Imagine a woman, Rita, who owns a food shop in Delhi. She lives in a small home with her husband and two children. The incomes from her business and her husband’s job cover the rent for their small apartment, household essentials, and school expenses, while also allowing them to send money to their family in the village and save for future expenses. Climate change has intensified the monsoon season in the past few years, and two years ago, a record-setting flood caused damage to Rita’s shop and all her business supplies. She has been working hard to rebuild her business, but a lack of capital has prevented her from operating at full capacity. An intense heatwave now is affecting Delhi and posing new hurdles to Rita’s business.

Rita’s situation is not unique and many small businesses around the world face similar challenges. Climate change disproportionately impacts low-income and vulnerable people and climate-related shocks are drastically altering the livelihoods and living conditions for many. Globally, MSMEs make up over 90 percent of firms and provide 70 percent of employment, and many are struggling with intensifying climate risks. As part of CFI’s longitudinal research on the impact of COVID-19 on MSMEs in four different markets (Colombia, India, Indonesia, and Nigeria), we conducted a dipstick survey in 2021 to understand the consequences of climate shocks on MSMEs and the ways they are preparing to adapt to climate change.

Our research revealed three takeaways:

1. Climate Change is Impacting MSMEs and Hindering Their Recovery from COVID-19 Financial Impacts

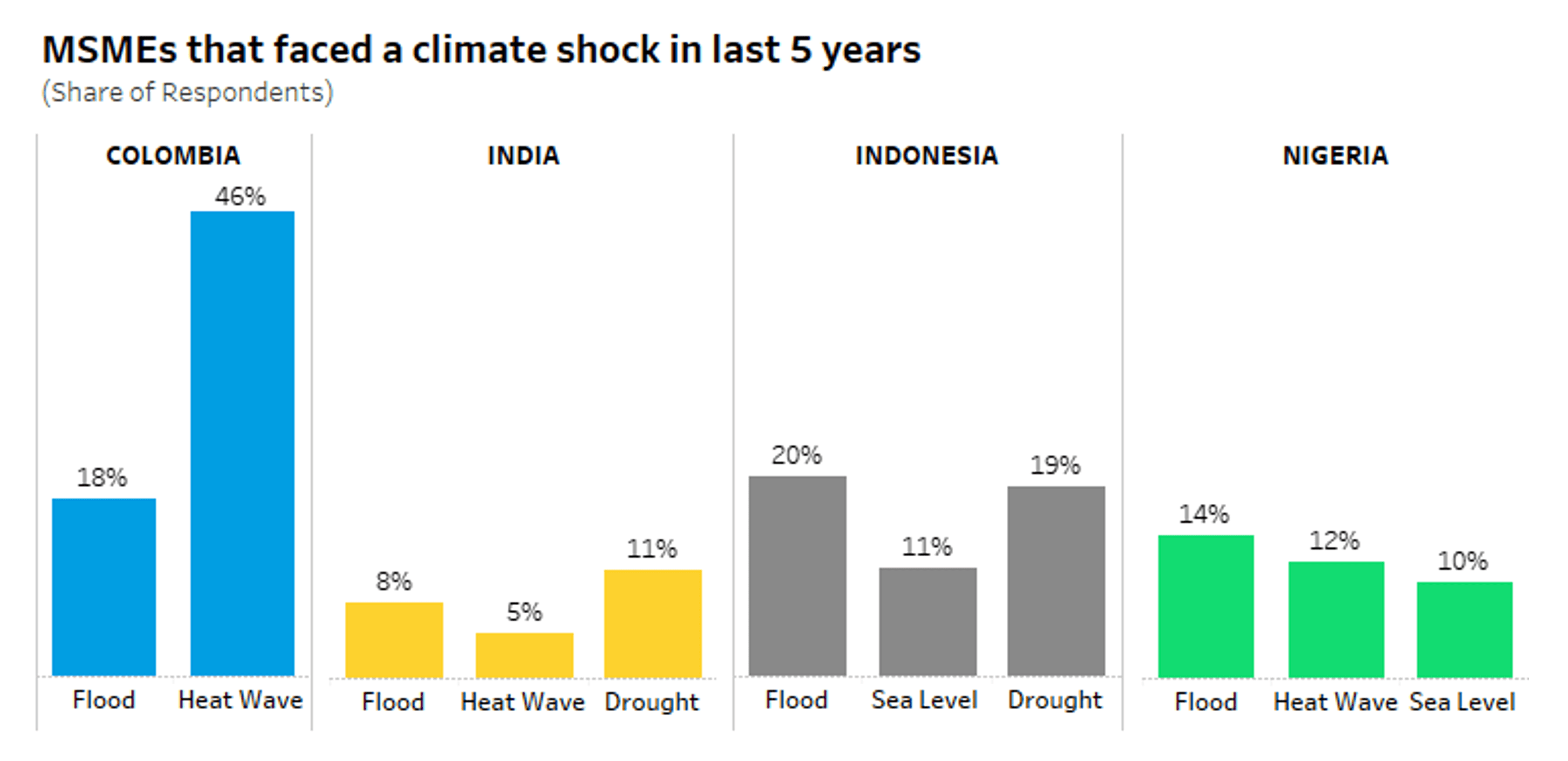

Thirty-two percent of survey respondents reported that at least one climate shock – including flooding, sea level increase, heat wave, or drought – has impacted their business within the past five years. The types of climate shocks and their impact varied by country (see graph below).

While climate change impacts all people, women bear the brunt of the escalating climate risks. Women make up much of the informal economy and their livelihoods are more likely to be impacted by climate risks. CFI’s data indicates that women show a higher level of concern than men that climate change will affect their ability to operate their business and maintain their quality of life – 61 percent of women business owners were concerned about this compared to 52 percent of men.

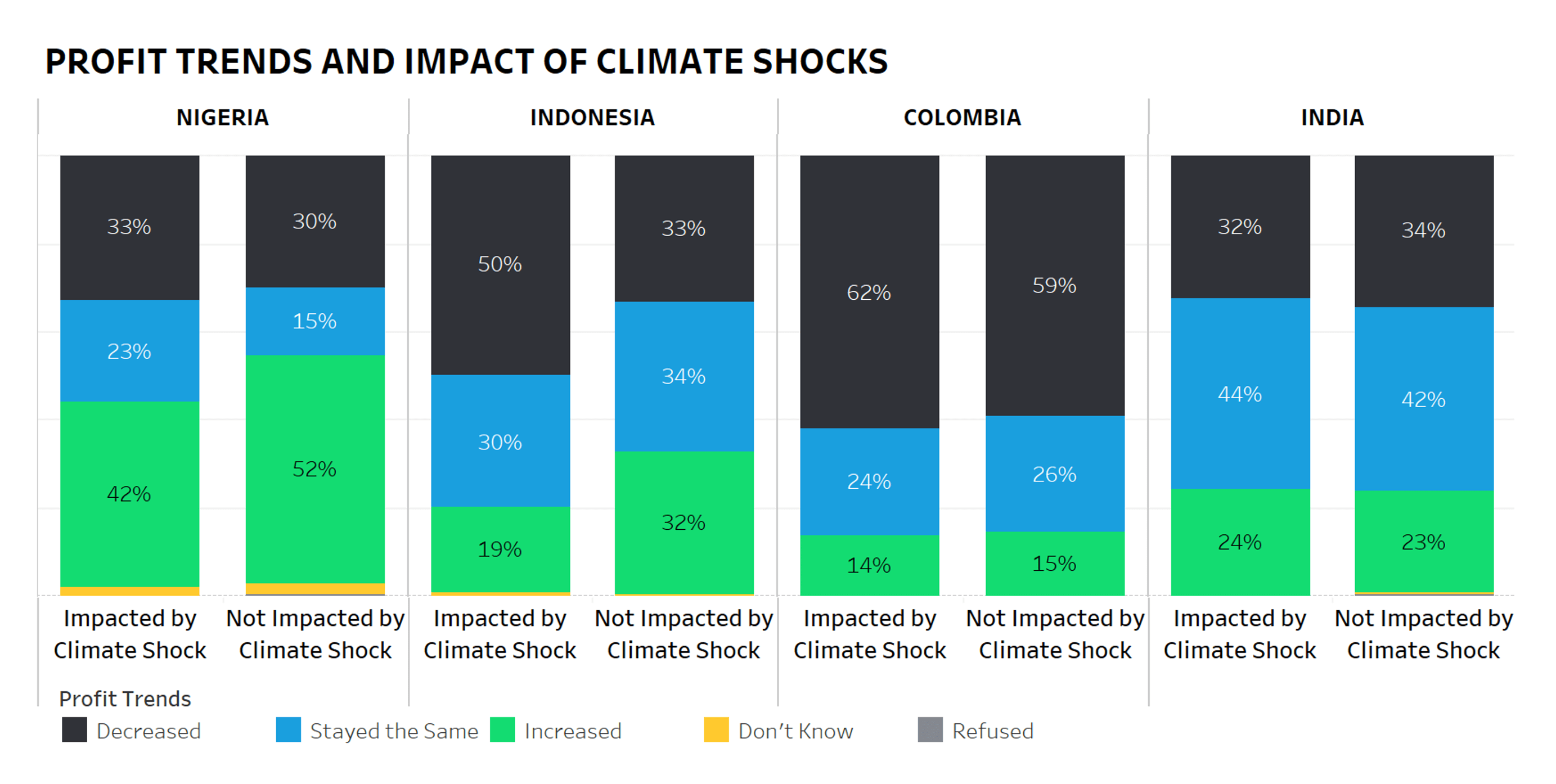

Additionally, among the MSME respondents who had been impacted by a climate shock, recovery from the financial impacts of the pandemic appears to be slower than those who had not faced a climate-related shock (see graph below).

2. MSMEs Are Unable to Actively Prepare for the Accelerated Effects of Climate Change

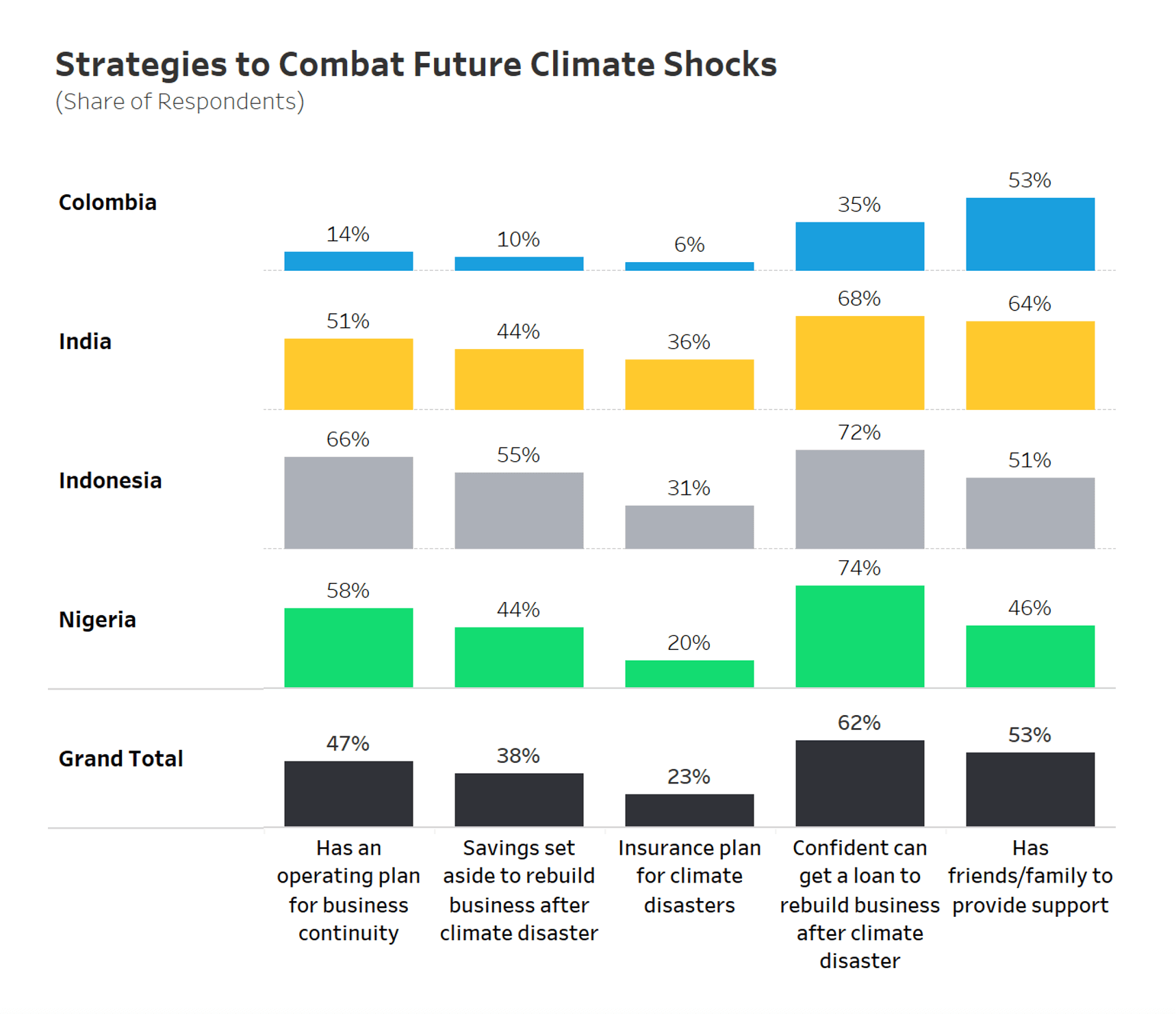

Extreme climate events are becoming a more frequent phenomenon around the world. And for MSME owners with limited resources and time, preparing for climate change can be a challenge. Across all survey respondents, only 47 percent reported that they had an operating plan in place for business continuity (see graph below).

Sixty-two percent said they are confident in their ability to get a loan to rebuild their business following a climate disaster, and 53 percent said they had friends and family who could provide financial support in the event of a climate shock. During the COVID-19 crisis, help from friends and family was essential to the ability of MSMEs to survive. In the immediate aftermath of the pandemic, 44 percent of business owners in Colombia said they borrowed from friends and family compared to 11 percent who borrowed from a financial service provider. This demonstrates the importance of both formal financial services and informal networks in supporting climate resilience.

Only 23 percent reported that they had an insurance plan for climate disasters, and 38 percent said they had savings set aside to cope with climate disasters. While there were variations among countries in the strategies employed to combat a future climate shock, data suggests that MSME owners are more likely to rely on reactionary strategies than preventative ones.

3. MSMEs Need Support From Governments and Financial Services Providers to Adapt Their Businesses to Increasing Climate Risks

CFI’s green inclusive finance framework outlines four pathways – Mitigation, Resilience, Adaptation, and Transition – that help to understand how inclusive finance can support low-income and vulnerable populations prepare for climate-related impacts. Financial services can help MSMEs build resiliency and respond to the disastrous effects of climate change. For example, access to savings products and emergency loans can help MSME owners carry out cost-intensive efforts to rebuild their business after an extreme weather event.

Our survey data indicates that MSMEs need support from governments and financial services providers to build resilience and adapt to climate change. In some cases, such as insurance products, governments and financial service providers will need to work together to ensure MSMEs have access to appropriate and affordable financial services.

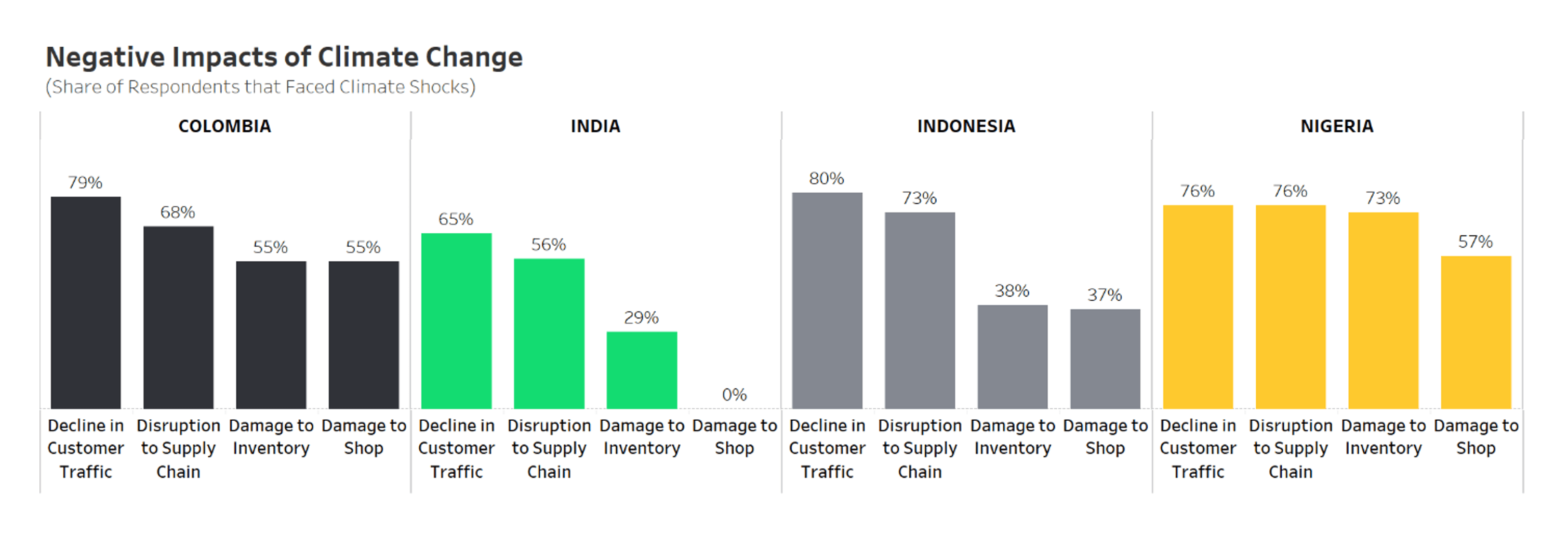

A significant share of MSME owners who experienced a climate shock faced damage to their shop or inventory (see graph below). To manage the impacts of climate disasters on their business operations, MSMEs need financing to make upgrades to their business location or inventory storage. Governments can provide grants or low-cost loans to MSMEs for making upgrades that would help avoid more drastic consequences of a climate emergency.

And as climate change makes the business models of some MSMEs no longer viable, financial services will be necessary to help business owners transition to new business models and livelihoods.

Forward-looking recommendations and actions should also consider that MSMEs are still struggling to recover from the COVID-19 crisis. There are lessons to learn about supporting MSMEs in preparing for the next crisis, and we must keep current struggles in mind while continuing to listen to their needs.