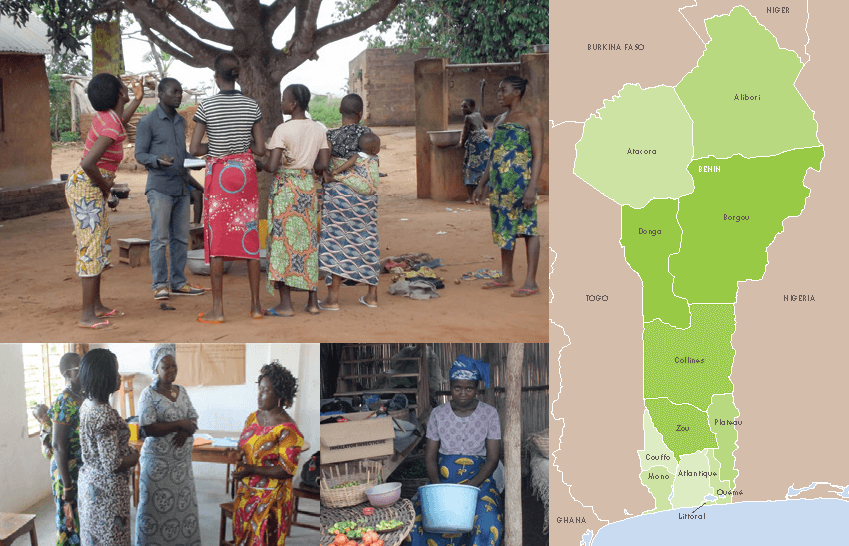

Benin’s Client Voice research includes the voices of over 1,500 current and former microfinance clients to understand the market’s consumer protection challenges. The Smart Campaign selected Benin as the African market for the Client Voices project for several reasons. First was the need for more demand-side research in Francophone West Africa, as relative to Anglophone East Africa. The Campaign also believed that the relevance of the Benin findings would likely extend beyond the country itself to the other seven members of the West African Economic and Monetary Union (WAEMU) given their operating under a common regulatory regime. Finally, Benin was selected because of the engagement of local stakeholders such as the Consortium Alafia – a 34-member local microfinance association.

Transparency, fair and respectful treatment of clients, and complaint resolutions mechanisms are the key consumer protection concerns for clients in Benin.

From May – October 2014, Bankable Frontier Associates (BFA) and its local research partner the Centre pour L’Environment et le Developpement en Afrique, Benin (CEDA Benin) carried out qualitative and quantitative research. The quantitative survey reached 1,733 Beninois (1,028 current MFI clients, 526 former clients, and 179 non-clients).

Key client protection risks emerged around the issues of transparency, fair treatment and complaint resolution mechanisms. Addressing these concerns requires a market-level approach that takes into consideration the unique role that regulators, the MFI industry, and clients themselves each must play. This page contains the results of the initial qualitative research, the follow-up quantitative survey and the final country report which weaves both pieces together. Finally the page has a link to the raw, anonymized data from the quantitative survey along with the survey instrument so that fellow researchers and client protection data wonks can play draw their own conclusions.