Topics

This is the second part of CFI’s blog series exploring 2019 data from Inclusive Fintech 50 and Results of the Fintech Benchmarks Proof-of-Concept to shed light on current gender disparities in the fintech industry — both at the management level and in their customer base. This blog post focuses on the role fintechs can play in designing products with women in mind, and thus help to close the gender gap in financial inclusion. It is structured around two broad observations and concludes with several recommendations for fintechs and researchers.

1. There is a gender gap in the customer base served by fintechs

The median fintech had only 36 percent female customers.

The Inclusive Fintech Benchmarks data reveals a gender gap in the customer base served by inclusive fintechs. Given the social aim of these fintechs, gathering critical demographic information is paramount to product design and meeting customer needs. However, only 20 out of 45 fintechs recorded sex-disaggregated data on their customer base. Among these 20 fintechs, the median fintech had only 36 percent female customers. This again drives home the need for such data, in particular to understand whether women were specifically targeted, and if so, which strategies were most effective. And if women were not specifically targeted, it would also be useful to understand how these female customers were attracted in the first place.

Perhaps it is not surprising that these fintechs have a low female customer base. Women in developing economies are 9 percentage points less likely to have a bank account than men, 8 percent less likely to own a mobile phone, and 7 percentage points less likely to be literate. These gaps in financial and digital literacy are much wider in certain regions, such as South Asia and East Africa.

Access to financial services is a key enabler for women to achieve financial independence and economic empowerment. However, women face unique and often intertwined barriers in accessing financial services, including but not limited to regulatory constraints (i.e. registrations requiring national ID cards), the aforementioned low financial and digital literacy levels compared to men, and social norms that may restrict their mobility and financial decision-making autonomy. One of the biggest barriers women face in accessing financial services is the lack of money or regular income.

However, mobile money has the potential to narrow the gender gap in financial inclusion. An analysis of the Findex 2017 data by GSMA finds that countries with high mobile money usage have indeed narrowed the gender gap in financial inclusion. By transacting digitally, women do not need to travel to inconvenient locations or where they feel unsafe, and they can make payments securely and privately. A study conducted on the International Rescue Committee’s (IRC) mobile money cash-aid programs in rural Sindh, Pakistan found that IRC’s consistent financial and digital literacy trainings played a crucial role. Female clients were not only able to use mobile money to receive their cash-aid, but appreciated the convenience, privacy and speed of mobile money.

Globally, however, women are still 33 percent less likely than men to own a mobile money account, mainly attributed to lower rates of mobile phone ownership and lack of access to identity documents. Some state governments in India, for example, have initiated programs to subsidize phone ownership, which helps to address the access gap but not the usage gap. Efforts to overcome women’s barriers to accessing financial services need to be coordinated, recognizing that women are not a homogenous group or customer segment. Fintechs are uniquely positioned to help close the gender gap in financial inclusion while also serving an untapped market that represents a large potential revenue source.

2. Female-led fintechs are more likely to target female clients and other underserved populations

Female-led fintechs appear more likely to serve female clients.

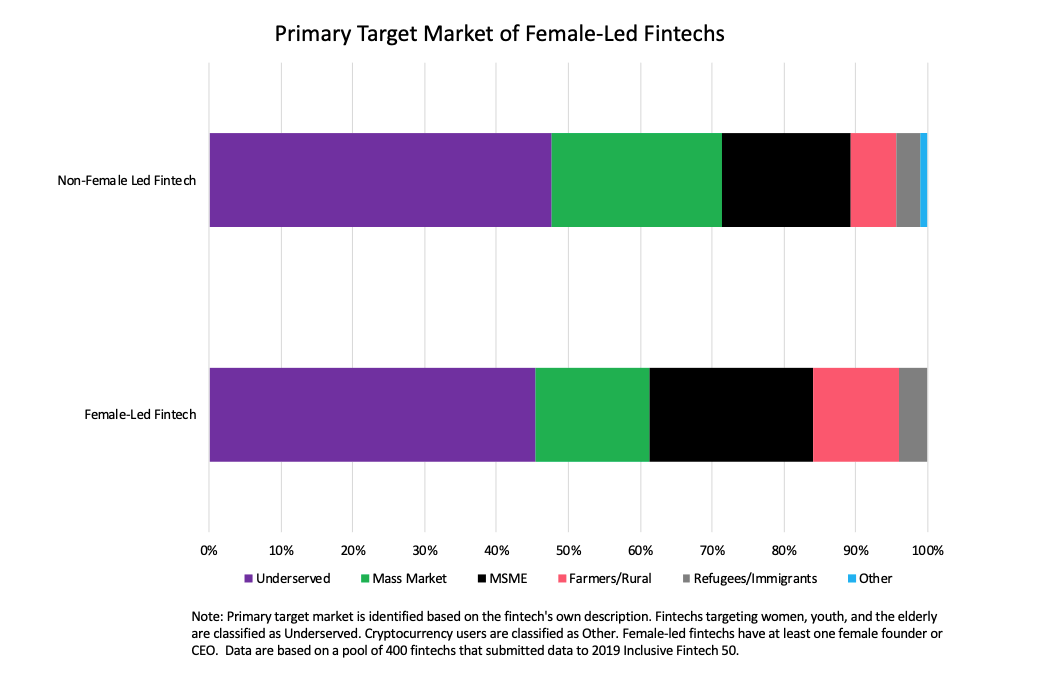

The 2019 Inclusive Fintech 50 data reveals that female-led fintechs target different markets than non-female-led fintechs. The Inclusive Fintech Benchmarks sample of 20 fintechs further shows that female-led fintechs appear more likely to serve female clients. The median female-led fintech had a customer base that was 58 percent female, compared to 35 percent female for fintechs that did not have women in leadership positions.

Diverse organizational leadership provides numerous benefits. For fintechs, female leaders can play a pivotal role in designing and marketing financial products to meet the needs of women. Although female-led and non-female-led fintechs in the Inclusive Fintech 50 2019 data target broadly defined “underserved” customers at similar rates, female-led fintechs are more likely to support micro, small, and medium enterprises (MSMEs), as well as farmers and rural households. Fintechs that do not have women in leadership positions are more likely to instead target their products to the general public, which may not produce as great an impact on financial inclusion.

Additionally, segmenting and targeting more female customers represents a market growth opportunity for fintechs. Much like sex-disaggregated client data, segmentation also forces providers to understand the specific needs of their target customers and the unique barriers they face. For instance, JazzCash Pakistan wanted to understand how to improve women’s mobile wallet usage. In exploring this, their research partners, Women’s World Banking and ideas42, found that female and male customers used JazzCash accounts in very similar ways and that the real problem was not usage but acquisition. Female customers accounted for only 15% of new account openings, likely due to marketing campaigns aimed at men. With further research, the team was able to design solutions to accelerate the acquisition of new female customers.

Recommendations

For Fintechs

- In order to ensure that they include female customers, fintechs must gather data on the gender makeup of their customer base. As mentioned earlier, among the 45 fintechs in the Inclusive Fintech 50 Benchmarks report, only 20 could report the number of female customers served, indicating a data gap. Having this data would enable fintechs to track their contribution to female financial inclusion and identify areas for growth.

- Fintechs must be intentional about including female customers when designing products. They would benefit from thinking about whether their product is designed in a way that excludes women, even if it is unintentional. This can only be accomplished by conducting market research on female customer segments to better understand their needs, preferences and barriers. It is imperative that providers design compelling use cases to meet women’s financial needs. Addressing this gender gap can also represent a commercial opportunity. For instance, if mobile operators could close the gender gap in mobile ownership and use in low and middle-income countries by 2023, this would provide an estimated $140 billion in additional revenue to the mobile industry.

- Fintechs should also consider gender when marketing and selling fintech products. For instance, JazzCash Pakistan recently tested behaviorally informed text messages to encourage current JazzCash users to send more referrals to women. Forthcoming data from RELAY, a fintech data solution developed by MIX, will examine the share of female agents among fintechs that rely on an agent network.

For Researchers

- Further research should examine the role of fintechs in serving women. Some questions to explore further can include: how to monitor the performance of fintechs; how to co-create products and solutions with female customers; effective marketing strategies to onboard women; the relationship between fintechs and the SME credit gap; and whether credit scoring algorithms introduce gender bias.

- Additional research is needed on the intersection between female financial inclusion and the societal and regulatory constraints that women face. Fintech products alone will not produce meaningful change in the lives of women without addressing broader disparities in digital and economic inclusion.

Fintech products alone will not produce meaningful change in the lives of women.

We are excited to delve deeper into the 2020 Inclusive Fintech 50 data to answer some of the questions we were not able to answer based on the 2019 data here. Nevertheless, this two-part blog post has highlighted several important ways in which advancing women’s inclusion in the fintech space, both at the leadership level and among the customer base, is not only the right thing to do, but also the smart thing to do.