies. These deficiencies not only deter women from seeking antenatal care but increase the financial burden of those who do.

The Three Delays: Understanding Uganda’s Maternal Health Crisis

To better understand and address Uganda’s maternal health crisis, FSD Uganda identified three critical delays that hinder access to maternal healthcare: delays in seeking healthcare, reaching the point of care, and receiving care. All three categories of barriers reference a lack of access to finance.

Recognizing that access to finance could help address healthcare delays and supply-side weaknesses, the Center for Financial Inclusion (CFI) has partnered with FSD Uganda as a research and learning partner to reduce maternal mortality rates by expanding financial access for both expectant mothers and healthcare providers. This initiative to expand women’s access to and use of digital financial services while strengthening their agency in both business activities and health-seeking behaviors.

Digital Solutions for Life-Saving Care

clinicPesa, a health tech platform, offers financial services designed to address barriers to antenatal health-seeking behavior and quality maternal healthcare. The platform provides financial services, training, and medical supplies to healthcare providers, aiming to health and financial outcomes for both expectant mothers and women clinic owners.

clinicPesa offers two core financial product offerings designed to support expectant mothers and healthcare providers:

- clinicPesa Mama’s savings app: Enables women to establish digital savings plans for medical expenses, checkups, and pharmaceuticals from registered providers. The platform incentivizes savings through automatic micro-deductions, customized savings plans, interest-bearing accounts, and targeted reminders. Women can access top-up loans, based on their savings behavior.

- clinicPesa Restock loan: Provides buy-now-pay-later working capital loans to healthcare providers, helping them maintain adequate medical supplies while reducing reliance on credit. clinicPesa partners with medical suppliers to offer discounted supplies with free delivery. The program provides business management training and assistance with business formalization to support women clinic owners who may have medical expertise but limited business backgrounds.

“I was by then saving with clinicPesa. So, it was easy for me to obtain high quality antenatal care services.” – Expectant mother, Kabale, Uganda

Designed to be accessible and affordable to women, key features of clinicPesa’s products and services include:

- Savings wallet that accepts very small deposits and features automatic deductions from a primary account, making it easier for low-income women to save regularly.

- Higher interest rates than competing mobile savings wallets.

- Family contribution options with privacy controls for women’s savings.

- Competitive loan rates without collateral requirements, criteria that often prevent women from borrowing.

- Direct delivery of supplies and medicines to healthcare facilities saves women the travel time, which is crucial for time-scarce women working long hours.

- Business management and financial literacy trainings for women owners acknowledges that women often have less access to financial education and have lower financial literacy than men.

- The transaction histories and digital trails built by using clinicPesa, will enable women patients and owners, to access additional financial services.

“I came to know about clinicPesa, so by the time I gave birth, I cleared [the bill] with clinicPesa Mama’s product.” – New mother, Fort Portal, Uganda

Determining Impact

As a research and learning partner to FSD Uganda and clinicPesa, CFI is monitoring a two-year expansion in Uganda’s Western region following a successful pilot in Kampala. The scale up initiative targets 50,000 women for the clinicPesa Mama’s product and 1,000 healthcare providers for the Restock loan. To date, 28,900 expectant mothers and 590 women clinic owners have accessed these products.

While baseline diagnostic studies continue, early feedback has been positive.

“I would recommend [clinicPesa]. Because you can access drugs at your facility door with no cost, apart from ordering online. Secondly, you get more clients, especially antenatal clients, who are using it. But you can also save with them on your clinicPesa account.” – Health clinic owner, Mbarara, Uganda

CFI will examine whether gender-deliberate digital financial solutions enhance impact, if business support to women-led healthcare facilities improves financial inclusion and business growth, and whether bundled financial services solutions reduce the access costs while increasing investment returns.

Sign up for the CFI email list to stay tuned.

[1] https://www.health.go.ug/2024/03/20/ugandas-steady-progress-in-advancing-maternal-and-child-health-outcomes/ Retrieved 1/24/2025.

[2] In comparison, the maternal mortality rate per 100,000 live births was 430 in low-income countries and 13 in high-income countries in 2020.

[3] For the purposes of this report “maternal healthcare” includes both antenatal and safe childbirth care.