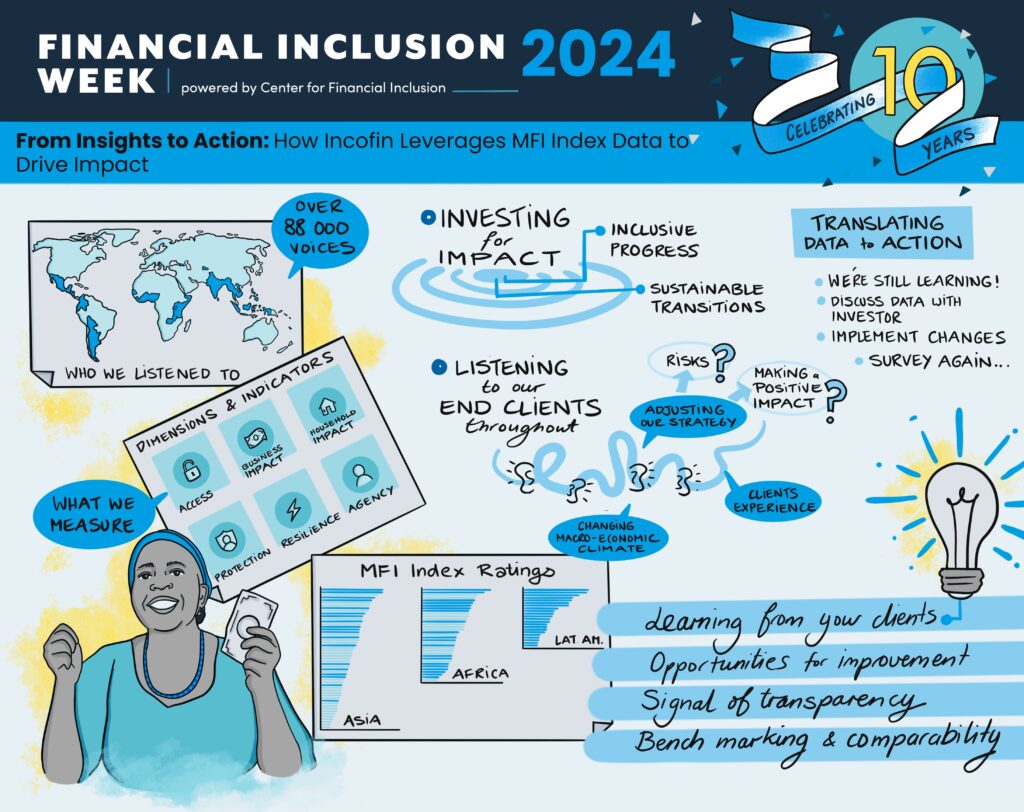

a decade of progress & the ROad Ahead

The 10th anniversary of the leading industry event on financial inclusion

2024 THEME

Financing the Future – Shaping the Next Decade of Inclusive Finance

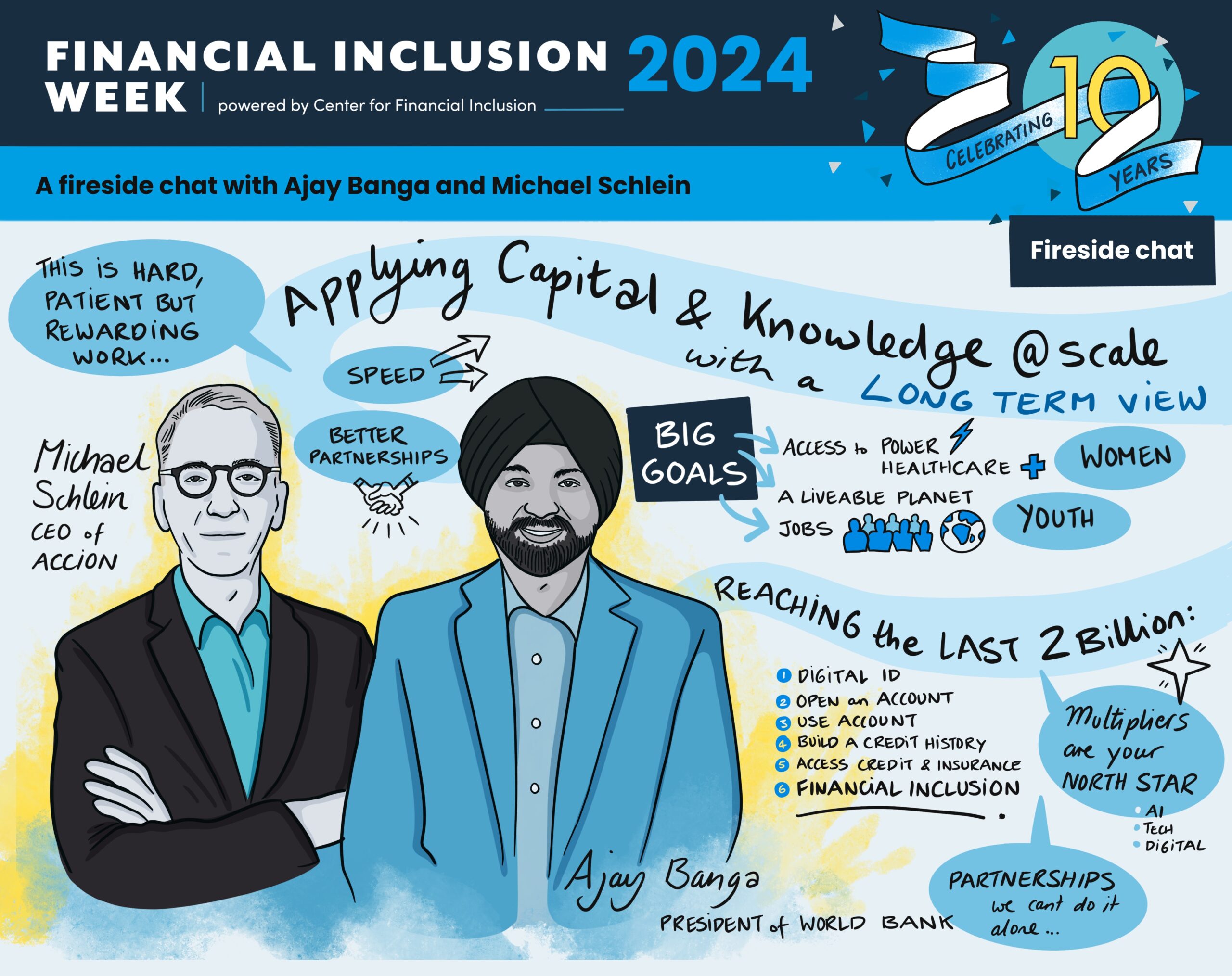

The 2024 event presented an industry-wide opportunity to reflect on how the inclusive finance sector has evolved over the past decade and what we need to do next to serve the nearly 2 billion people that remain excluded from the formal financial system.

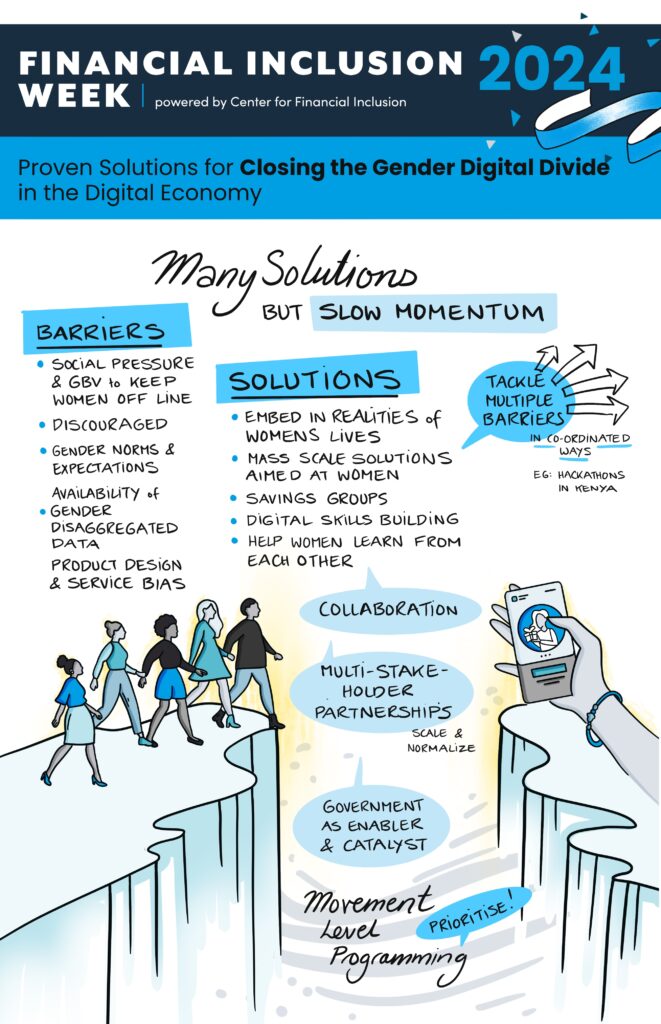

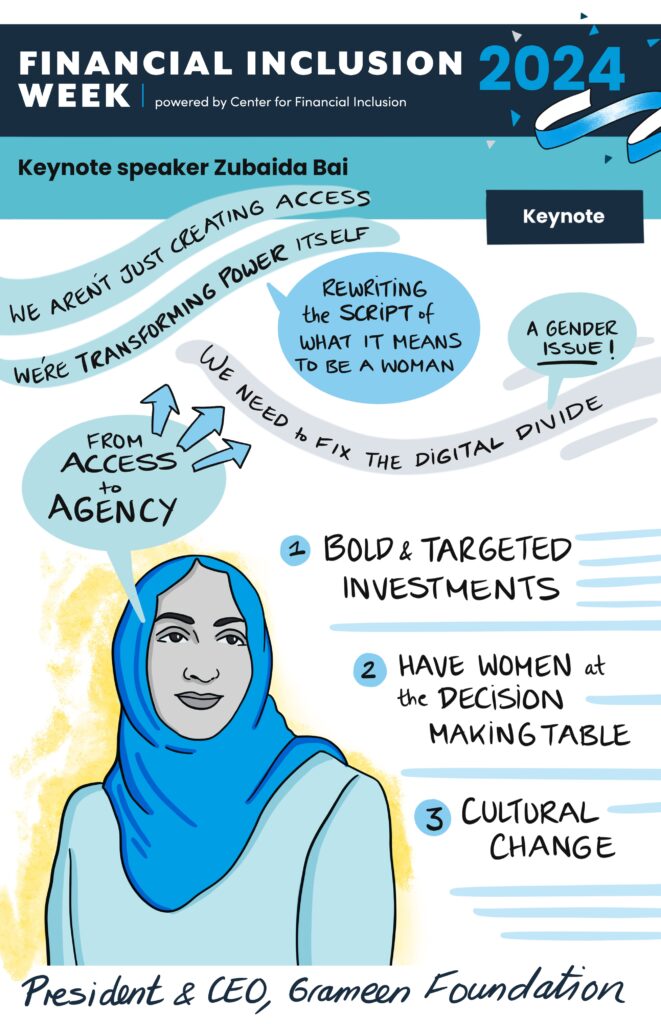

In 2011, the inaugural Global Findex Report revealed only 50% of the global population had access to formal financial services – and significantly more men than women. Fast forward to 2021, and we saw a sharp increase in access, with 76% of people and 74% of women having financial accounts. We now look beyond access to usage and quality outcome indicators, making the picture more complex. Creative solutions are needed to ensure inclusivity in the next digital decade and avoid erasing the progress of the last 10 years.

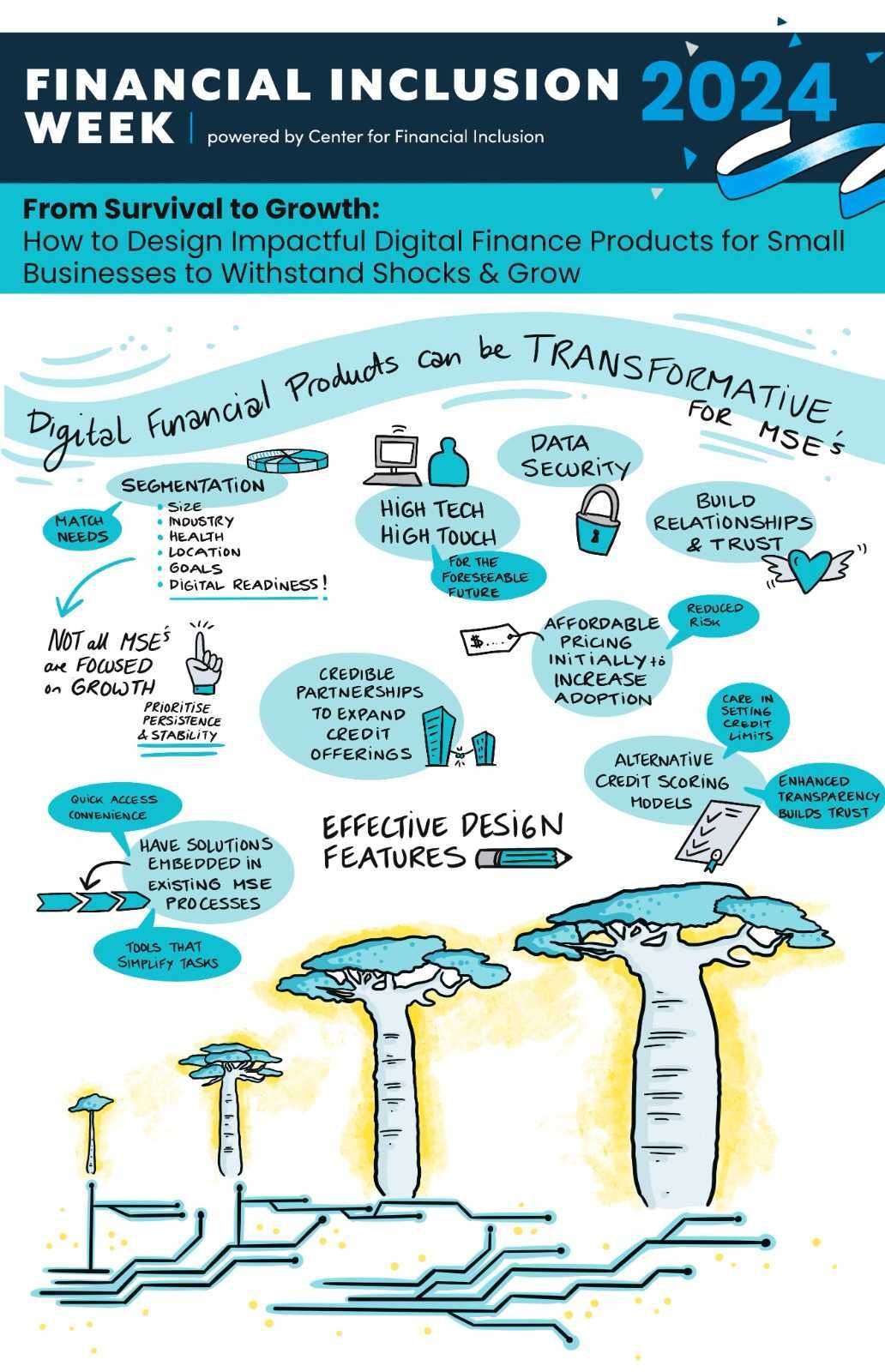

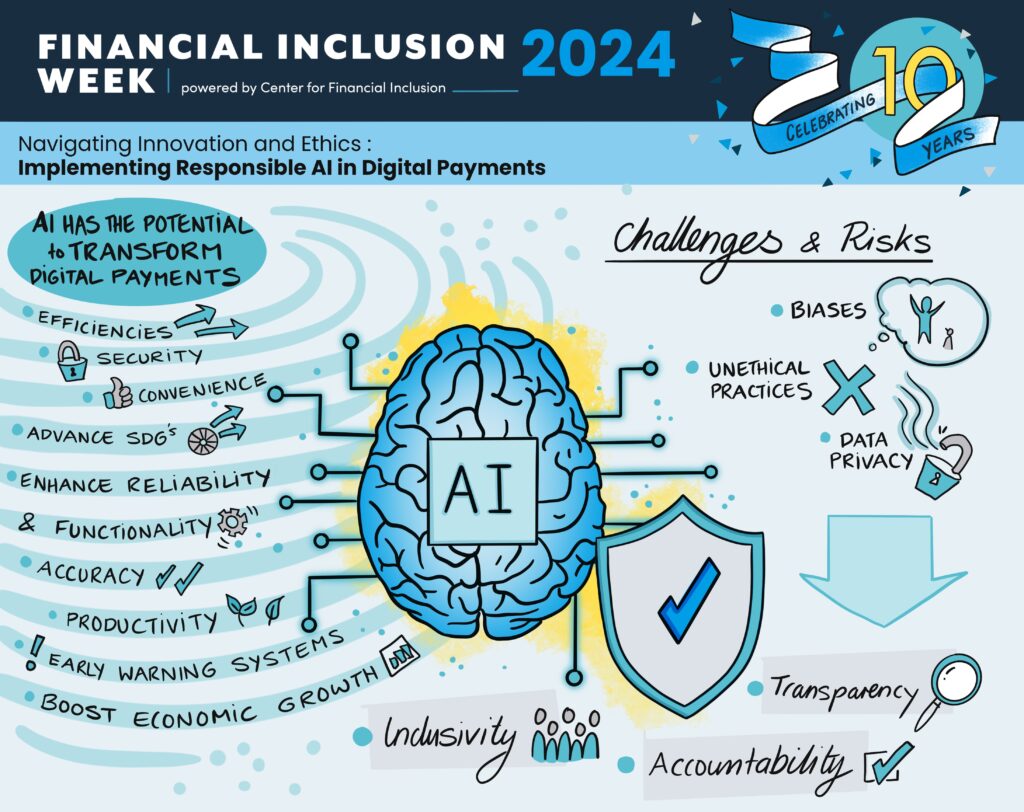

Today, financial services providers have expanded to include fintechs to BigTech, and the use of AI is widespread across product and service design and delivery. What solutions can we implement now to propel financial inclusion forward and ensure everyone can use responsible financial services to make informed decisions and improve their lives?

2024 TRACKS

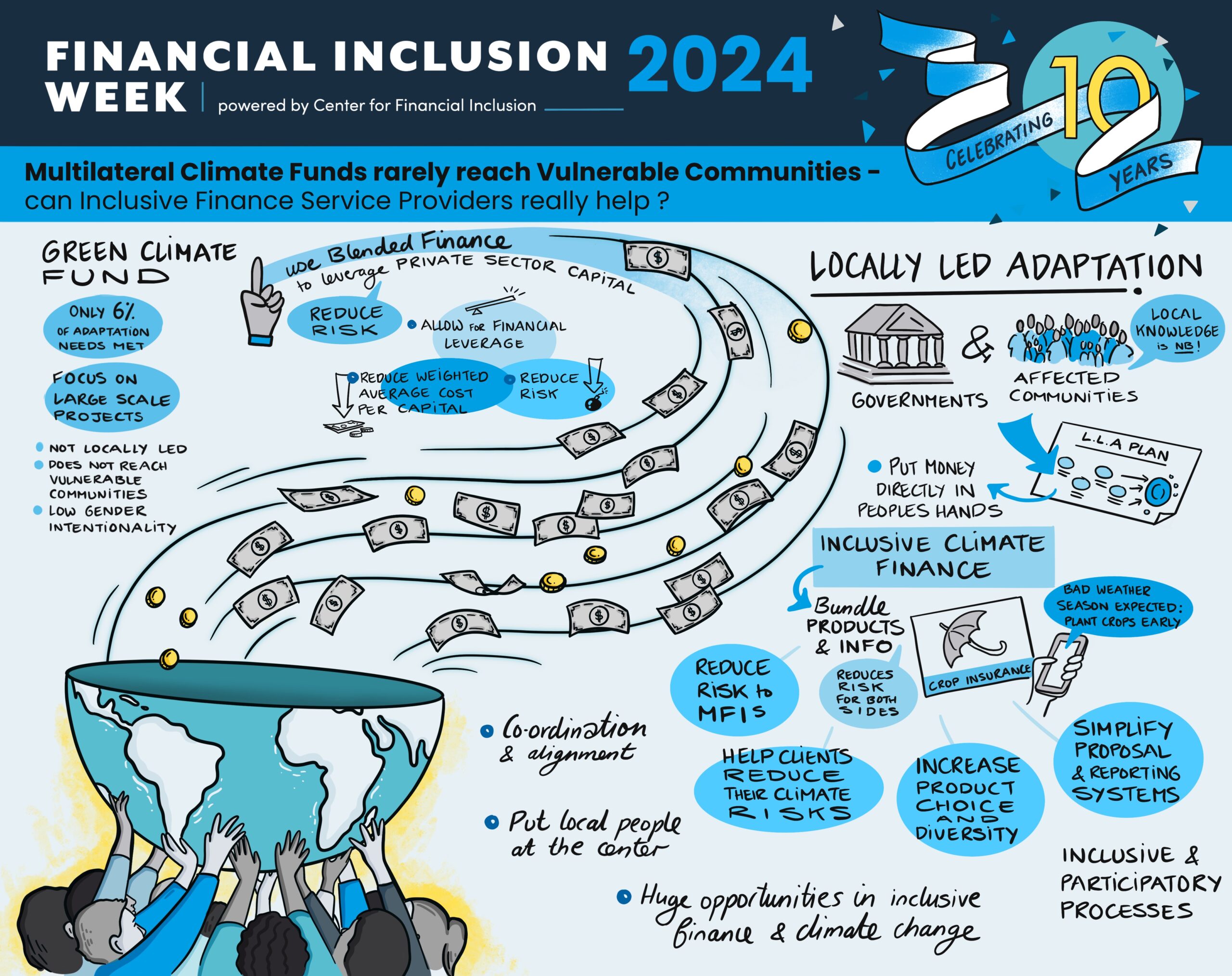

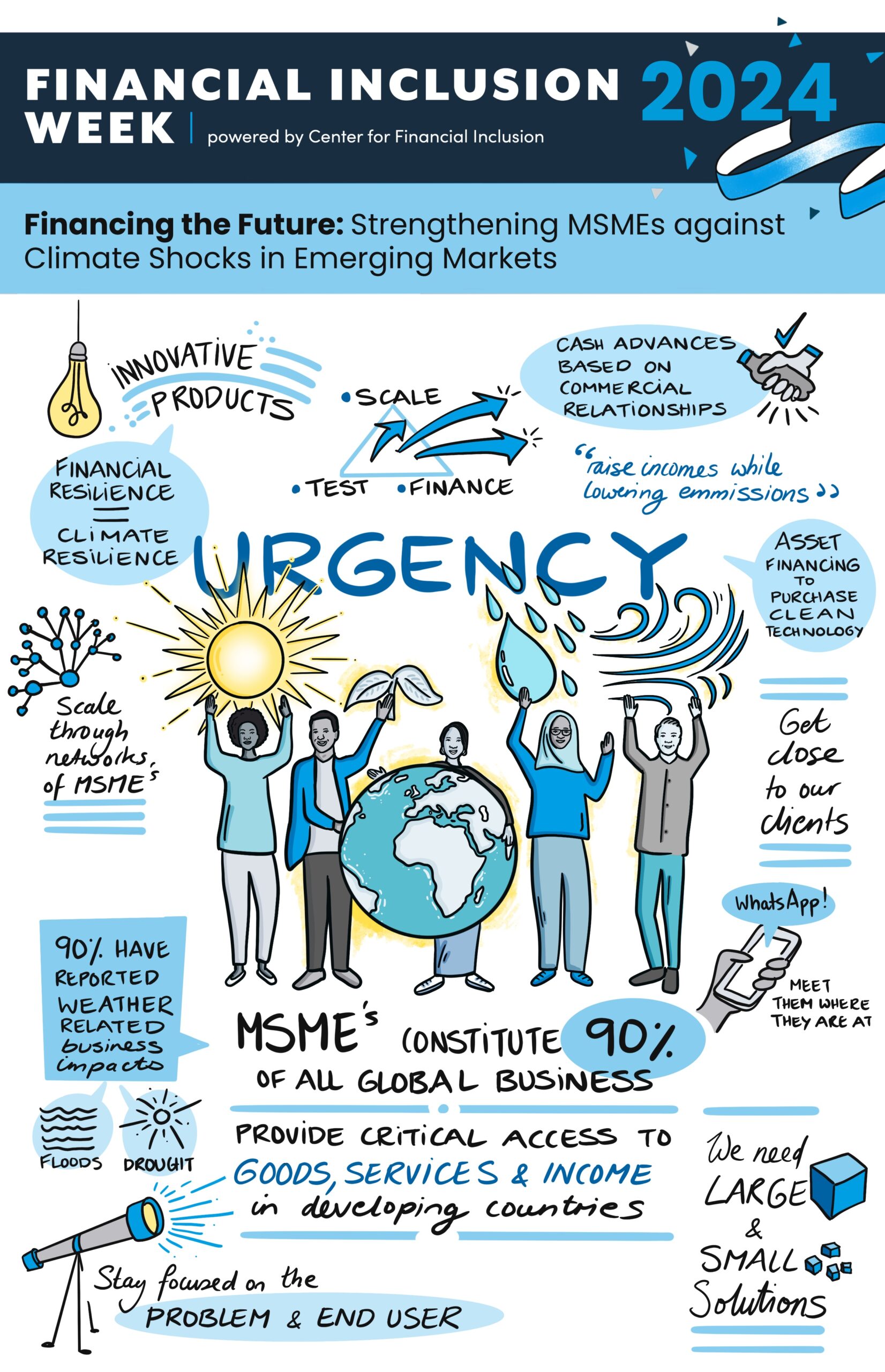

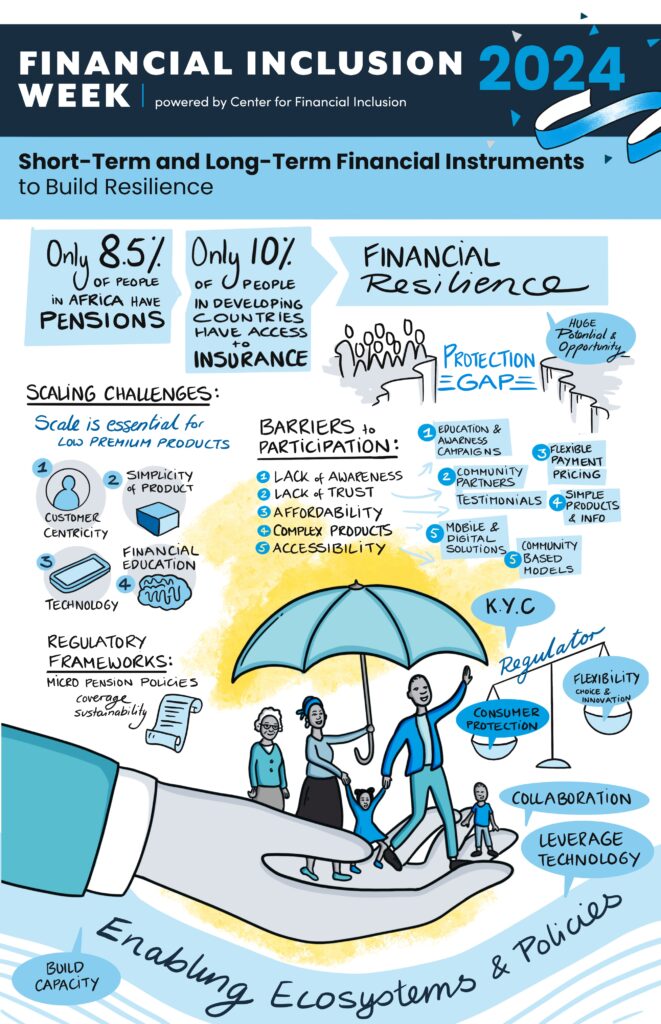

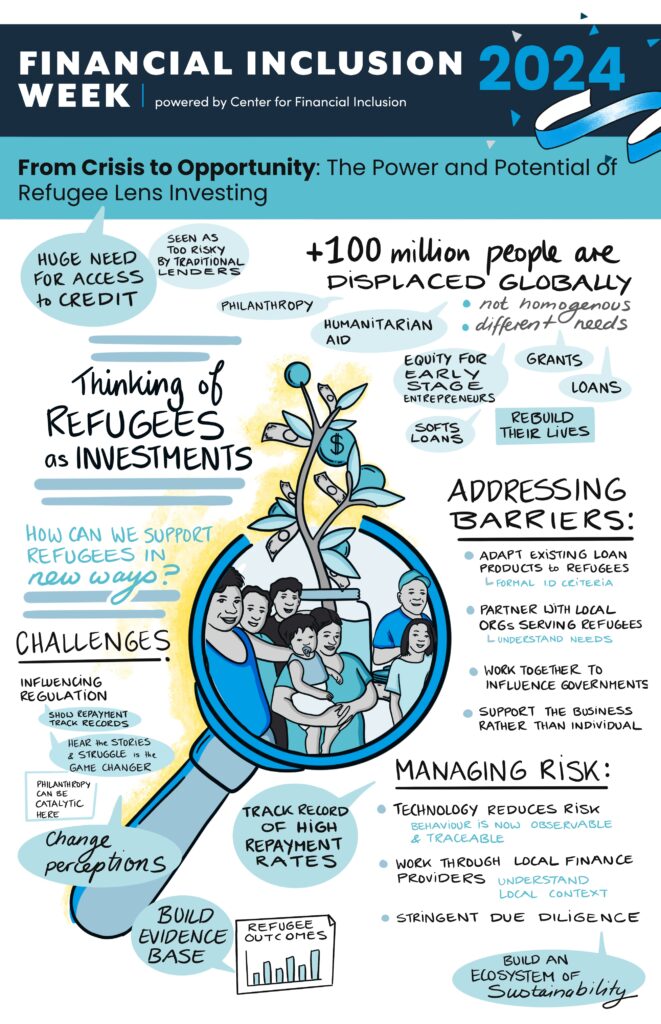

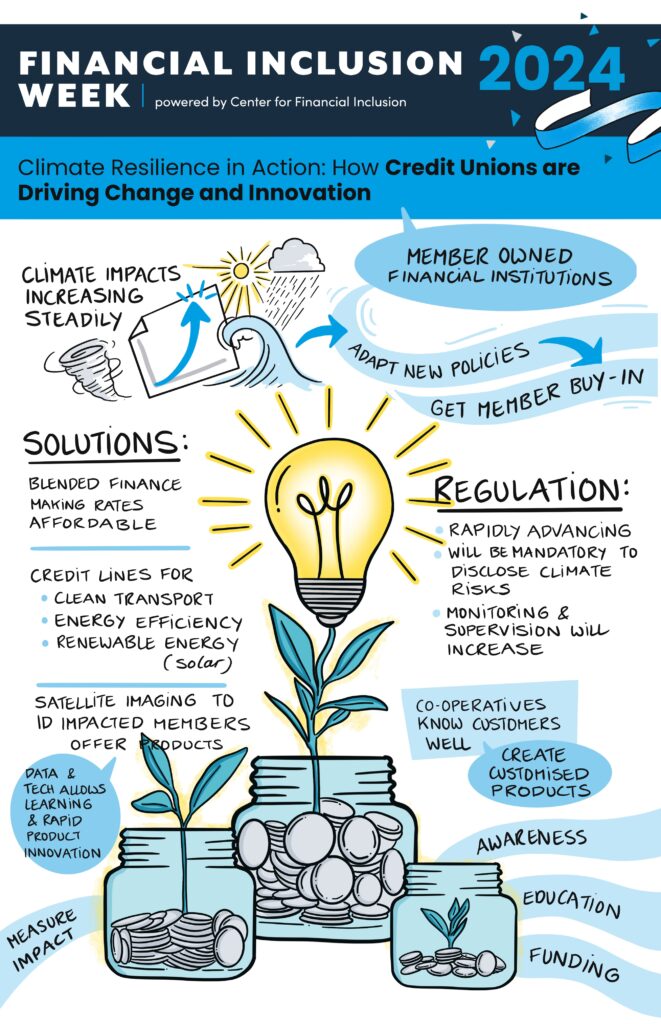

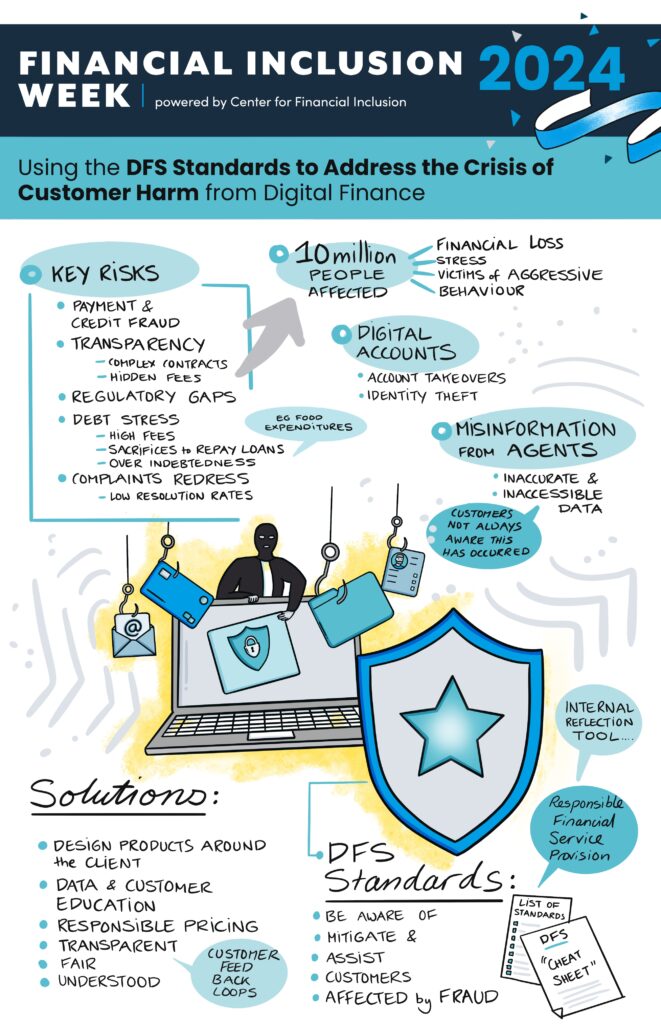

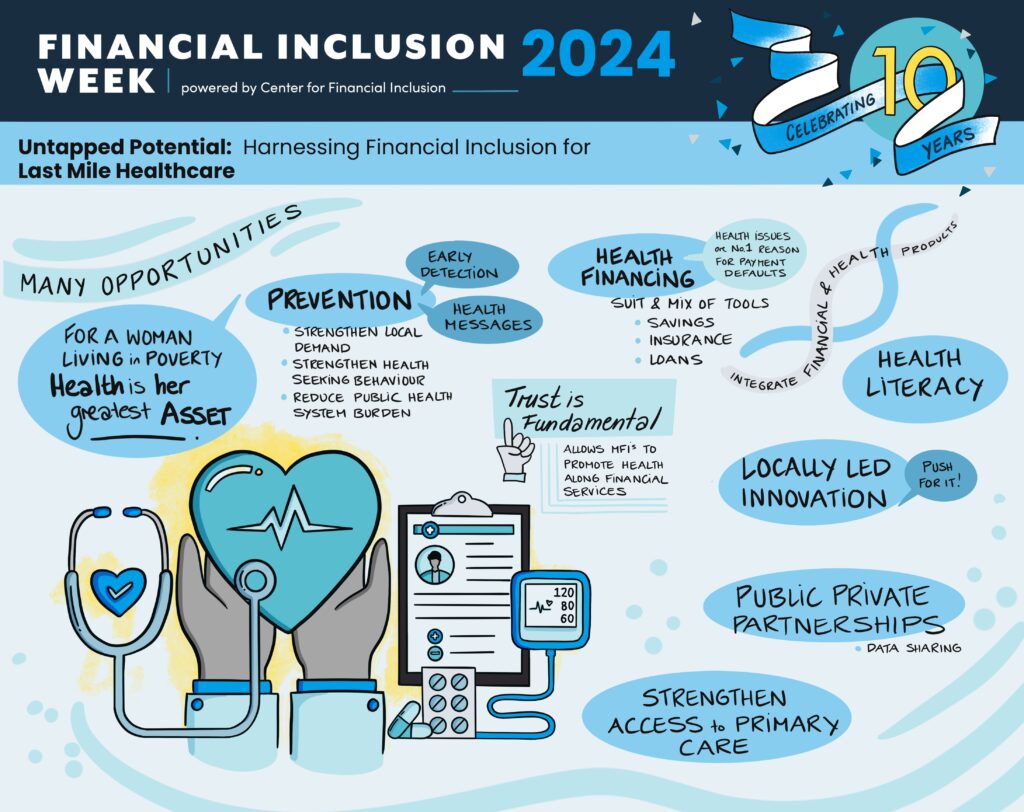

Today, a complex web of interrelated risks threatens to reverse the gains of the last 10 years. How can the inclusive finance community help strengthen people’s resilience and better prepare consumers to withstand shocks?

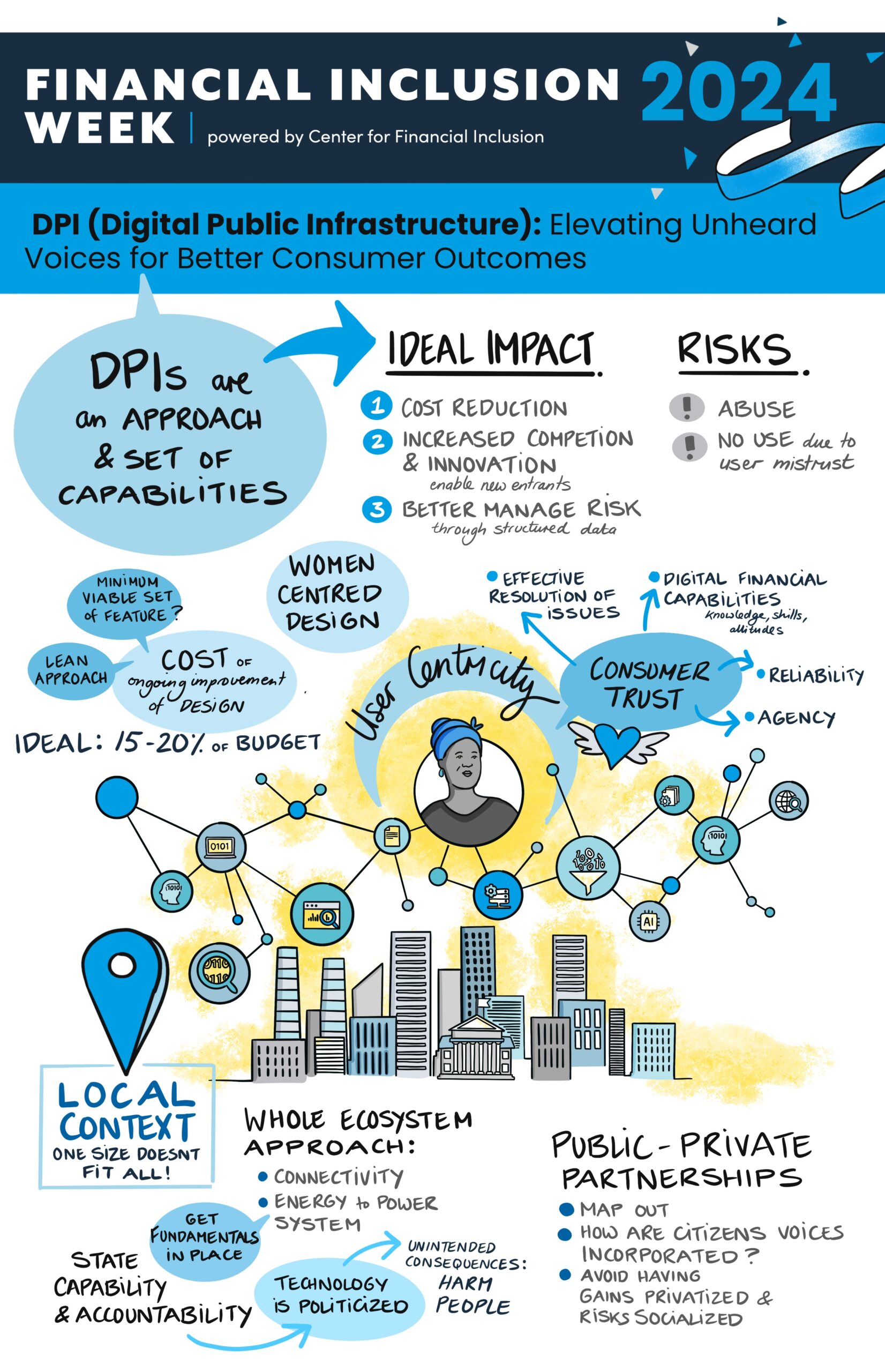

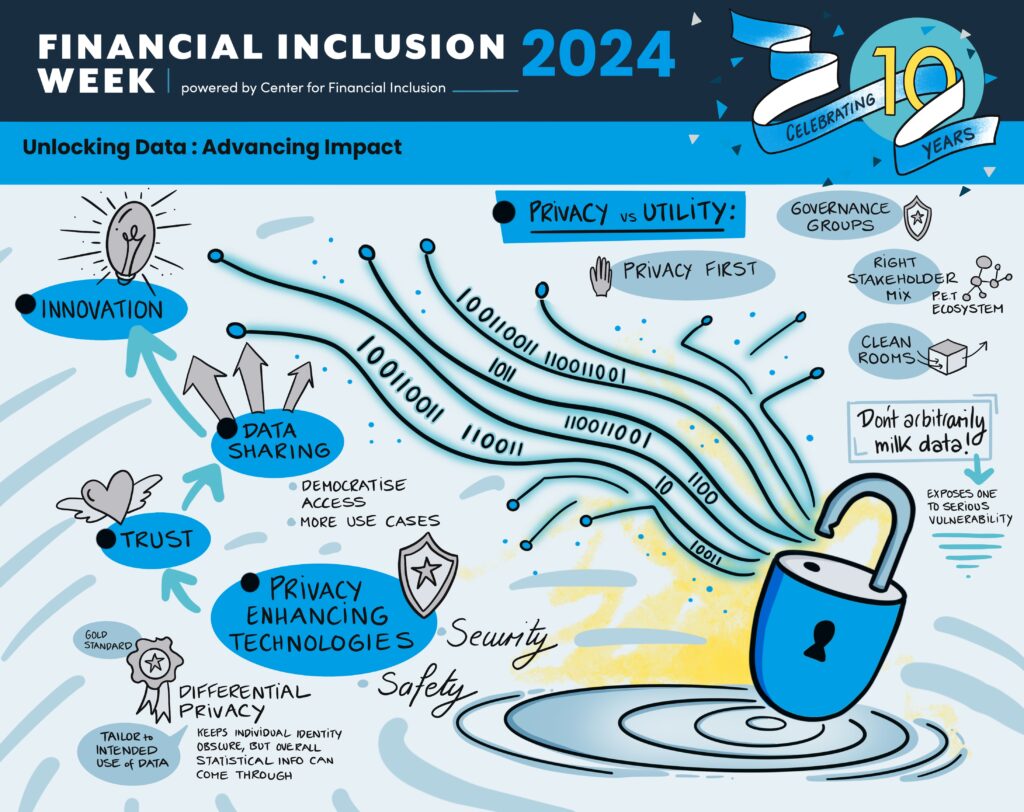

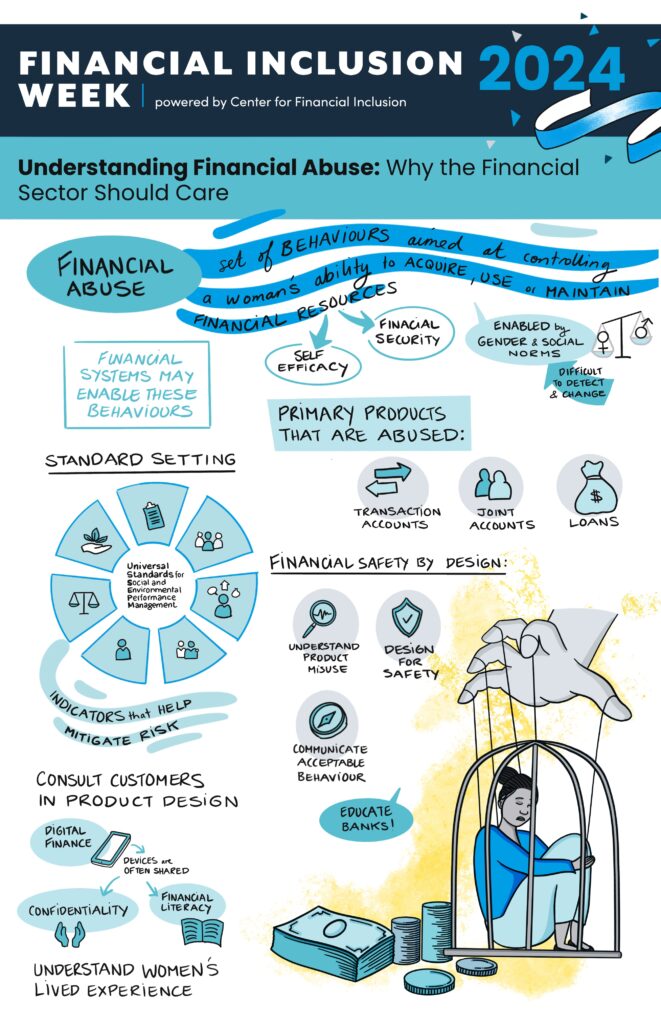

Data is key to delivering financial services, yet while it can help people access personalized, effective financial tools, the use of consumer data also poses new risks. How can the inclusive finance sector encourage data transparency and responsible practices, protect vulnerable populations from algorithmic bias, create inclusive open finance or digital public infrastructure systems, and deliver data privacy and protection frameworks to support consumers?

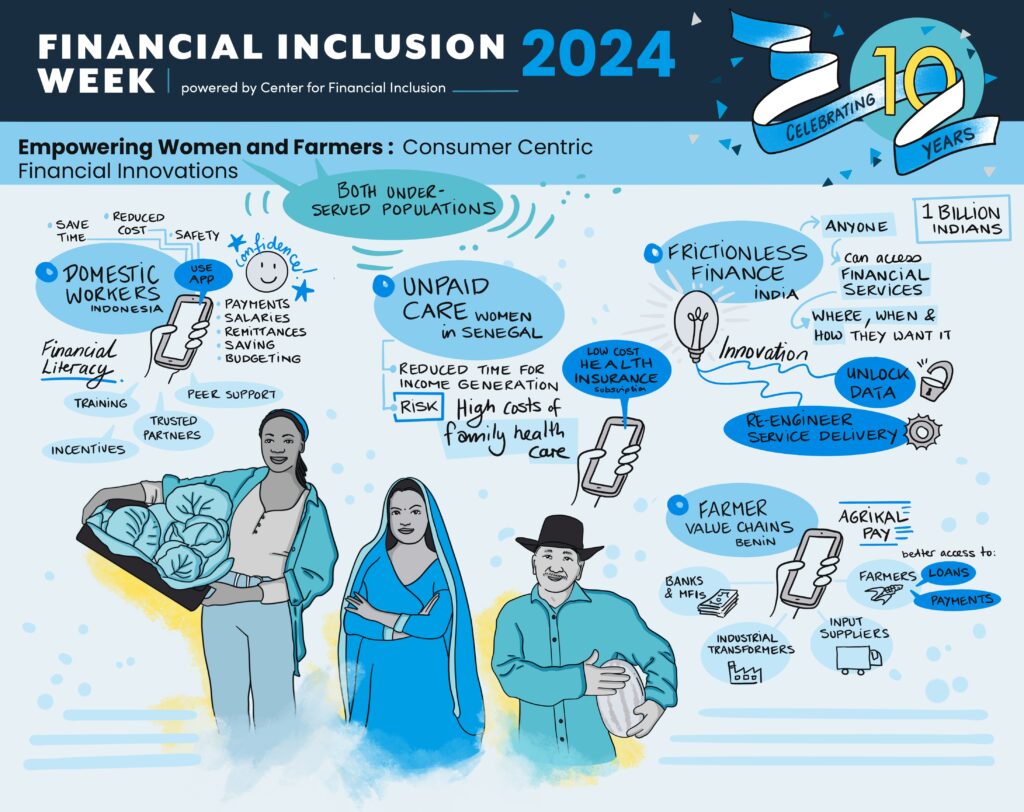

As more processes become automated and more players enter the financial services space, consumer protection and consumer privacy measures must be considered from the outset. How do we ensure the consumer remains top-of-mind when designing new financial products and services? What processes can we implement to ensure new solutions meet the needs of low-income consumers?

2024 Stats

3,100+

69%

1,931

143

348

2024 Session Recordings

Browse through and watch all 2024 live and on-demand sessions.