Topic

Why Financial Health Matters

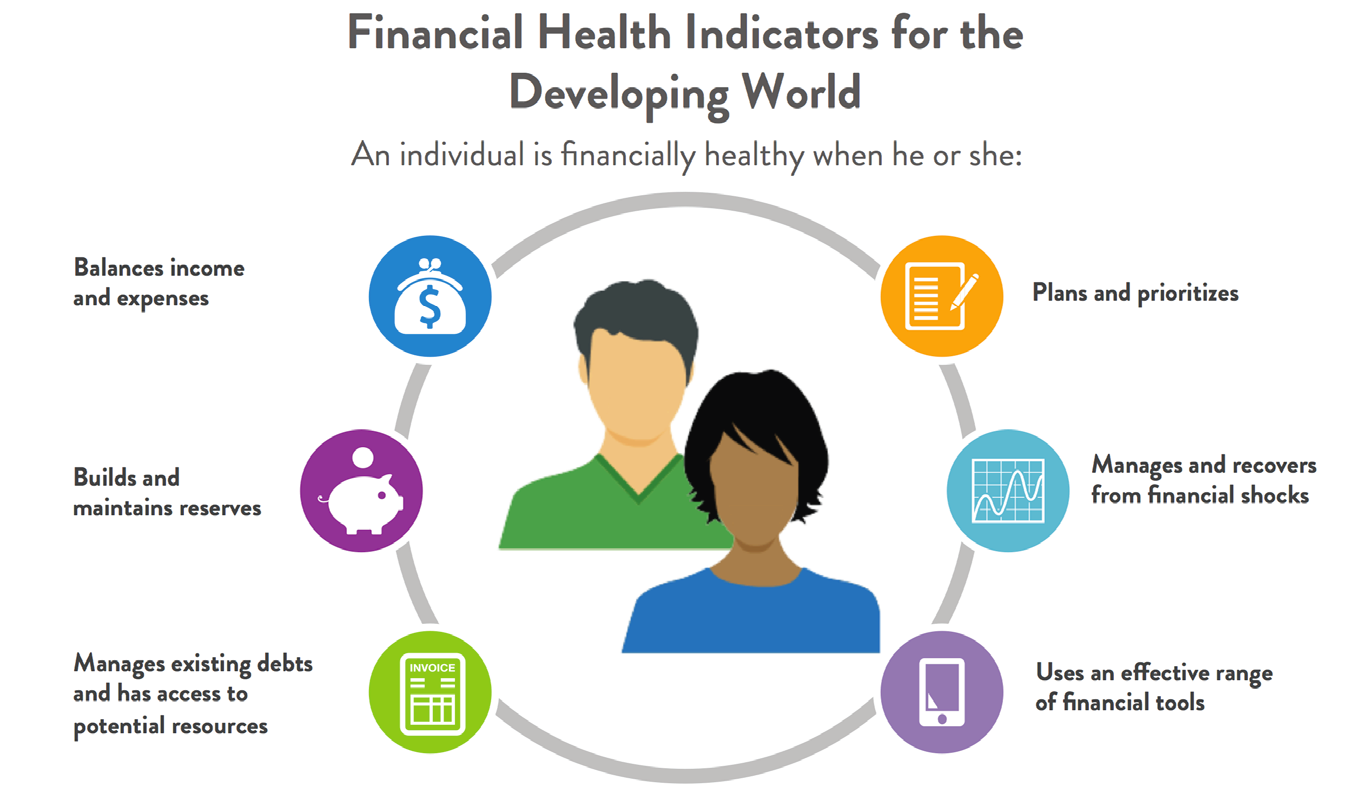

Everyone strives to be financially healthy: to manage day-to-day finances, to weather financial shocks and to pursue longer term goals. Arguably, the core purpose of financial inclusion is to help people achieve financial health.

If the financial inclusion sector begins to measure the financial health of customers and considers ways to support financial health in their products and policies, it will have made a significant shift toward addressing what matters most – customer benefit.

Challenge

While financial health resonates universally with consumers, providers and policymakers, the concept had not been adapted to or tested in a global context. In 2015, the Center for Financial Services Innovation (CFSI, now the Financial Health Network) established a financial health framework for the United States, but without adaptation, this framework could not be applied around the globe, where financial lives are lived very differently. To validate the concept of financial health, we set out to examine how people in lower income countries think about and experience financial health.

Approach

We are committed to moving financial health from theory to practice. Here’s what we’ve done so far:

- In partnership with CFSI and Dalberg Design, and with support from the Bill and Melinda Gates Foundation, we created a global framework for assessing financial health. Our research in India and Kenya helped us determine the universal and contextual factors that define financial health, even for lower income people in developing countries. In these countries, we observed that people have a harder time realizing financial health because their incomes are not only lower, but also irregular and unpredictable. People who use a variety of formal and informal financial tools have greater financial health.

- In partnership with the Microfinance Centre in Warsaw, Poland, and with support from MetLife Foundation, we are building a financial health tool for Eastern European microfinance institutions and their customers to help gauge and improve customer financial health.

- We tested the financial health with Accion’s own employees as a way to understand how financial institutions and other employers can support the financial health of their staff. This energized our whole team to improve our own financial health and to promote the concept in the workplace.

- We are building a network of people and organizations that are working to make financial health a north star for financial inclusion.

Results

- We laid a foundation for global financial health that is informing additional research, product and policy design, and models for serving customers.

- We are launching a financial health assessment as a consumer-facing tool in Eastern Europe. We realized that a simple quiz has the power to motivate consumers to improve their financial health, and we are developing an app that takes this discovery to the next level.

- We learned how financial health may be a relevant concept for employers. By turning our research on ourselves here at Accion, we identified the financial health issues of Accion staff, and motivated our internal stakeholders to tackle the issues we found. This experience convinced us that employers can benefit from measuring and supporting the financial health of workers.

- We have raised awareness and created a global conversation on financial health that includes policy makers, banking associations, researchers and others. Interest is growing. Our growing community includes more than 200 practitioners and researchers around the world.

Financial Health Reports

Use our financial health assessment to see how you or your customers are doing on financial health.