Topics

- Agent Banking

- Alternative Data

- Challenges and Crises

- Enabling Environment

- Fintech

- Inclusive insurance

- Insurance

Program

The severe economic impacts of COVID-19 on low-income households and small businesses have underscored the need for innovative solutions that can build greater financial resilience. Findings from surveys of MSMEs conducted by the Center for Financial Inclusion (CFI) show that since COVID-19 struck, many small businesses in Indonesia, Colombia, and Nigeria have either had to close or found their profits significantly decreased. At the same time, the pandemic has provided opportunities for inclusive fintechs to leverage their agility and adaptability to strengthen and support the financial resilience of low-income, financially underserved customers.

Financial resilience is the ability to mitigate, adapt to, and recover from shocks and stresses in a manner that reduces chronic vulnerability and facilitates inclusive growth. Individuals must deftly navigate a delicate balancing act to stay afloat and may be thrown off course by a whole host of shocks, ranging from unexpected health crises to weather-related disasters that can disrupt otherwise appropriate financial plans. The nuances associated with financial resilience can complicate the financial service industry’s ability to develop and design comprehensive solutions for low-income customers.

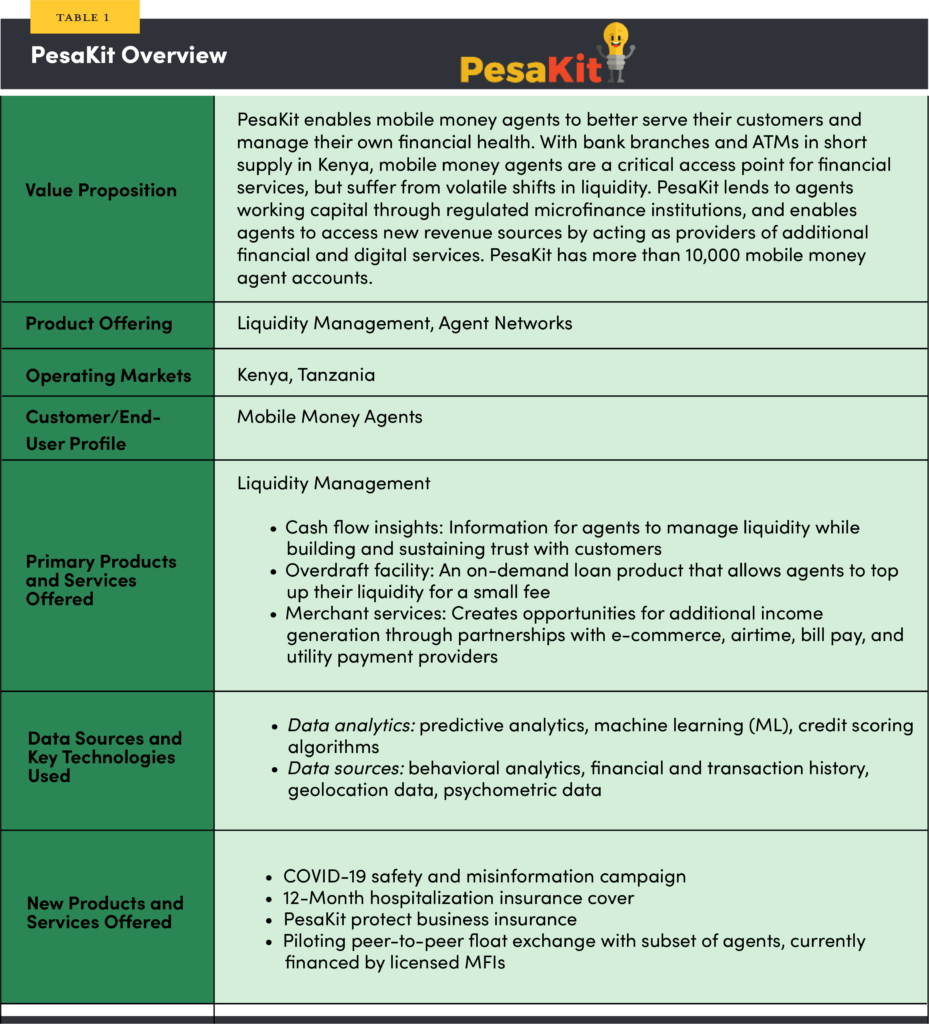

PesaKit and reach52, two winners of the 2020 Inclusive Fintech 50, have responded to the extraordinary challenges posed by the COVID-19 pandemic by continuing to innovate to meet their customers’ needs.

PesaKit and reach52, two winners of the 2020 Inclusive Fintech 50 — a competition founded by MetLife Foundation and Visa, with support from Accion and IFC, and additional funding from BlackRock and Jersey Overseas Aid & Comic Relief — have responded to the extraordinary challenges posed by the COVID-19 pandemic by continuing to innovate to meet their customers’ needs. In this paper, we share insights on how these two fintechs have adapted to a challenging economic landscape to serve as early examples of how fintechs have leveraged their agility and innovation during crisis. These findings build on the 2020 Inclusive Fintech 50 white paper that draws on the data submitted by the 2020 cohort of applicants and highlights how fintechs are continuing to advance financial inclusion and resilience for the estimated 3 billion financially underserved people worldwide.

PesaKit

Providing a Lifeline to Mobile Money Agents

Mobile money agents serve as the infrastructural backbone of the mobile money system and are brand ambassadors of digital finance providers. They are often a community’s human touch point to mobile money, helping build their communities’ capabilities in mobile money services and products. Agents provide essential services to individuals and businesses in rural and other difficult to reach areas not served by traditional financial institutions, but are limited by their own liquidity. Many agents tend to have a limited amount of cash on hand — approximately two months’ worth in Kenya, for instance — to be able to buffer against any emergency or shock, founder and CEO Andrew Matua said in a December 2020 interview.

In serving a network of more than 7,600 mobile money agents across Kenya (and soon Tanzania), the majority of whom run microbusinesses of their own in addition to their mobile money businesses, PesaKit has a deep understanding of the links between financial resilience and financial health, and crucially the interconnectedness between the microentrepreneurs’ household finances and the businesses themselves. PesaKit’s goal is to strengthen their agents’ defenses against emergencies or shocks by building a safety net of Ksh 15,000 to Ksh 60,000 so that agents and their families can sustain themselves for a period of one to four months without any income.

To accomplish this, after completing a simple onboarding process, PesaKit equips agents with liquidity management tools, which are crucial to agents’ ability to build and maintain trust with their customers. Liquidity management remains a notoriously difficult challenge in operating mobile money agent networks, and as noted by PesaKit founder and CEO Andrew Mutua, liquidity is “actually what they [agents] are in business for. If they have enough float or enough cash, they are able to serve customers. If you don’t have that [as an agent], you are losing income and you are also losing your reputation and the community trust.”

Liquidity management remains a notoriously difficult challenge in operating mobile money agent networks.

Leveraging data generated through agents’ interactions with PesaKit’s app and predictive analytics, its cash flow insights tool provides agents with the granular information agents need to effectively manage their liquidity, such as how much cash they need, how much float they need, how many customers they might serve, and how much they might earn in commissions.

The biggest challenge for PesaKit has been getting enough robust and consistent data to provide agents with accurate and relevant business insights. While M-Pesa’s continued domination of the Kenyan mobile money market impedes PesaKit’s ability to directly access some mobile money transaction data, PesaKit collects other data through agents’ interaction with its app that reveals key information about agents’ businesses (e.g., demand, business operations, footfall). This information helps agents access small loans that will then generate a credit history and afford them the opportunity to access larger value loans over time.

Protecting Agents from the Pandemic’s Worst Economic Impacts

Protecting Agents from the Pandemic’s Worst Economic Impacts

The pandemic reinforced the important role of PesaKit’s data-driven model, as COVID-19 presented significant challenges to business as usual. At the height of the pandemic, starting in March 2020, the Kenyan government imposed a strict 7 p.m. curfew, which curtailed agents’ hours of operation, restricted the movement of cash, and placed a heavier financial burden on agents overall. PesaKit agents faced increased costs to rebalance their cash flows, as customers were making more deposits than withdrawals, coupled with having to equip their locations with the personal protective equipment, hand sanitizers, cleaning products, and masks they needed to be able to serve their customers safely while observing social distancing guidelines.

To strengthen agents’ social safety net in this time of immense need, PesaKit introduced a 12-month hospital cash insurance cover to provide agents with greater financial security if they tested positive, were quarantined, or were hospitalized due to COVID-19. Again, PesaKit’s proximity to clients enabled them to move quickly and provide appropriate services to help their customers navigate these difficult times.

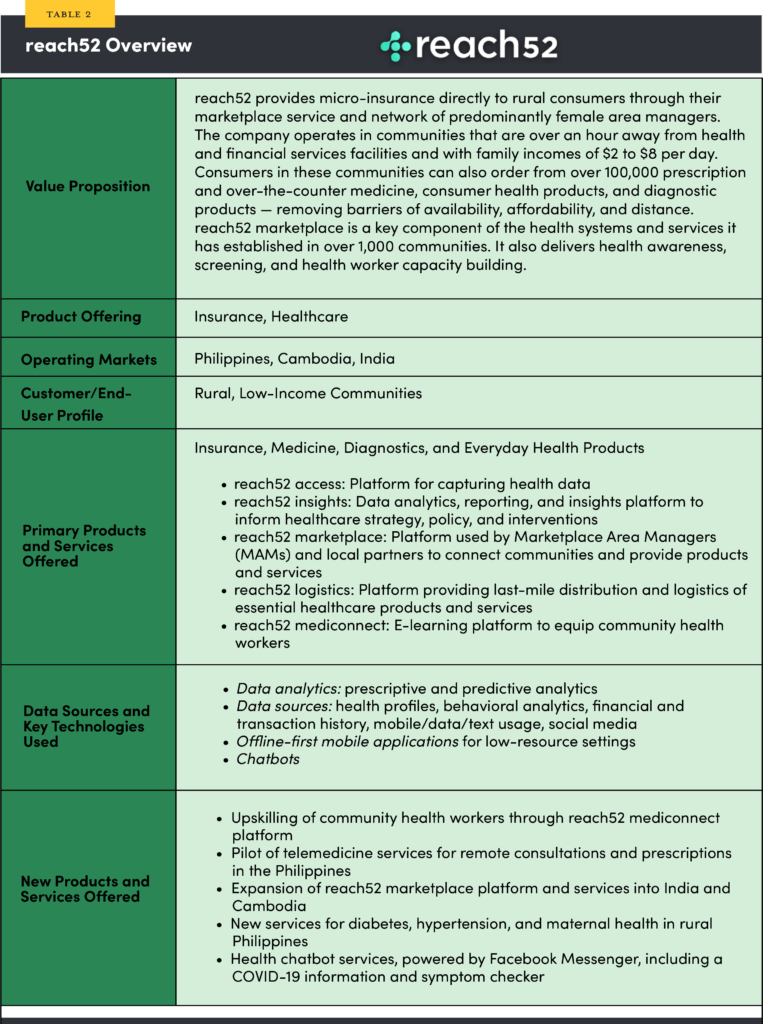

reach 52

Leveraging Community Trust to Expand Access to Healthcare

reach52 seeks to shield low-income, underserved households in rural areas from the disruptive financial burden of out-of-pocket (OOP) health expenditures and protect their livelihoods by providing access to affordable and comprehensive health insurance and healthcare services.

Research by CGAP found that those living in low- and middle-income countries pay as much as 60 percent of their health expenditures out of pocket. An unexpected health crisis can force a family to make one of two nearly impossible choices: borrow from an informal moneylender at great expense or sell a household asset to make ends meet. If neither of these are options, families have to suffer poor, if not catastrophic, health outcomes by rationing necessary medical treatment or forgoing it entirely.

Insurance products are meant to help households avoid facing any of those decisions, yet providers often find that insurance is a difficult product to sell to low-income, underserved households. Consumers with less experience or comfort with the formal financial system don’t always understand the basics of how insurance works, how it benefits them, what adverse events it protects or mitigates against, and how claims on their policies are paid. Rather than focusing on the intangible nature of insurance and the functional details of their plans and policies, reach52 taps into the emotional and practical benefits of insurance. “Nobody really wants to buy insurance,” notes Rich Bryson, Chief Strategy and Marketing Officer at reach52. “But everybody does want to protect their families and look after them. That is a universal trait and that is absolutely the case in the communities that we’re operating in.”

“Nobody really wants to buy insurance. But everybody does want to protect their families and look after them.”

reach52 builds on communities’ trust of local leaders, fellow residents, and community-based nongovernmental organizations that are already locally embedded to drive adoption of its insurance products and to scale its solutions more widely. “Trust is absolutely huge,” continues Bryson. “There can be distrust of external organizations in communities where information is less available and quite a lot of scamming goes on. Partnering with NGOs and individuals in the communities to run the services helps to overcome this. You can then build trust obviously as more people use the service and by sharing positive claims stories, showing how community members have benefited from insurance when they needed it most.”

reach52 recruits and equips Marketplace Area Managers (MAMs) from these aforementioned groups to lead its outreach and onboarding efforts, either in sites directly managed by reach52, or those run by reach52’s on-the-ground partners such as NGOs. MAMs serve as the bridge that connects low-income and rural clients with established insurance providers, using the reach52 marketplace mobile app to help clients find affordable health coverage, as well as prescription and over-the-counter medicines to meet their unique needs.

Expanding Service Offerings and Forging New Partnerships

reach52 drew from a wealth of guidance from its local teams and partners to understand how it could operate safely given travel restrictions and social distancing protocols. With its teams not able to travel, the fintech shifted to focus on its strategy, response, and the development of remote services that could help healthcare workers and the local community. For instance, they developed Facebook Messenger-enabled health chatbot services — used by more than 100,000 people — for sharing information on topics such as COVID-19 and its symptoms.

Specifically, reach52 has focused its recent efforts on combatting COVID-19, addressing barriers to healthcare access the pandemic has created for rural and low-income populations, and examining the adverse economic impacts it has had on livelihoods. In partnership with Johnson & Johnson, reach52 has provided upskilling and remote learning opportunities for nearly 2,000 of its community health workers in the Philippines and Cambodia through its mediconnect platform. It has also expanded the range of healthcare products and services available through the reach52 marketplace, including reach52’s launch into India and Cambodia.

reach52 has focused its recent efforts on combatting COVID-19, addressing barriers to healthcare access the pandemic has created for rural and low-income populations

More broadly, the increased focus on global health and health access issues has accelerated reach52’s partnerships with public and private sector health actors and other key stakeholders, including Pfizer, Biocon, Allianz, and UNICEF Innovation, among others. These new initiatives have ranged from exploring new models of care to address both communicable and chronic health conditions (e.g., dengue fever, diabetes, and hypertension) to new insurance plans and mobile wallet services for low-income communities.

Conclusion

Beyond COVID

reach52 and PesaKit credit their success to placing their end users at the center of everything they do. By focusing on developing solutions that address customer pain points and working to provide additional opportunities for agents to generate income, PesaKit stakes its success on the success of its agents, which it believes will build and maintain customer loyalty and is key to the sustainability of its business over time.

Emphasizing the importance of community and global health, Bryson of reach52 argues that “no one is protected until everyone is protected […] it is critical that we look at global health and by nature the global economy” as being interconnected in this way.

As the world continues to grapple with the health and economic fallout from the COVID-19 pandemic, the financial needs of customers will continue to evolve. Inclusive fintechs must remain agile and continue adapting to the ever-changing context and evolving needs of their customers. Doing so can help customers manage their immediate needs while also building their financial resilience to mitigate against future crises.