Financial capability is the capacity to make and execute financial decisions that support one’s wellbeing and that fit within one’s lifestyle and environmental circumstances. Yet, how can financial service providers (FSPs) help their customers build financial capability, and how can they measure customers’ progress? CFI, in partnership with MetLife Foundation, launched a project in February 2018 to enhance financial customer engagement by building their capabilities. The project aims to develop and promote digital tools that FSPs can use to diagnose clients’ financial health, identify gaps, and develop actionable plans to improve financial well-being. To date, the project has partnered with two FSPs – Grassland Finance Limited and FINCA Kosovo – to design and deploy a minimum viable product (MVP) web application aimed to build financial capability using a customer-centric and behavioral-driven approach. This post shares initial learnings from the pilots.

Background

Why Focus on Financial Capability?

Financial capability building equips people with the knowledge, skills, attitudes, and behaviors (KSABs) necessary to achieve their desired financial and personal outcomes. Knowledge is a person’s understanding of a subject, skills are the proficiencies a person has to apply to specific situations, attitudes are a person’s general perceptions of a subject, and behaviors are the actions that a person demonstrates.

Building customers’ financial capability is good for both the customer and the FSP. While the link between earnings and a non-financial service, such as financial capability building, might not be immediately obvious, evidence exists that financially capable customers make for a financially sound portfolio, barring macroeconomic volatility. Financially capable borrowers are more likely to repay their loan, thus boosting FSPs’ profitability by lowering the problem loan ratio. Additionally, financially capable customers are more likely to be eligible for loan renewals, and retaining customers costs less than acquiring new ones.

Why Develop an App?

While many FSPs continue to focus on digital transformation, limitations in technology infrastructure and financial resources pose key barriers to digitalization. With these challenges in mind, CFI and MetLife created FinVenture, a mobile-compatible, browser-based web app. FinVenture aims to build customers’ financial capability by presenting users with a series of relevant activities to complete in return for rewards.

The MVP app was designed with the following goals:

- maximize availability across devices

- reduce steps required to access

- allow for operation independent of an FSP’s existing IT infrastructure

- minimize the risk of having complex technology be a distraction – a common pitfall in digitalization, and

- allow ample room for iteration.

Finally, and importantly for customer engagement, FinVenture’s simple design and interface ensure that customers with basic digital literacy could engage with it.

Lessons Learned

The following three key takeaways have come out of our pilots with Grassland Finance Limited and FINCA Kosovo. These pilots are expected to run until June 2022. After that, an analysis of user engagement and feedback will be instrumental in determining the future of the FinVenture platform and our partners’ financial capability-building activities.

Lesson 1: Build Activities Around “KSABs”

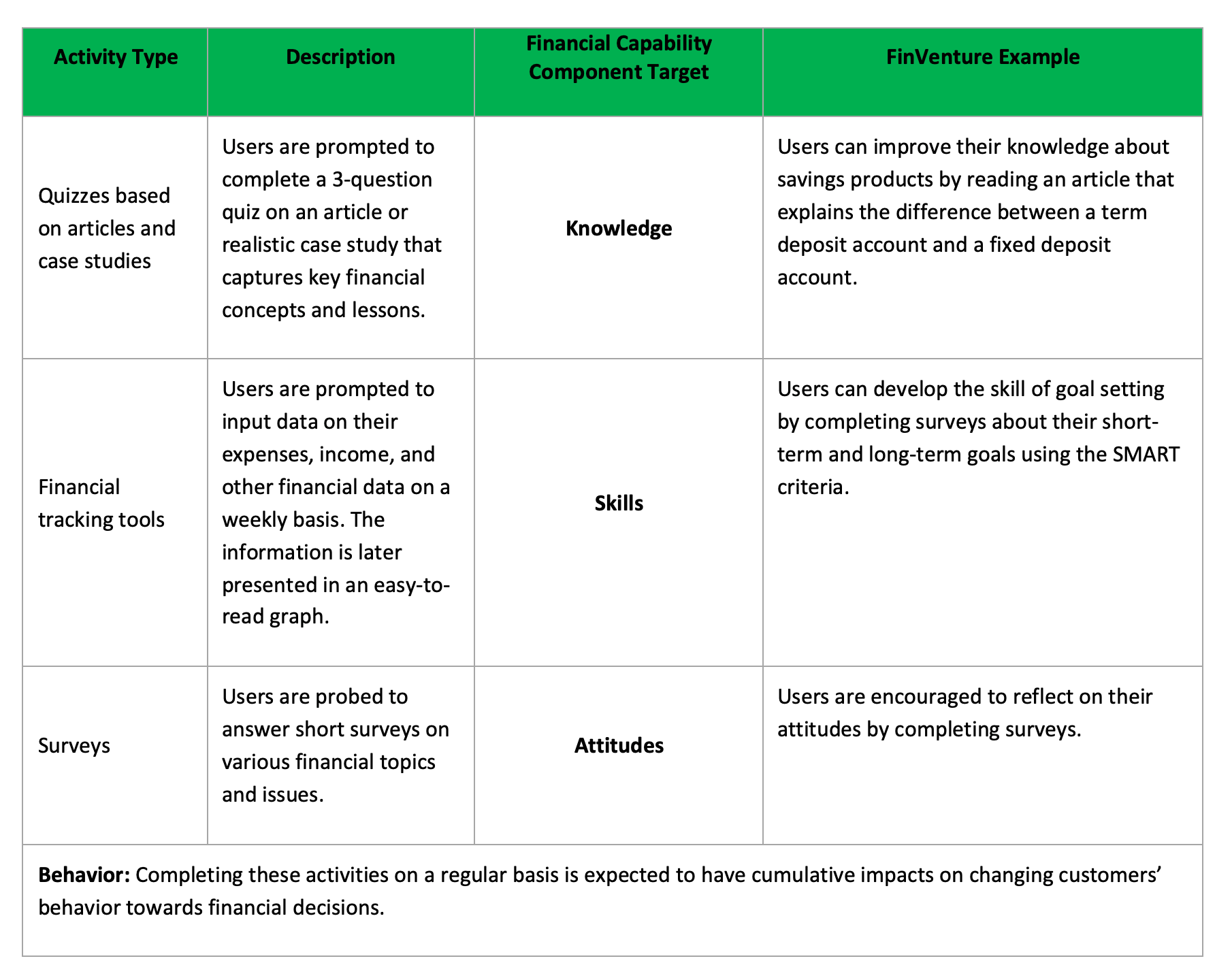

If financial literacy interventions have taught us anything, it is that focusing solely on improving knowledge and skills, which traditionally relies on rote memorization and lecture-based learning, is not sufficient for improving financial outcomes. With this in mind, CFI used the four financial capability components — the knowledge, skills, attitudes, and behaviors (KSABs) — as the launching point to design a diverse set of activity types.

Following extensive user research, we determined a core set of activity types that offer variety while also prioritizing the need for simplicity and functionality. The table below illustrates how each activity type — namely, quizzes based on articles and case studies, financial tracking tools, and surveys — is expected to enhance a financial capability component.

Lesson 2: Structure the App Content to Allow for Personalization

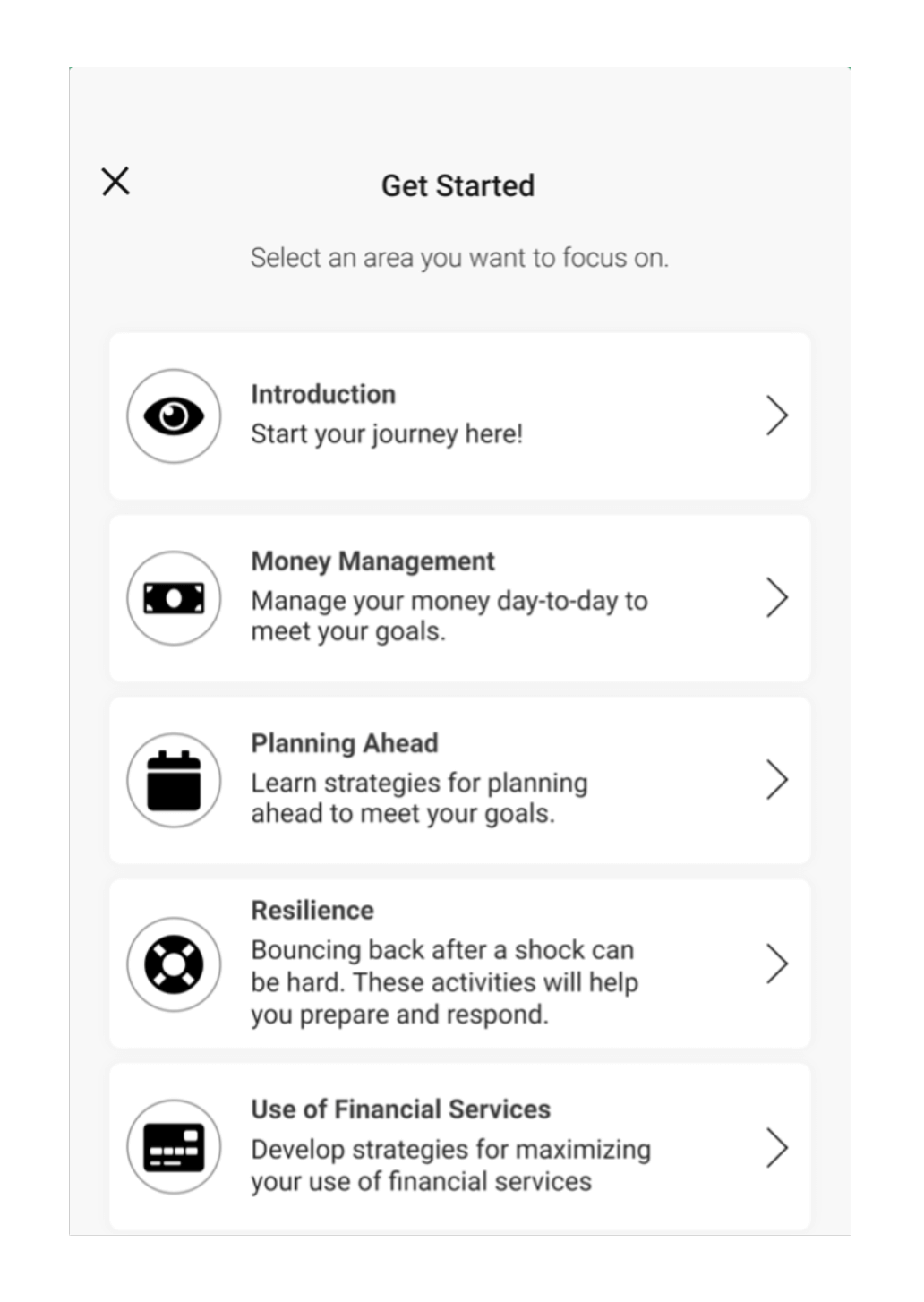

To make the content as relevant as possible for each user, the FinVenture app encourages users to begin by completing an introductory activity to measure their baseline level of financial capability. The introductory activity primes users to reflect on their financial goals and create a personalized experience based on those goals. Users are then prompted to select up to three activities to complete at a time. This structure allows FSPs to leverage user engagement data to inform the design of products and services that can best help customers achieve their financial goals.

For many customers, the breadth of financial information available can be a deterrent from thinking meaningfully about their finances. Creating an organizing structure that is based on financial goals is one way to help overcome potential information overload. We identified core financial goals – namely money management, planning, resilience, and use of financial services – to shape the FinVenture modules.

Lesson 3: Build Incentives to Keep Users Engaged

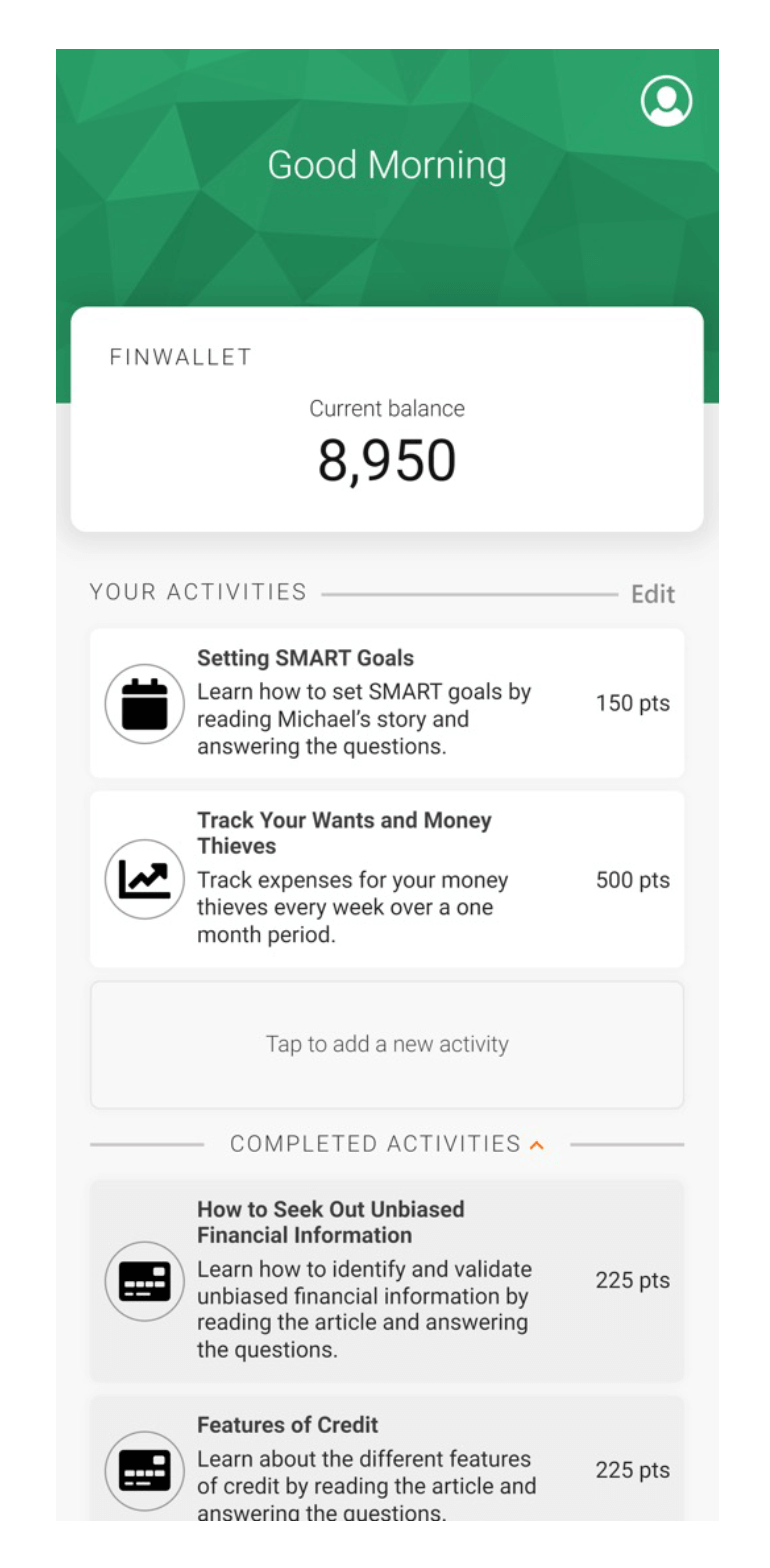

To incentivize user engagement, FinVenture’s point system (FINWALLET) contributes to internal motivation while also providing institutions the option to offer material rewards. By allowing partners the ability to choose what rewards to give, the app can be customized to encourage user engagement. One of our pilot partners, Grassland, chose to integrate FinVenture into their client education platform and set up a rewards system in which clients can exchange FinVenture points for a variety of rewards, ranging from tangible gifts such as a reusable grocery bag to lump-sum discounts that can be applied to their loan installment payments.

Considerations for Future App-Based Financial Capability Interventions

Although the following features didn’t make the FinVenture MVP development due to resource and time constraints, they are worth mentioning for FSPs that are considering developing a financial capability-building app. These features draw from our user research, behavioral science best practices, and pilot partner suggestions.

Peer Exchange

One way to strengthen an app’s effectiveness in shifting attitudes would be to incorporate a peer exchange functionality – for example, users could share financial milestones achieved or personal finance hacks that have worked for them. Using social media and storytelling has proven to be effective for influencing attitudes and changing behaviors.

Soliciting Customer Feedback to Inform Content

Another way to increase user engagement would be to have customers identify where they need help. If an app provided initial recommendations of topics, these could be further refined based on users’ activity engagement and performance. In addition, the FSP can leverage its established feedback channels such as social media, focus groups, or email to take requests from customers. This added feature would allow customers to better chart their own course to improve their financial capability.

Group Activities

FSPs can leverage peer and social relationships to encourage financial capability-building behaviors by presenting users with a series of tasks as part of a team in return for rewards. This is worth exploring for users who share financial responsibility with other household members.

Conclusion

This project has begun to shed light on how FSPs can use a customer-centric and behaviorally-informed app to begin building customers’ financial capability. In addition to the financial benefits for FSPs that result from having financially capable clients, investing in the financial success of customers strengthens customer relationships and has the potential to further financial inclusion.