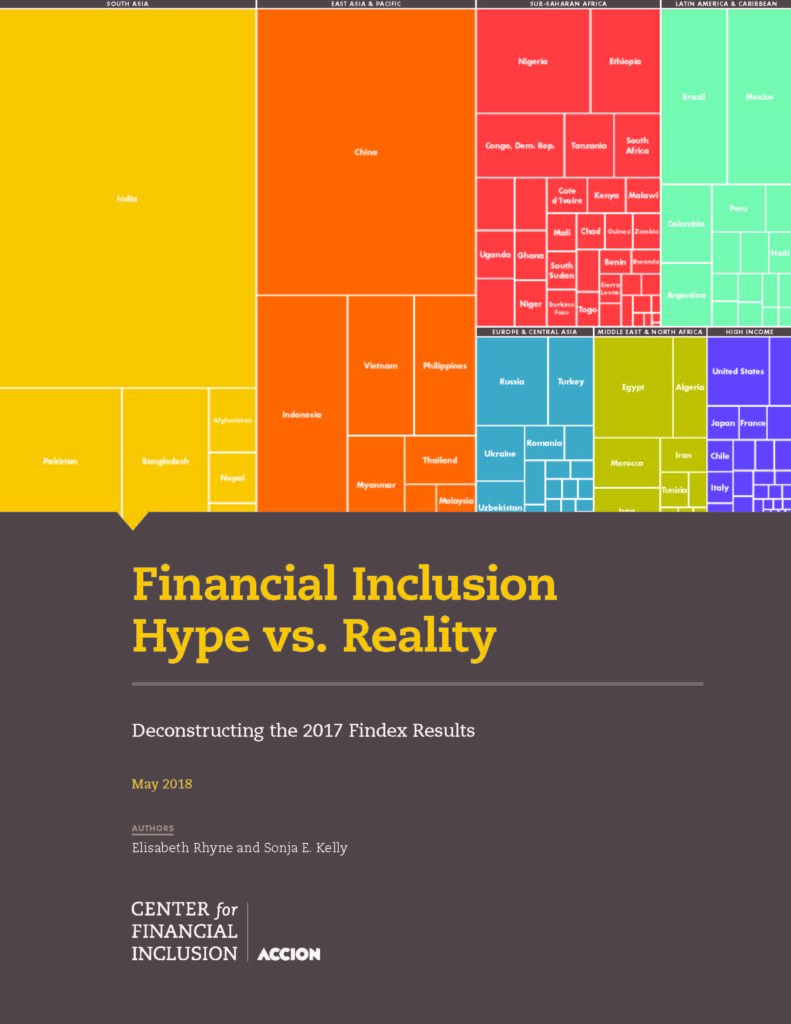

The World Bank’s Global Findex is the most comprehensive database on how people access and use financial services in 150 countries across the world. In Financial Inclusion Hype vs. Reality, we examine the Findex data from our own perspective, seeking to deconstruct what it’s telling us about financial inclusion progress.

This report spotlights key financial inclusion indicators, including account usage, borrowing, saving and resilience, among others, and takes an in-depth look at six countries that help tell the story of financial inclusion progress around the world. In short, we find that after correcting for account dormancy in developing countries, account growth has slowed, the access-usage gap is widening, credit is flat and savings is declining. A bright spot, however, is the proliferation in the use of digital payments.

The Findex analysis is sobering, but financial inclusion, while further away than expected, is still an achievable goal. We hope the financial inclusion community will use the 2017 Findex results to reconsider how financial inclusion initiatives are affecting usage, products and financial well-being, and to re-engage with eyes wide open as we continue pursuing the important tasks at hand.