As we look back at the last two years of the pandemic, the disproportionate impact on women is striking. Because of COVID-19, many women left the workforce and shut down their businesses. As schools and care facilities closed, women took on additional responsibilities related to childcare, eldercare, and household chores. The World Economic Forum estimated that the global gender gap – as measured by the gap in health, education, economic and political attainments – increased by 36 years in 2021 as the burdens of the pandemic took a toll on women.

We must first understand how women were impacted by the pandemic to support a gender-inclusive recovery.

Now, as we rebuild from the effects of COVID-19, we must remember that women are not a homogenous group. Women MSME owners have unique needs when it comes to financial products and services. We have a unique opportunity to build more equitable systems, but to do so, we must first understand how women were impacted by the pandemic to support a gender-inclusive recovery.

Data from CFI’s longitudinal surveys in Colombia, India, Indonesia, and Nigeria, illustrates how women-owned businesses have struggled to recover and rebuild – even more so when compared to those owned by men. This research is part of our partnership with the Mastercard Center for Inclusive Growth.

From our data, we see the following three trends:

1. Women-Owned Businesses Were Disproportionately Affected

MSMEs in emerging markets – particularly micro and small businesses – bore the brunt of the economic slowdown. Many businesses struggled to keep their doors open as consumer spending declined. Reduced business income severely impacted many business owners’ household finances and dramatically affected their ability to respond to challenges. But the economic fallout was particularly drastic for women business owners.

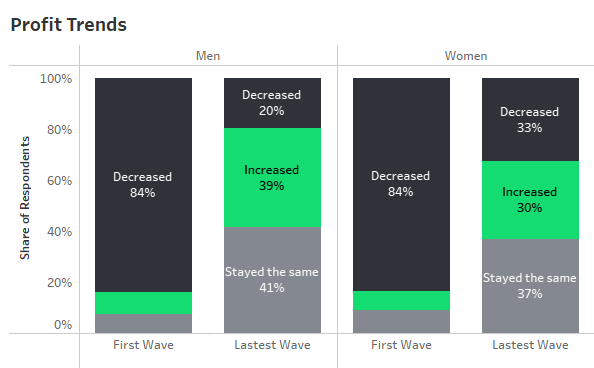

In the first wave of surveys CFI conducted in the early months of the pandemic, 18 percent of women reported having closed their businesses, 6 percentage points higher than men. While both men and women respondents reported a decline in business profits and an inability to cover business expenses using revenue at similar rates in wave 1, in the latest survey conducted a year after the first wave, women reported declining profits and inability to cover expenses at a higher rate than men, highlighting the uneven nature of the recovery (see “Profit Trends” table).

Women business owners also experienced a greater impact on household resilience and higher rates of food insecurity than their male counterparts. Twenty percent of women business owners said someone in their household had eaten fewer or smaller meals compared to 13 percent of men business owners, according to data collected in the second half of 2021.

2. Women Owners Are Less Likely to Transact Digitally

Digital platforms allowed many business owners to continue operating during COVID-19 and enabled them to reach new customers despite movement restrictions. Data from CFI’s surveys shows that the use of mobile money was an effective tool in supporting the resilience of many MSME businesses. From our data, business owners who used mobile money were more likely to cover business expenses with revenue and to report increased profit levels.

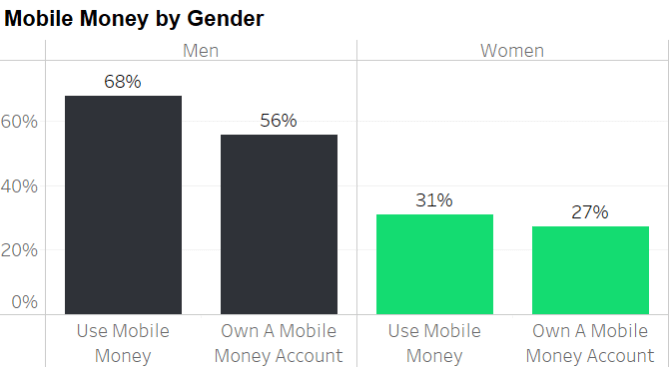

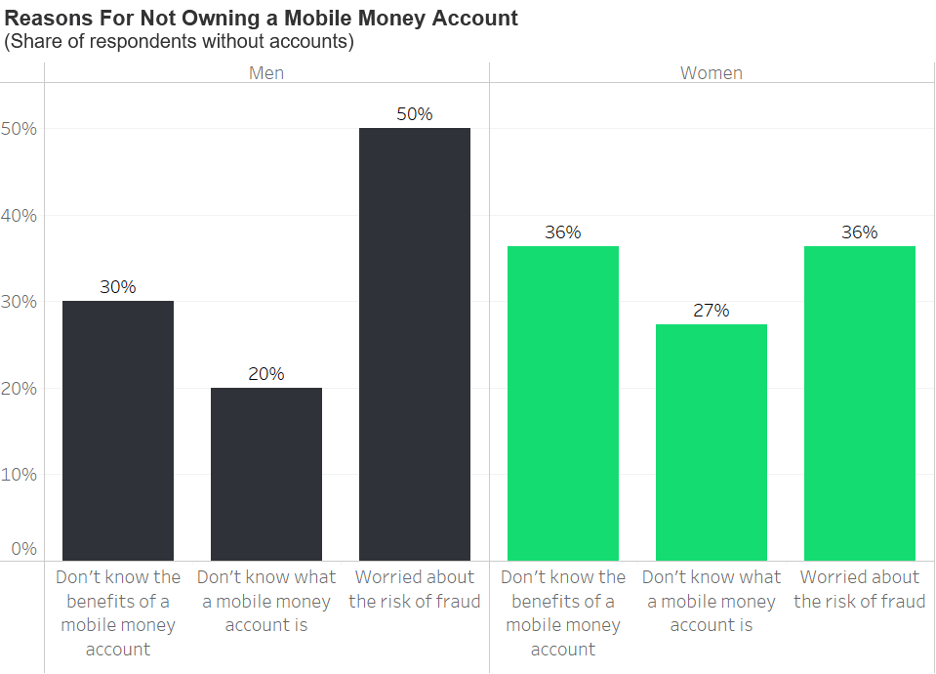

But our data also shows that women are less likely to conduct financial transactions via a mobile phone, use mobile money, or own a mobile money account (see “Mobile Money by Gender”). Women are also less likely to know the benefits of mobile money or to know what a mobile money account is (see “Reasons for Not Owning a Mobile Money Account”).

Globally, a significant gender gap in smartphone ownership and access to mobile internet remains. In 2020, women were 7 percent less likely to own a mobile phone and 15 percent less likely to use mobile internet than men. CFI’s sample has little to no gender gap in smartphone ownership, yet there is a substantial gap in the use of mobile money between men and women, indicating that there may be other barriers to digital adoption beyond access.

One of the barriers for lower levels of digital adoption among women could be a lack of knowledge of digital tools and the available protection mechanisms for digital transactions. Our survey data suggests that women were less likely to know the fees associated with mobile money accounts and less likely to understand how to report suspicious activity using mobile money.

3. Women Saved More, But Informally

We also saw a difference among men and women in their level of trust in formal financial institutions. A higher proportion of women reported saving during the pandemic (see “Savings Activity”) but preferred to save via informal means over formal bank or mobile money accounts (see “Savings Instruments”) as compared to men. Additionally, women revealed a high level of concern with financial institutions collecting their personal data. These findings support the hypothesis that the lack of trust in formal institutions and data privacy concerns can hinder the adoption of formal financial services and digital tools among women.

Pushing for Gender Inclusive Recovery

As we prepare for the post-pandemic world, we have an opportunity to build more equitable products, services, and systems. Donors and market facilitators must invest in building women’s financial health and digital skills. Governments must prioritize policies related to childcare and education that support women’s participation in the economy. Financial service providers and digital platforms must integrate gender norms into their products and services. A gender-inclusive recovery can finally bring about a sustainable change by eliminating barriers to women’s empowerment.