Topics

Series

For the past 15 years, the Global Microscope team at Economist Impact (formerly part of the Economist Intelligence Unit) has collected data on the policies and regulations that governments around the world have adopted to promote an inclusive financial system. In 2021, we looked at the historical data from the countries included in the Microscope to identify the policies that drove change and have led to greater rates of account ownership. We used the findings to develop a new assessment framework that regulators and policymakers can use to promote more accessible, usable, and safe financial systems.

As a result, the 2021 Global Microscope is different from previous versions and poses four key questions. In this report, we discuss the policies that have driven change, the priorities to keep in mind for the future, the tools that will help achieve these goals, and the unique ways these priorities and tools apply across different parts of the financial system. The Global Microscope work is supported by CFI, the Bill & Melinda Gates Foundation, and IDB LAB.

Question 1: Looking Back, What Policies Have Driven Change?

A country’s overall Global Microscope score historically has been a composite of five categories, each measuring a different aspect of the enabling environment: Government and Policy; Stability and Integrity; Products and Outlets; Consumer Protection; and Infrastructure. This year, our regression analysis found that the overall Global Microscope scores have a positive relationship with account ownership. The correlation was mostly driven by two of the five categories: infrastructure and consumer protection – revealing that more extensive infrastructure and strong consumer protection propel financial inclusion. Within the category of infrastructure, connectivity proved to be a highly significant indicator of account ownership and digital IDs were also moderately significant.

The speed and magnitude of reform adoption significantly impact financial inclusion.

In line with findings from a World Bank study, our analysis also found that the speed and magnitude of reform adoption significantly impact financial inclusion. Broad financial inclusion strategies have helped drive fast and concerted efforts to create more inclusive financial systems and are another indicator that demonstrated a highly significant relationship with account ownership.

Our analysis also allowed us to identify the leading countries enacting meaningful change. Argentina, China, and Jordan have had the greatest leaps in scores since the Microscope began its global coverage in 2014. Tanzania, Côte d’Ivoire, and Costa Rica have seen the greatest improvements since we began covering the digital financial services revolution in 2018.

Question 2: Looking Ahead, What Policies Should We Keep in Mind for the Future?

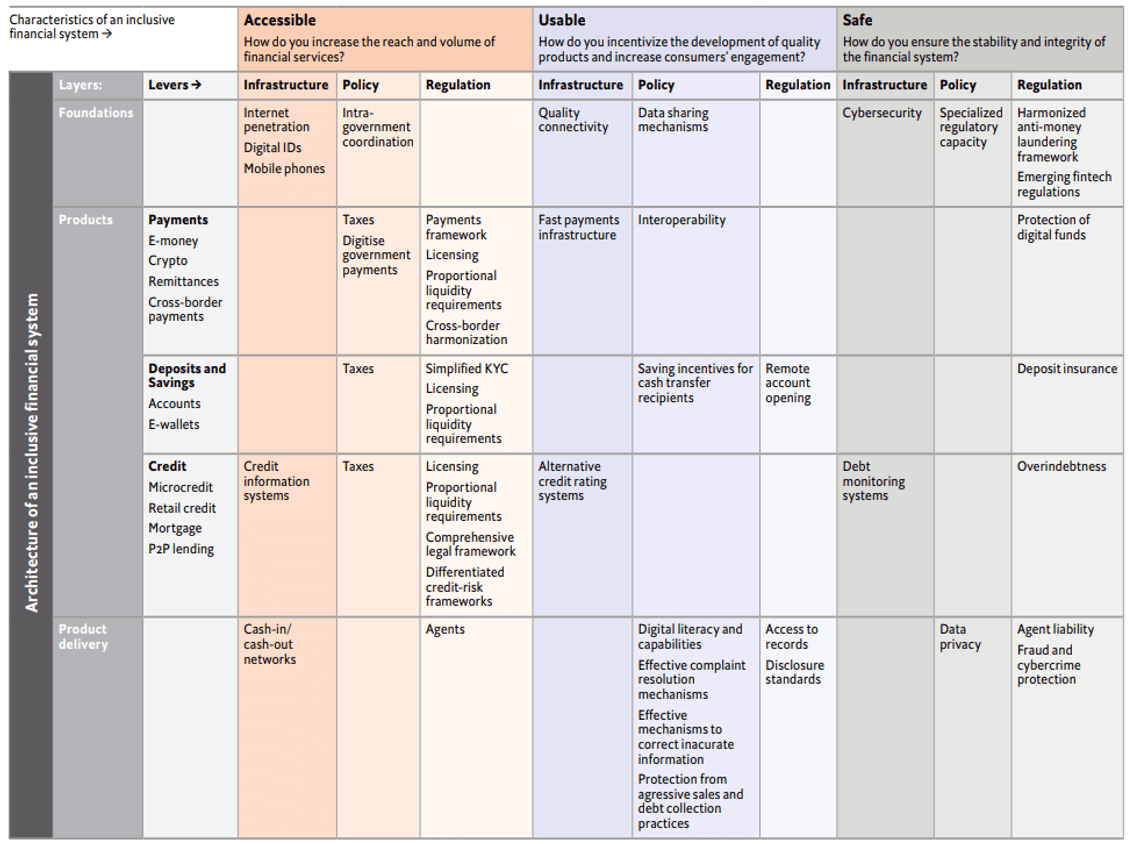

The new Microscope framework focuses on capturing the main regulations, policies, and infrastructure investments that governments should prioritize over the coming years. Instead of aggregating all data under one score, the new framework allows users to identify the enablers of three desirable outcomes: accessibility, usability, and safety.

- The accessibility category looks at policies and regulations that seek to increase the reach and volume of financial services to low-income customers.

- The usability category looks at policies linked to the quality of products and customer engagement.

- The safety category looks at challenges arising because of the spread of digital financial services and threats to the integrity and stability of the financial system, which are part of the core mandate of financial regulators.

These measures are not necessarily correlated with increased access to financial services but are key to creating a trustworthy financial system.

Question 3: How Do We Make Progress Towards These Priorities?

The Global Microscope team assessed the link between the three desirable outcomes (accessibility, usability, and safety) and the various levers of influence that can be used by policymakers, politicians, and authorities. Each of the three outcomes in the Microscope’s framework can be achieved via three primary levers: Infrastructure, Policy, and Regulation.

Governments can use a combination of these levers to drive swift and concerted change:

- The infrastructure lever enables the development and expansion of inclusive financial systems, establishing platforms that institutions can use to reach consumers and that products and services utilize to carry out transactions.

- The policy lever comprises coordination between and within the public and private sectors, as well as actions and plans promoting financial inclusion.

- The regulation lever is concerned with how authorities supervise and govern financial service provision.

Question 4: How Do These Priorities and Levers Change for Different Types of Financial Products and Services?

Furthermore, the Microscope’s new assessment framework also identifies three unique layers – Foundations, Products, and Product Delivery – that make up the financial system. Each financial inclusion outcome (accessibility, usability, and safety) can be pursued at any financial system layer:

- The foundations layer enables the development and delivery of all financial products and comprises levers related to the overarching enabling environment in a country (i.e. internet access and mobile connectivity, broad coordination among actors, and enablers such as digital identification and cybersecurity).

- The products layer constitutes the primary touchpoints (i.e. payments, deposits, credit) through which a customer enters the financial system.

- The product delivery layer covers the distribution channels by which products are made available and the permissions customers need for access.

The new Microscope framework presents a valuable tool for policymakers to use when approaching financial inclusion decisions and policies.

The new framework allows decision makers to dive deeper into this data to shape policies and regulations that can lead to the creation of more inclusive financial systems.

Policymakers are faced with a broad range of decisions and recommendations that are often based on assumptions or individual country studies. The Microscope project has developed a vast set of historical datasets that can be used by policymakers to identify policies that have worked and several peer countries that have successfully implemented these. The 2021 Microscope efforts look beyond the rankings and analyze these dynamics, and the new framework allows decision makers to dive deeper into this data to shape policies and regulations that can lead to the creation of more inclusive financial systems.

Explore the 2021 Global Microscope report for a closer look at the results.