Series

Women in Latin America and the Caribbean (LAC) are achieving growing economic participation throughout the region, yet they still face limitations to the full exercise of their economic rights and agency. Women’s incorporation into labor markets and their roles as entrepreneurs face barriers related to structural social and gender inequalities. Faced with an increase in the feminization of poverty and the persistent sexual division of labor, both of which worsened during the pandemic, it is essential to strengthen public policies and legal frameworks that can address women’s economic rights and respond to their financial needs.

According to the latest Global Findex report, the gender gap in financial inclusion has been gradually closing worldwide since 2014. However, this trend is not occurring in Latin America and the Caribbean, where, although account ownership in general has increased, the gender gap widened by approximately two percentage points through 2024.

CAF — the development bank of Latin America and the Caribbean — has found that in several parts of the region, gender gaps are evident not only in access to and usage of financial products, but also in financial well-being, as evidenced by gaps in women’s financial knowledge, skills, attitudes, and behaviors. Due to the multiple social and gender barriers women face, they are less resilient to negative financial shocks than men. The traditionally weaker position of women in the labor market results in lower incomes for women,[1] decreasing their ability to accumulate assets. This, combined with women paying more for credit, leaves women more vulnerable to financial, economic, social and environmental crises.

To address women’s economic rights and to respond to their financial needs throughout Latin America and the Caribbean, CAF has partnered with the Inter-American Commission of Women (CIM) of the Organization of American States (OAS) to develop a model law for women’s financial inclusion.

As part of soft law, a model law is a legislative framework or guideline that supports processes of legislative or regulatory creation or reform. Model laws define terms, identify basic concepts and mechanisms, identify the attributions and powers of the authorities and supervisory bodies, and establish sanctions. A model law is a tool in international law to help countries develop legal provisions on specific issues while outlining good practices.

The OAS has had success developing other model laws for its member states, including the Inter-American Model Law on Care. This was the basis for the new law approved in Panama in April 2024, which established a national care system and upholds caregivers’ rights, among other provisions.

The proposed model law for women’s financial inclusion will be a legal reference document for multiple actors in the financial ecosystem, including supervisory bodies, regulators, and financial institutions. It will also serve as an important advocacy tool for civil society and multilateral organizations for the advancement of women, through reducing gender gaps in the financial system.

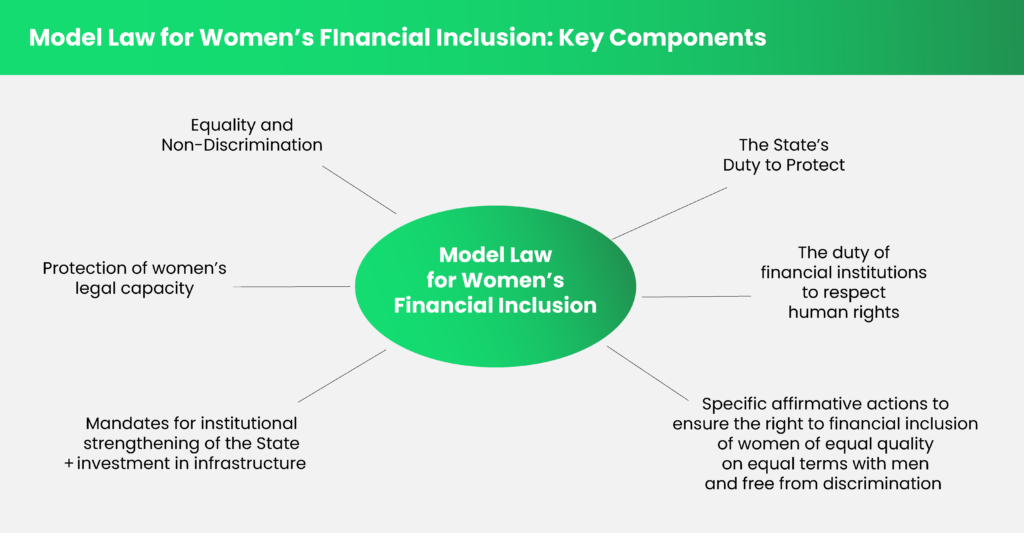

Model Law for Women’s Financial Inclusion – Key Components

The model law includes provisions on:

- Equality and non-discrimination

- Protection of women’s legal capacity

- Mandates for institutional strengthening of the State and investment in infrastructure

- The State’s duty to protect (including a national policy on financial inclusion with a gender perspective, data and statistics with a gender lens, transparency and accountability, promotion of responsible finance, financial consumer protection, etc.)

- The duty of financial institutions to respect human rights (including the prohibition of arbitrary discrimination, gender-sensitive governance practices, transparency duties, etc.)

- Specific affirmative actions to ensure the right to financial inclusion of women as the right to access and use financial services, products, and assets of equal quality on equal terms with men and free from discrimination (including financial education and promotion of financial information, access to financial products, information campaigns, access to and ownership of financial products, access to and use of digital services, etc.)

Once the model law is finalized and validated, CAF and CIM/OAS are committed to support the adaption of the model law in a pilot country of the LAC region. Both at CAF and CIM, we strongly believe that achieving transformational changes in the financial system in favor of gender equality and women’s economic rights requires breaking down the structural barriers that limit women’s equal access to and use of financial and non-financial products and services. In this sense, our overall aim for creating this model law on women’s financial inclusion is to provide LAC countries with a regional public good that can support them in addressing these challenges and adapt their national regulatory framework in favor of greater gender equality and women’s rights.

[1] https://rshiny.ilo.org/dataexplorer55/?lang=en&id=LAP_2FTM_NOC_RT_A. In 2024, women earned only 60.5% of what men earned on average.